In the startup world, "runway" means how long a company can operate before running out of money. It's a critical metric that determines everything from hiring decisions to product priorities. But here's what's interesting: this concept is incredibly powerful for personal finance, yet almost nobody talks about it.

Your financial runway is how long you could maintain your current lifestyle without any income. It's more nuanced than an emergency fund and more actionable than net worth. Understanding your runway changes how you think about career decisions, risk-taking, and what financial freedom actually means.

Let me show you how to calculate your financial runway and why it might be the most important number in your financial life. Download our spreadsheet to calculate your runway now.

Why Financial Runway Matters More Than Emergency Funds

Most financial advice focuses on emergency funds—3 to 6 months of expenses saved for unexpected problems. But financial runway flips this concept:

Emergency Fund Thinking: "How much do I need for when things go wrong?" Financial Runway Thinking: "How much freedom do I have to make choices?"

This mental shift is profound:

- Career decisions: With 12 months of runway, you can quit a toxic job before finding the next one

- Entrepreneurship: Sufficient runway lets you start a business without immediate income pressure

- Life changes: Want to go back to school, take care of family, or relocate? Runway shows what's possible

- Negotiation power: Knowing you can walk away gives you leverage in salary negotiations

Your runway directly correlates with your life choices. More runway equals more freedom.

