How to Track Spending Without Selling Your Soul to Big Tech

Every transaction you categorize in a "free" budgeting app becomes data that's monetized by someone else. Here's how to take back control.

Last month, I received an email that made my blood boil.

A reader forwarded me a targeted ad they'd received for a high-interest personal loan. The ad mentioned their specific spending patterns, recent large purchases, and even referenced their current bank balance ranges.

The loan company knew all this because they'd purchased data from the "free" budgeting app this person had been using for two years.

This is the hidden cost of convenience. While you think you're getting a tool to manage your money, you're actually paying with something far more valuable: your financial privacy and independence.

Here's how to build a completely private expense tracking system that protects your data while giving you better insights than any app ever could. We've even built a Google Sheet template to get you started.

The Real Cost of "Free" Budgeting Apps

Before we dive into the solution, let's understand what you're actually giving up when you use budgeting apps:

Your Spending Patterns Are Sold to Marketers

- Credit card companies buy data to target you with new cards

- Retailers purchase spending patterns to optimize their pricing

- Insurance companies use spending data to assess risk profiles

- Loan companies target you based on your financial stress indicators

Your Financial Behavior Is Analyzed and Monetized

- Apps sell insights about when you're likely to make large purchases

- Your debt levels and payment patterns are packaged and sold

- Your investment behavior is analyzed and monetized

- Your financial stress patterns are identified and exploited

You Lose Control Over Your Own Financial Information

- You can't export your data in usable formats

- You can't control who has access to your information

- You can't delete your financial history completely

- You're locked into their system and their privacy policy changes

The Hidden Psychological Cost

When you know your financial data is being watched and monetized, it changes how you behave with money. You start optimizing for the app's algorithms instead of your own financial goals.

The Privacy-First Alternative: Building Your Own System

The good news? You can build a more powerful, completely private expense tracking system using tools you already have access to.

The Core Philosophy: Your financial data should work for you, not against you. Every piece of information about your spending should help you make better decisions, not help someone else make money from you.

Why Google Sheets Beats Apps for Privacy

Complete Data Ownership:

- Your data stays in your Google account

- No third-party access or data sharing

- Easy to export and move anytime

- You control exactly who can see what

No Hidden Monetization:

- Google doesn't sell your personal Sheets data to third parties

- No targeted ads based on your spending patterns

- No data mining of your financial behavior

- No surprise privacy policy changes affecting your data

Unlimited Customization:

- Track exactly what matters to you

- Create categories that match your actual life

- Build reports that answer your specific questions

- Modify the system as your needs change

Future-Proof Security:

- No risk of the company shutting down

- No surprise subscription fees

- No feature limitations or paywall restrictions

- Works as long as Google exists (which is effectively forever)

Our spreadsheet is a perfect example of this in action.