The Complete Financial Runway Calculator

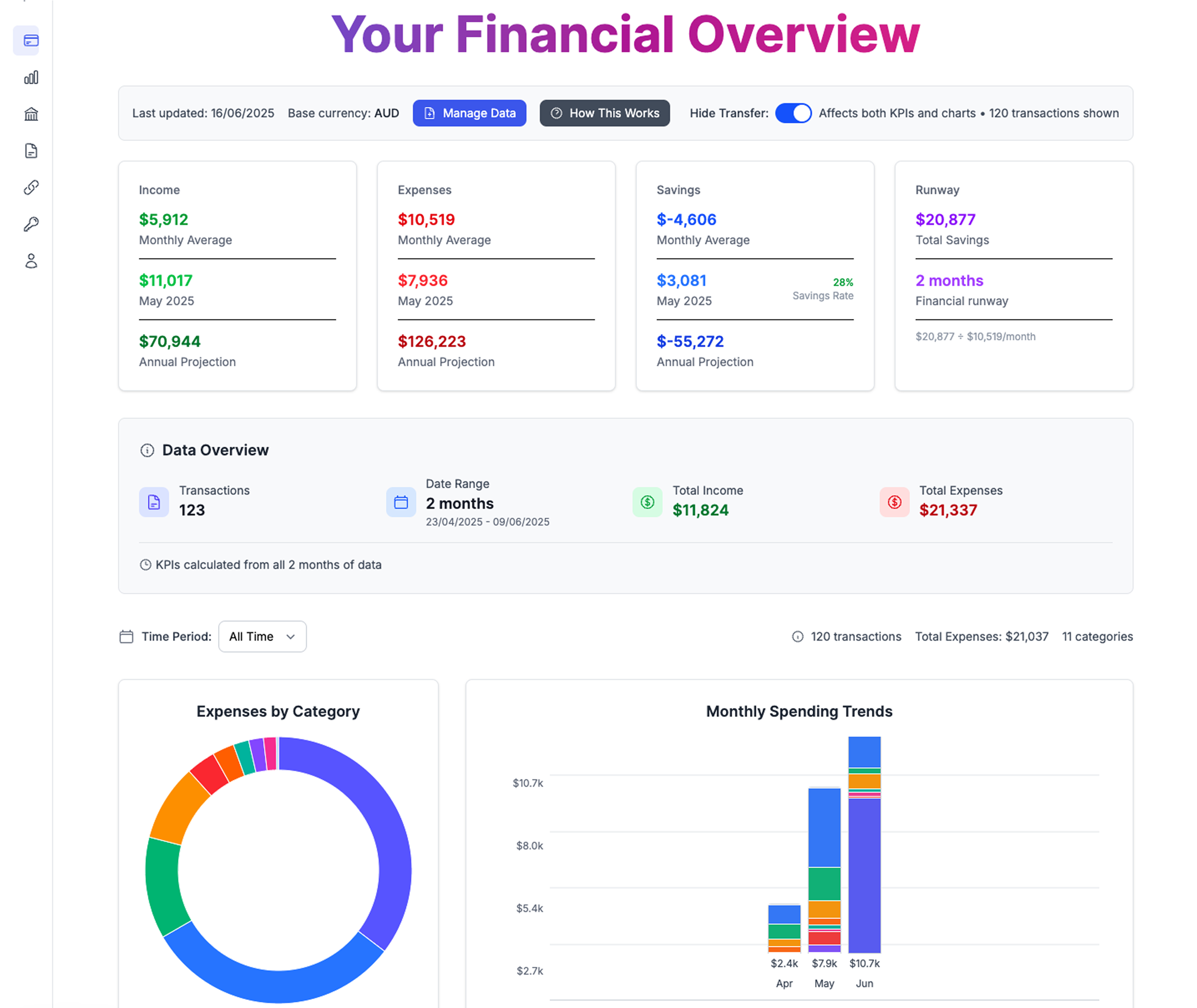

Complete financial overview showing your runway calculation, savings rate, and spending patterns in one clear dashboard

Complete financial overview showing your runway calculation, savings rate, and spending patterns in one clear dashboard

Want the answer without the manual math? Our Google Sheet calculates your financial runway for you.

Step 1: Calculate Your True Monthly Expenses

Unlike emergency fund calculations that assume reduced spending, runway calculations use your actual lifestyle costs—because the goal is maintaining your chosen quality of life, not just surviving. To get accurate numbers, use our expense tracker Google Sheets template to track spending for 2-3 months.

Essential Fixed Expenses:

- Housing (rent/mortgage, property taxes, insurance)

- Utilities (electricity, water, gas, internet, phone)

- Insurance premiums (health, car, life, disability)

- Debt payments (minimum payments on all debts)

- Transportation (car payments, insurance, gas, maintenance)

Essential Variable Expenses:

- Groceries and household supplies

- Healthcare (prescriptions, regular care, copays)

- Basic clothing and personal care

- Pet care and expenses

Quality of Life Expenses:

- Dining out and entertainment

- Subscriptions and memberships

- Hobbies and recreation

- Travel and vacation fund

- Shopping and discretionary purchases

Total Monthly Expenses: $______

Note: Be honest here. The goal isn't to impress anyone with low numbers—it's to understand your actual financial needs.

Step 2: Calculate Your Available Resources

Your financial runway comes from multiple sources, ranked by accessibility:

Tier 1: Immediate Cash (0-3 days access)

- Checking account balance: $______

- Savings accounts: $______

- Money market accounts: $______

- Cash on hand: $______

Tier 2: Liquid Investments (1-7 days access)

- Brokerage account (taxable): $______

- High-yield savings: $______

- Short-term CDs (under 6 months): $______

Tier 3: Semi-Liquid Assets (1-30 days access)

- Longer-term CDs: $______

- Roth IRA contributions (penalty-free): $______

- Bonds or bond funds: $______

Tier 4: Credit and Borrowing (availability varies)

- Available credit card limits: $______

- Home equity line of credit: $______

- 401k loans (if available): $______

Total Liquid Resources: $______ (Tiers 1-3 only)

Step 3: Calculate Your Basic Runway

Basic Financial Runway = Total Liquid Resources ÷ Monthly Expenses

This gives you the number of months you could maintain your current lifestyle without any income.

Example:

- Monthly expenses: $5,000

- Liquid resources: $60,000

- Basic runway: 12 months

Step 4: Adjust for Real-World Factors

Tax Considerations: If significant portions of your resources are in taxable investments, reduce the total by your estimated tax rate (typically 10-30% depending on your situation).

Market Risk Buffer: For investments subject to market fluctuation, apply a 10-20% discount to account for potential downturns when you might need the money.

Inflation Adjustment: For runways longer than 12 months, reduce by 2-3% annually to account for inflation.

Adjusted Financial Runway: ______ months

Advanced Runway Scenarios

The Conservative Runway

Uses only cash and guaranteed resources (Tier 1 + guaranteed Tier 2). This is your rock-solid, worst-case-scenario runway.

The Aggressive Runway

Includes all liquid resources plus available credit. This shows your maximum possible runway but comes with higher risk.

The Opportunity Runway

Excludes emergency fund money—how much runway you have for planned opportunities without touching your safety net.