The Complete Private Expense Tracking System

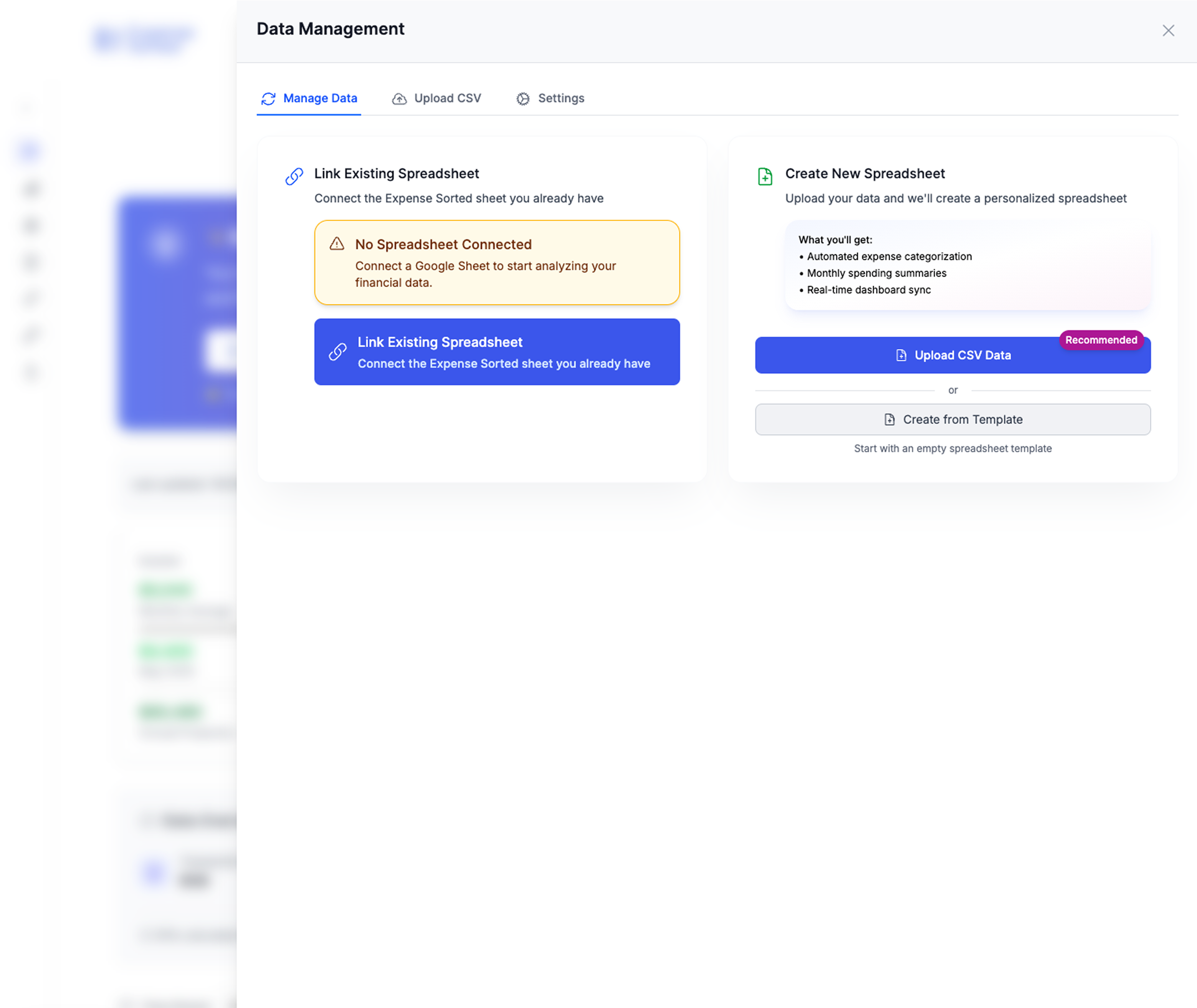

Complete data management with full privacy control - your financial data stays yours

Complete data management with full privacy control - your financial data stays yours

Foundation: The Smart Category System

Most people fail at expense tracking because they use generic categories that don't match their actual spending patterns. Here's how to build categories that work:

Level 1: Essential Categories (The Big 4)

- Housing: Rent/mortgage, rates, utilities, maintenance

- Transport: Vehicle costs, public transport, fuel, parking

- Food: Groceries, dining out, coffee, takeaways

- Everything Else: All other spending

Level 2: Detailed Categories (Once You Have Data) After tracking Level 1 for a month, you'll see where "Everything Else" money actually goes:

- Personal care and health

- Entertainment and recreation

- Clothing and household items

- Insurance and financial services

- Children and family expenses

Level 3: Insight Categories (For Optimization) These categories help you understand your spending psychology:

- Convenience spending: Purchases made to save time

- Impulse spending: Unplanned purchases under $50

- Emotional spending: Purchases made during stress or celebration

- Investment spending: Purchases that save money long-term

The Three-Tab System

Tab 1: Transaction Log Simple input system for all spending:

- Date | Amount | Description | Category | Payment Method

- One row per transaction

- Weekly batch entry (15 minutes)

- Monthly review and categorization refinement

Tab 2: Monthly Dashboard Visual overview of your spending:

- Current month spending by category

- Budget vs actual comparisons

- Trend analysis (spending up/down vs last month)

- Cash flow summary (money in vs money out)

Tab 3: Analysis Engine Deep insights into your spending patterns:

- Average spending by category over 3/6/12 months

- Seasonal spending pattern identification

- Spending efficiency metrics (cost per convenience, etc.)