Interpreting Your Financial Runway

0-3 Months: Survival Mode

- Reality: Living paycheck to paycheck

- Implications: Can't take career risks, limited negotiation power

- Priority: Build emergency fund first, then focus on runway

3-6 Months: Basic Security

- Reality: Can handle job loss but with significant stress

- Implications: Some ability to be selective about next job

- Priority: Extend runway to reduce career pressure

6-12 Months: Career Flexibility

- Reality: Can afford to be choosy about opportunities

- Implications: Ability to quit toxic situations, pursue training, relocate for better opportunities

- Priority: Consider whether longer runway or investment growth is better use of additional savings

12-24 Months: Strategic Freedom

- Reality: Can make major life changes without immediate income pressure

- Implications: Entrepreneurship becomes viable, can support family members, educational opportunities available

- Priority: Balance between runway extension and wealth building

24+ Months: Life Design Freedom

- Reality: Approaching financial independence territory

- Implications: Work becomes optional, can pursue passion projects, extensive travel possible

- Priority: Optimize for long-term wealth building while maintaining adequate runway

Building Your Financial Runway

Our Google Sheet template is the perfect tool to help you track your expenses and build your runway systematically.

The Systematic Approach

Phase 1: Foundation (0-3 months runway)

- Track every expense for one month to understand true costs

- Build $1,000 emergency buffer

- Eliminate unnecessary recurring expenses

- Focus on debt payments to reduce monthly obligations

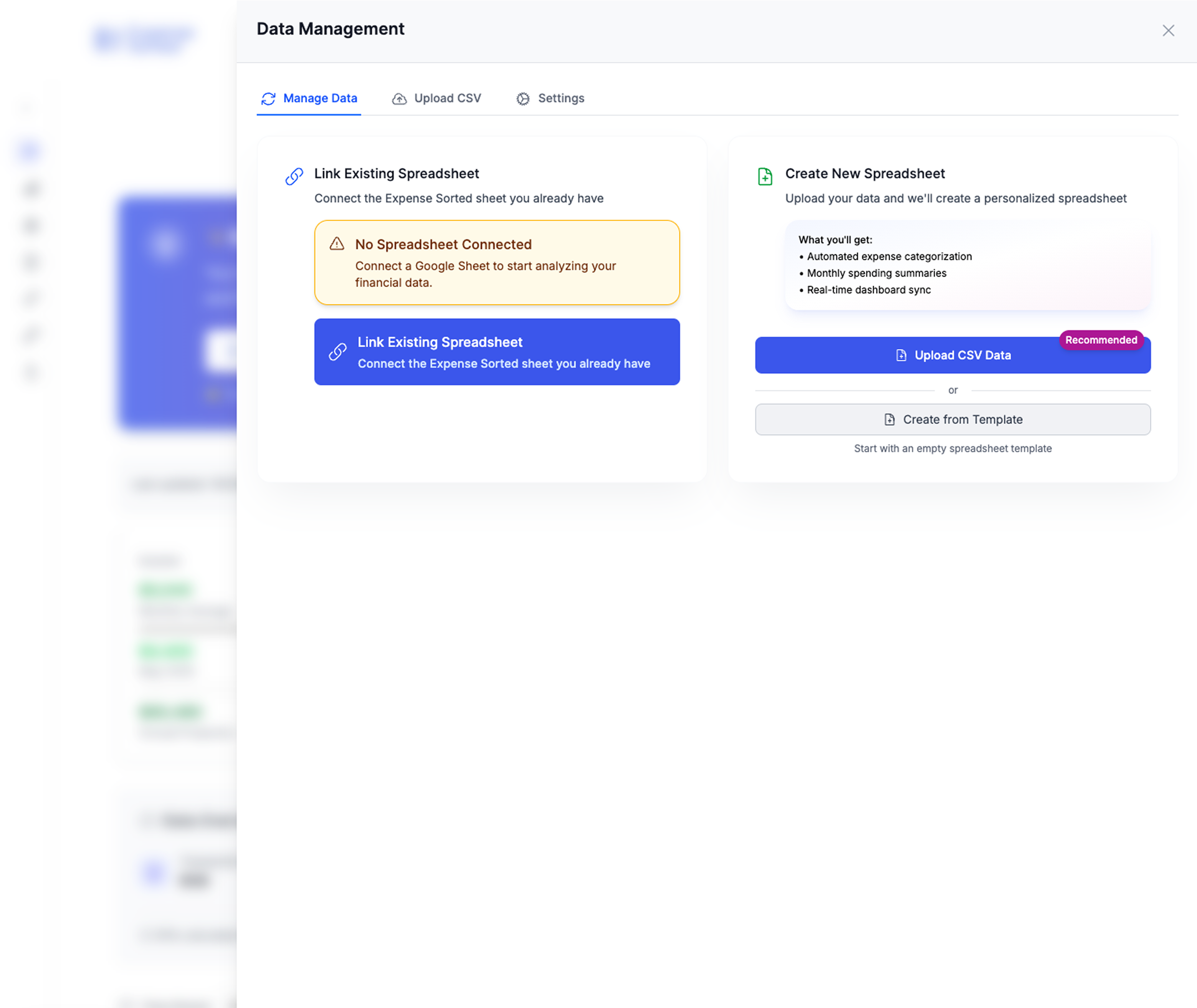

Comprehensive data management makes tracking your true expenses effortless - essential for accurate runway calculations

Comprehensive data management makes tracking your true expenses effortless - essential for accurate runway calculations

Phase 2: Stability (3-6 months runway)

- Automate savings—save runway money first, spend what's left

- Optimize major expenses (housing, transportation, food)

- Increase income through skills development or side income

- Keep runway money in high-yield savings accounts

Phase 3: Flexibility (6-12 months runway)

- Consider more aggressive savings rates (20-30% of income)

- Optimize for tax efficiency

- Begin strategic investing for long-term growth

- Evaluate whether additional runway or investment growth provides more value

Phase 4: Freedom (12+ months runway)

- Balance runway maintenance with wealth building

- Consider alternative income streams

- Plan for desired lifestyle changes or career transitions

- Optimize for both liquidity and growth

Runway-Building Strategies

Income Optimization:

- Negotiate salary increases with your improved financial position

- Develop marketable skills that command higher pay

- Create income streams that don't require active management

Expense Optimization:

- Focus on the big three: housing, transportation, food

- Eliminate subscription creep and recurring charges

- Optimize for value, not just lowest cost

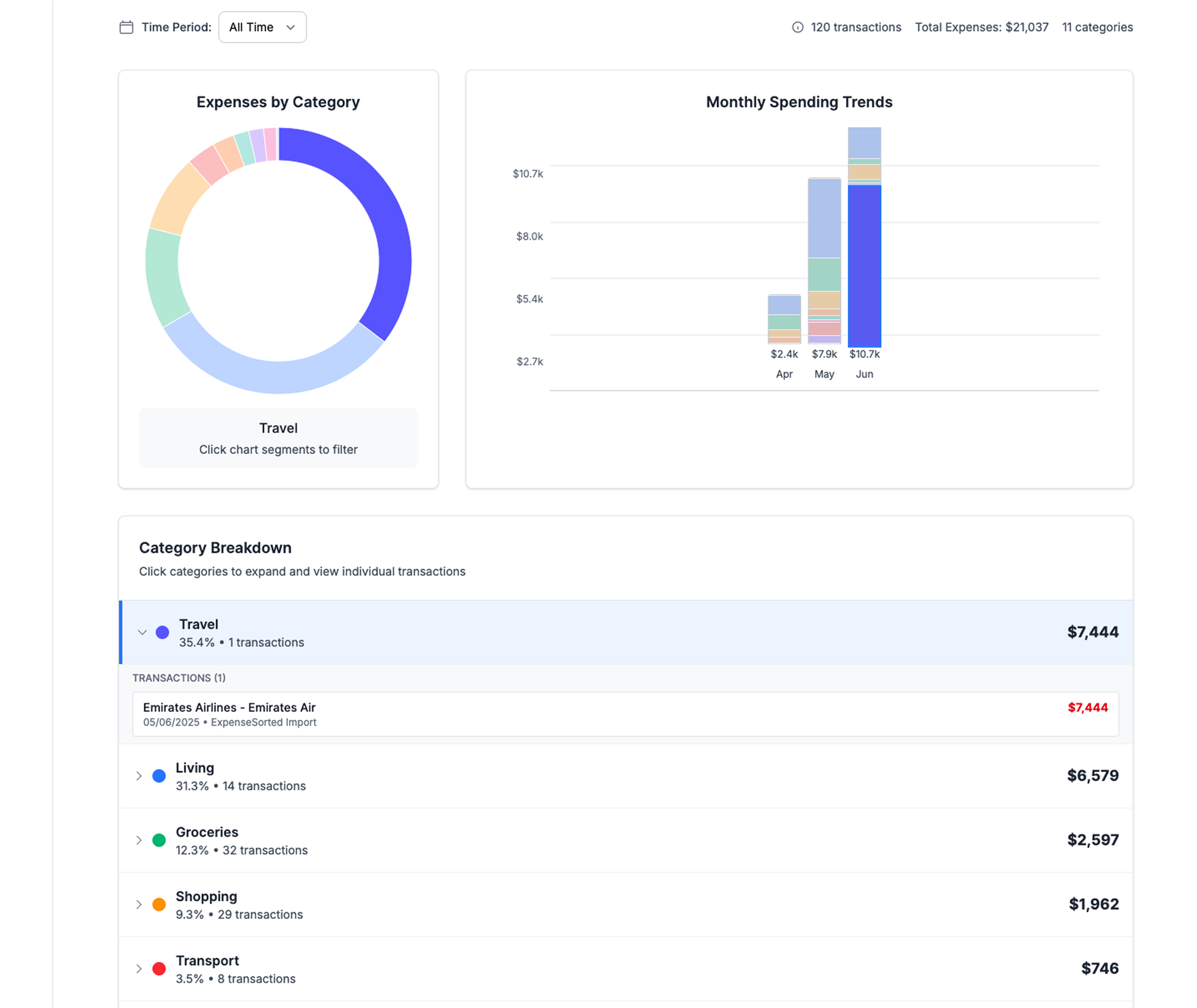

Intelligent category analysis helps identify where your money goes and optimize your runway-building strategy

Intelligent category analysis helps identify where your money goes and optimize your runway-building strategy

Savings Rate Focus:

- Track your savings rate as closely as your runway

- Aim for 20%+ savings rate if possible

- Use percentage-based targets rather than fixed dollar amounts

Using Your Financial Runway Strategically

Career Decisions

With adequate runway, you can:

- Quit before finding the next job

- Take time for strategic job searching

- Negotiate from a position of strength

- Accept lower-paying but higher-potential opportunities

- Pursue additional education or training

Entrepreneurship

Financial runway enables business ownership by:

- Providing time to validate business ideas

- Reducing pressure for immediate profitability

- Allowing focus on long-term value creation

- Enabling investment in business growth over personal salary

Life Transitions

Runway supports major life changes:

- Geographic relocation for better opportunities

- Career changes requiring retraining

- Supporting family members through difficulties

- Taking sabbaticals for personal development

Maintaining Your Runway

Regular Recalculation

Review your runway quarterly:

- Update expense calculations based on actual spending

- Recalculate available resources

- Adjust for any major life changes

- Plan for seasonal expense variations

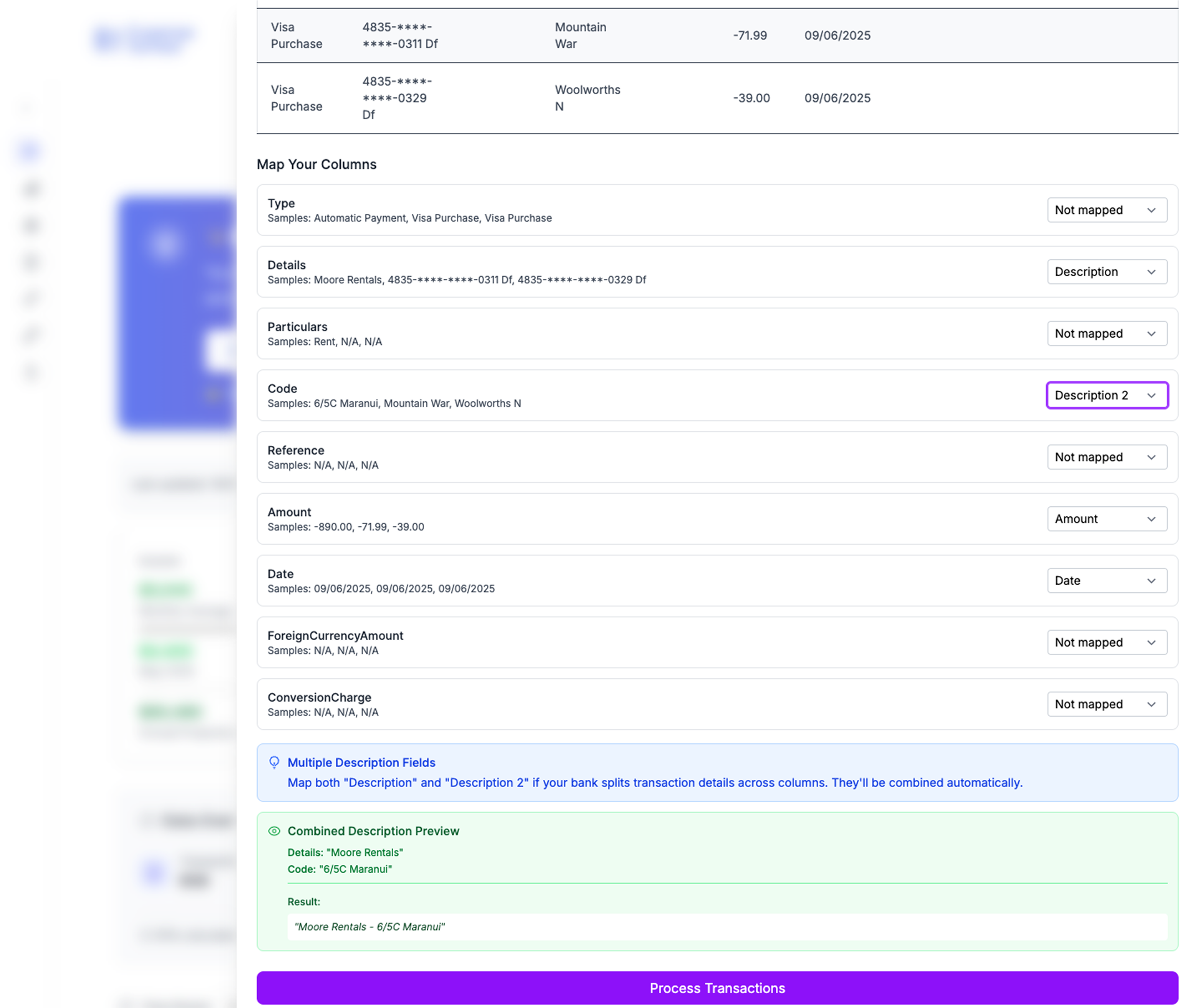

Seamless bank statement import ensures your runway calculations stay accurate with minimal time investment

Seamless bank statement import ensures your runway calculations stay accurate with minimal time investment

Runway vs. Investment Balance

As your runway grows, consider whether additional months provide diminishing returns compared to investing for long-term growth.

Guidelines:

- 12 months runway covers most career transitions

- 24 months enables major life changes

- Beyond 24 months, additional runway provides less incremental freedom per dollar

Economic Cycle Considerations

Your needed runway may vary based on economic conditions:

- Strong economy: Lower runway requirements as opportunities are plentiful

- Uncertain times: Higher runway provides crucial flexibility

- Industry downturns: Increase runway if your field is particularly affected

Financial Runway vs. Other Metrics

Runway vs. Net Worth

Net worth includes illiquid assets (home equity, retirement accounts) that don't provide immediate flexibility. Runway focuses on accessible resources for near-term decisions.

Runway vs. Emergency Fund

Emergency funds prepare for problems; runway creates opportunities. You need both, but they serve different purposes.

Runway vs. FIRE Number

Financial Independence/Retire Early (FIRE) calculations determine when you can stop working entirely. Runway determines what choices you have right now.

The Psychology of Financial Runway

Confidence and Risk-Taking

Knowing your runway number provides psychological benefits:

- Reduced financial anxiety from understanding your true flexibility

- Improved decision-making by removing desperation from choices

- Increased confidence in negotiations and career moves

- Better work-life balance by reducing dependence on any single income source

Avoiding Runway Inflation

As runway increases, resist the temptation to increase spending proportionally. Lifestyle inflation can quickly erode your financial flexibility.

Your Next Steps

- Calculate your current runway using the method above

- Set a target runway based on your goals and risk tolerance

- Create a building plan with specific monthly savings targets

- Optimize your financial system for runway building

- Use your runway strategically to make better life choices

Remember: Financial runway isn't about hoarding money—it's about creating choices. The goal is to reach a point where you work because you want to, not because you have to.

Your runway is your freedom. How long is yours?

Related Articles

Emergency Fund Planning:

- 6 Month Emergency Fund Calculator: How Much Should You Really Save?

- Why 8 Months is the New Gold Standard for Emergency Funds in 2025

- Emergency Fund Calculator: How Much Do You Really Need? (2025 Updated)

Financial Freedom Concepts:

- Emergency Fund to Freedom Fund: Calculate Your Path to Financial Independence

- Financial Freedom vs Financial Independence: What I Wish I'd Known 10 Years Ago

- Financial Wellness: Beyond Budgets to True Freedom

Calculation Tools:

- Savings Rate Calculator: Your Path to Financial Independence (2025 Guide)

- Expense Tracker Google Sheets Template: Complete Setup Guide (2025)

Life Planning:

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money