- Financial runway calculations

Advanced Privacy Features

Transaction Description Masking Instead of recording "Coffee at Starbucks," record "Caffeine." Instead of "Dinner at expensive restaurant," record "Social dining."

This protects your privacy even if someone gains access to your sheet while still giving you the spending insights you need.

Location Independence Never record specific locations or businesses unless necessary for tax deductions. Focus on categories and spending patterns, not vendor tracking.

Secure Sharing If you need to share financial information (with a partner, accountant, or financial adviser), create summary views that don't include detailed transaction data.

Setting Up Your Private System (Step-by-Step)

Want to skip the setup? Grab our pre-built, privacy-focused Google Sheet template here.

Step 1: Create Your Tracking Sheet (30 minutes)

- Open Google Sheets and create a new spreadsheet

- Name it something generic like "Monthly Expenses" (avoid "Budget" or "Finance")

- Set up Tab 1 (Transaction Log) with columns:

- Date | Amount | Category | Payment Method | Notes

- Create your initial category list (start with 8-10 categories max)

- Set up basic formulas for monthly totals by category

Step 2: Establish Your Input Routine (Week 1)

Daily Option: Quick mobile entry

- Use Google Sheets mobile app

- 30-second entry for each transaction

- Best for people who make many small purchases

Weekly Option: Batch processing (Recommended)

- Review bank/credit card statements once per week

- Enter all transactions in one 15-minute session

- Best for people who prefer dedicated financial admin time

Hybrid Option: Cash daily, cards weekly

- Enter cash transactions immediately (they're easily forgotten)

- Batch process card transactions weekly from statements

Step 3: Build Your Analysis System (Week 2)

Basic Analysis:

- Monthly spending by category

- Budget vs actual variance

- Month-over-month trends

- Annual spending projections

Advanced Analysis:

- Spending per day of week (identify patterns)

- Seasonal spending variations

- Cost per convenience calculations

- Financial runway based on essential vs discretionary spending

Step 4: Optimize for Insights (Month 2+)

Once you have a month of data, start optimizing your system:

Category Refinement: Split categories that are too broad, combine categories that are too narrow

Pattern Recognition: Look for spending patterns you didn't expect:

- Higher spending on specific days of the week

- Emotional spending triggers

- Seasonal variations you hadn't considered

Optimization Opportunities: Identify areas where small changes could have big impact:

- Subscription services you'd forgotten about

- Convenience spending that doesn't actually save time

- Social spending that doesn't align with your values

Advanced Privacy Protection Techniques

Data Minimization

Only track what you need for decision-making. More data isn't always better - it's just more information that could potentially be compromised.

What to Track:

- Amount, category, date

- Payment method (for cashflow management)

- Essential notes for tax or reimbursement purposes

What NOT to Track:

- Specific vendors unless required for taxes

- Exact locations of purchases

- Detailed personal information

- Information that doesn't impact financial decisions

Access Control

Google Sheets Security Settings:

- Set sharing to "Private" (only you can access)

- Use two-factor authentication on your Google account

- Regularly review account access and connected apps

- Never share edit access unless absolutely necessary

Device Security:

- Use screen locks on all devices accessing your financial data

- Log out of Google Sheets when using shared computers

- Avoid accessing financial data on public Wi-Fi

- Keep your devices updated with latest security patches

Data Portability Planning

Always maintain the ability to leave any platform:

Regular Backups:

- Monthly export of your complete spreadsheet

- Save copies in multiple formats (Excel, CSV, PDF)

- Store backups in different locations (local drive, cloud storage)

Platform Independence:

- Use formulas and features that work in multiple spreadsheet programs

- Avoid Google Sheets-specific features that lock you into the platform

- Document your system so it could be recreated elsewhere

Handling New Zealand Banking Specifics

Multiple Bank Account Tracking

Most Kiwis have accounts with multiple banks. Here's how to track efficiently:

Account Coding System:

- ANZ-C: ANZ Credit Card

- ASB-S: ASB Savings

- WBC-E: Westpac Everyday

Weekly Reconciliation Process:

- Download CSV files from each bank

- Import into a staging area in your sheet

- Categorize and clean up transaction descriptions

- Copy finalized transactions to your main log

- Verify totals match bank statements

Handling New Zealand Payment Methods

EFTPOS vs Credit Card Tracking:

- EFTPOS transactions: Immediate impact on cash flow

- Credit card transactions: Track both purchase date and payment date

- Direct debits: Set up automatic categorization for recurring payments

Cash Transaction Management:

- Weekly cash withdrawal tracking

- Simple cash expense categories (coffee, parking, tips)

- Don't obsess over exact cash allocation - estimate is fine

Online Payment Services:

- PayPal, Apple Pay, Google Pay: Track the underlying funding source

- Afterpay, Laybuy: Track both the purchase and the payment schedule

- Direct debit services: Set up automatic recognition

Advanced Formulas for Financial Insights

Spending Velocity Calculator

Track how quickly you spend money after receiving income:

=DAYS(LastPayDate, SpendDate) / TotalSpent

This helps identify if you're spending too quickly after payday.

Financial Runway Calculator

How long your savings would last at current spending rates:

=CurrentSavings / (AVERAGE(LastThreeMonthsSpending))

Updates automatically as you add new transactions.

Spending Efficiency Metrics

Compare cost per use for different categories:

=MonthlySubscriptionCost / TimesUsedPerMonth

Helps identify subscriptions that aren't worth their cost.

Seasonal Spending Analysis

Identify patterns in your spending across the year:

=SUMIFS(Amount, Month, "December") / SUMIFS(Amount, Month, "June")

Helps with annual budgeting and cash flow planning.

Building Your Financial Privacy Community

Partner/Spouse Collaboration Without Compromising Privacy

Separate Individual Tracking: Each person maintains their own transaction log Shared Summary Reports: Create monthly summaries that don't include transaction details Joint Category Decisions: Agree on categories and spending goals together Privacy Boundaries: Respect each other's right to financial privacy within agreed limits

Sharing with Financial Professionals

Accountant Sharing: Create summary reports by category, not detailed transactions Financial Adviser Sharing: Focus on patterns and trends, not individual purchases Tax Preparation: Export only tax-relevant transactions with supporting documentation

Teaching Children Financial Privacy

Age-Appropriate Tracking: Start with simple categories and basic tracking Privacy Education: Explain why financial information should be kept private System Building: Teach them to build their own tracking system as they grow Values Alignment: Help them understand how spending connects to their values

Common Setup Problems and Solutions

"I Can't Remember to Track Everything"

Solution 1: Set up weekly calendar reminders for batch processing Solution 2: Link tracking to an existing habit (Sunday evening planning) Solution 3: Use bank statement imports rather than manual entry Solution 4: Accept 80% accuracy rather than perfect tracking

"My Categories Don't Work"

Solution 1: Start with fewer categories and split them as needed Solution 2: Track your "miscellaneous" spending for a month to see patterns Solution 3: Use broad categories initially, then add subcategories Solution 4: Copy successful category systems, then customize

"The System Is Too Complicated"

Solution 1: Start with a single tab and basic tracking Solution 2: Add complexity gradually as you get comfortable Solution 3: Focus on the 20% of features that give 80% of the benefit Solution 4: Remember: simple but consistent beats complex but abandoned

"I Don't See the Value"

Solution 1: Track for three months before evaluating usefulness Solution 2: Focus on finding one significant spending leak Solution 3: Calculate the privacy value, not just the financial value Solution 4: Connect tracking to a specific financial goal

The Psychology of Private Expense Tracking

Behavioral Changes from Privacy-First Tracking

Increased Mindfulness: When you know your data isn't being sold, you focus on your actual spending patterns rather than optimizing for an algorithm.

Reduced Anxiety: No worry about data breaches, privacy policy changes, or targeted marketing based on your financial stress.

Better Decision-Making: Data that serves your goals rather than someone else's profit motives leads to better financial decisions.

Authentic Goal Setting: Without external algorithms suggesting what you should want, you develop goals that align with your actual values.

The Compound Effect of Financial Privacy

Year 1: Basic privacy protection and awareness of spending patterns Year 2: Improved financial decision-making from unbiased data Year 3: Significant savings from avoiding targeted financial marketing Year 5: Complete financial autonomy and privacy-first financial systems Year 10: Generational privacy practices that protect your family's financial future

Advanced Integration Strategies

Integration with Investment Tracking

- Separate investment tracking from spending tracking

- Use different systems for different purposes

- Maintain privacy across all financial systems

- Coordinate without compromising compartmentalization

For a comprehensive view of how your expense tracking can work alongside other financial tools and systems, check out our complete guide to financial integrations that respect your privacy while maximizing your financial insights.

Tax Optimization Integration

- Flag tax-deductible expenses without detailed tracking

- Export tax-relevant data without exposing personal information

- Maintain documentation standards for IRD compliance

- Separate business and personal tracking systems

Estate Planning Integration

- Document your financial systems for beneficiaries

- Provide access instructions without compromising current privacy

- Create simplified versions for emergency access

- Maintain control while planning for transition

Measuring Success: Privacy + Financial Health

Privacy Metrics

- Zero instances of financial data being used against you

- Complete control over who accesses your financial information

- Ability to export and delete your data anytime

- No surprise marketing based on your spending patterns

Financial Health Metrics

- Spending patterns aligned with your stated values

- Improved financial decision-making over time

- Increased savings rate through spending optimization

- Reduced financial stress and anxiety

System Effectiveness Metrics

- Time spent on tracking (should decrease over time)

- Accuracy of spending insights (should increase over time)

- Usefulness of reports for decision-making

- Sustainability of the tracking habit

Your 30-Day Private Tracking Challenge

Week 1: Foundation

- Set up your basic Google Sheets tracking system

- Define your initial categories (maximum 10)

- Enter one week of transactions manually

- Set up your weekly tracking routine

Week 2: Automation

- Set up bank statement import process

- Create basic analysis formulas

- Establish your weekly review process

- Identify initial spending patterns

Week 3: Optimization

- Refine categories based on actual spending

- Add privacy protection features

- Create summary reports for decision-making

- Identify first spending optimization opportunity

Week 4: Integration

- Connect tracking to your financial goals

- Set up monthly reporting routine

- Plan for system maintenance and improvement

- Evaluate benefits and plan next steps

The Bottom Line: Your Data, Your Decisions

Every month you use a "free" budgeting app is another month of:

- Financial data being sold to companies that profit from your spending patterns

- Targeted marketing designed to separate you from your money

- Algorithmic suggestions that serve corporate interests, not your financial freedom

- Lock-in to systems that prioritize their profits over your privacy

Building your own private expense tracking system isn't just about protecting your data - it's about protecting your financial autonomy.

When your financial tracking system works for you instead of against you, you make better decisions. When your data stays private, you maintain control over your financial future.

Your money is private. Your spending patterns are private. Your financial goals are private.

It's time your tracking system reflected that reality.

Ready to build a completely private expense tracking system?

Get Started Today:

- Download the Private Tracking Template (Google Sheets)

- Follow the 30-Day Setup Guide (Step-by-step instructions)

- Join the Financial Privacy Community (Tips, updates, and support)

- Learn Advanced Privacy Techniques (Masterclass series)

Related Reading:

- Why Financial Privacy Matters More Than You Think

- Google Sheets vs Budgeting Apps: The Complete Comparison

- Building Financial Independence Without Surveillance Capitalism

- Complete Personal Finance Health Check - Take our 3-minute assessment to identify your next steps toward financial freedom

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money