Stop thinking about emergency funds. Start building a freedom fund.

The difference isn't just semantic—it's revolutionary. An emergency fund keeps you alive during crisis. A freedom fund gives you choices, leverage, and the ability to build wealth on your terms.

Here's how to transform your financial safety net into a strategic weapon for independence.

The Emergency Fund Trap

Traditional emergency fund advice puts you in survival mode:

- "Save 3-6 months of expenses"

- "Keep it in savings earning 4%"

- "Only touch it for real emergencies"

This mindset creates a psychological barrier. Your emergency fund sits there, unused and growing slowly, while you remain tied to your job and dependent on your next paycheck.

Better approach: Build a progressive freedom fund that serves multiple purposes while growing toward complete independence.

The Freedom Fund Framework

Your freedom fund has four distinct phases, each unlocking new life possibilities:

Phase 1: Stability Fund (1-3 Months)

Purpose: Handle basic emergencies without debt Amount: 1-3 months essential expenses Psychology: Peace of mind, reduced financial anxiety

Phase 2: Flexibility Fund (3-8 Months)

Purpose: Career transitions, strategic decisions

Amount: 3-8 months essential expenses

Psychology: Job negotiation power, career choice freedom

Phase 3: Freedom Fund (8-24 Months)

Purpose: Extended breaks, business building, major life changes Amount: 8-24 months essential expenses Psychology: Work becomes optional for extended periods

Phase 4: Independence Fund (25+ Months)

Purpose: Complete financial independence Amount: 25x annual expenses (traditional FIRE number) Psychology: Work becomes completely optional forever

Calculate Your Freedom Fund Progression

Use this calculator to determine your targets for each phase:

Download our spreadsheet to calculate your freedom number now

Step 1: Calculate Monthly Essential Expenses

Essential expenses only:

- Housing (rent/mortgage, utilities, insurance)

- Food (groceries, not restaurants)

- Transportation (car payment, gas, insurance)

- Healthcare (insurance premiums, medications)

- Debt minimums (required payments only)

- Basic services (phone, internet)

Example: $4,500/month essentials

Step 2: Calculate Each Phase Target

- Stability Fund: $4,500 × 3 = $13,500

- Flexibility Fund: $4,500 × 8 = $36,000

- Freedom Fund: $4,500 × 18 = $81,000

- Independence Fund: $4,500 × 12 × 25 = $1,350,000

Step 3: Track Your Current Position

Current savings: $28,000 Current phase: Flexibility Fund (6.2 months) Next milestone: 8-month Freedom Fund ($36,000) Gap to close: $8,000

The Psychology of Freedom Funds

Each phase fundamentally changes your relationship with work and money:

Stability Fund Psychology

- "I won't go into debt if something happens"

- Reduced daily financial anxiety

- Ability to handle minor emergencies

Flexibility Fund Psychology

- "I can quit my job if needed"

- Negotiation leverage with employers

- Freedom to be selective about opportunities

Freedom Fund Psychology

- "I can take extended time off"

- Ability to start businesses or freelance

- Freedom to pursue passion projects

Independence Fund Psychology

- "I never have to work again"

- Complete autonomy over time and energy

- Work becomes creative expression, not necessity

Strategic Deployment: Beyond Emergency Use

Your freedom fund isn't just insurance—it's investment capital for your future:

Career Investment

Traditional emergency thinking: "Don't touch the fund unless fired" Freedom fund thinking: "Invest in skills that increase earning power"

- Take unpaid internships in new fields

- Fund coding bootcamps or certification programs

- Start consulting business with runway for client acquisition

Business Building

Traditional emergency thinking: "Keep money safe in savings" Freedom fund thinking: "Deploy capital strategically for wealth building"

- Fund business launches with calculated risk

- Invest in equipment or inventory for side hustles

- Bridge income gaps during business scaling

Lifestyle Optimization

Traditional emergency thinking: "Maintain current lifestyle indefinitely" Freedom fund thinking: "Optimize lifestyle for long-term freedom"

- Move to lower cost-of-living areas

- Downsize housing to extend runway

- Eliminate recurring expenses that don't add value

Advanced Freedom Fund Strategies

Multi-Bucket Approach

Instead of one large emergency fund, create strategic buckets:

Bucket 1: Immediate Access (1 month)

- High-yield checking account

- Instant access for true emergencies

Bucket 2: Short-term Access (3-6 months)

- High-yield savings account

- 1-2 day transfer time

Bucket 3: Medium-term Growth (6-12 months)

- Money market accounts or short-term CDs

- Slightly higher returns, 3-7 day access

Bucket 4: Long-term Wealth Building (12+ months)

- Conservative investment portfolio

- Higher growth potential, longer time horizon

Dynamic Allocation Strategy

Adjust your freedom fund allocation based on life circumstances:

High Job Security Period:

- Reduce immediate cash to 2-3 months

- Increase investment allocation for growth

Career Transition Period:

- Increase immediate cash to 6-8 months

- Reduce investment risk temporarily

Business Building Period:

- Maintain higher cash reserves

- Prepare for income volatility

Tax-Optimized Freedom Funds

Traditional emergency funds sit in taxable accounts earning 4%. Smart freedom funds use tax-advantaged growth:

Roth IRA Strategy

- Contribute $6,500 annually to Roth IRA

- Access contributions penalty-free anytime

- Earnings grow tax-free for retirement

- Dual purpose: Emergency access + retirement savings

Health Savings Account (HSA) Strategy

- Contribute $4,150 annually (2025 limit)

- Triple tax advantage (deductible, growth, withdrawal)

- Use for medical emergencies immediately

- Becomes retirement fund after age 65

Conservative Investment Strategy

- 20% stocks, 80% bonds in taxable account

- Lower volatility than pure stock portfolio

- Higher growth than pure savings account

- Acceptable risk for freedom fund money

Real-World Freedom Fund Success Stories

Sarah's Career Transition

Starting point: 3-month emergency fund, $15,000 Goal: Transition from teaching to UX design Strategy: Built 12-month freedom fund, took bootcamp Outcome: 18-month transition, 85% salary increase

Mike's Business Launch

Starting point: 6-month emergency fund, $32,000 Goal: Launch consulting business Strategy: Extended fund to 18 months, planned gradual transition Outcome: Successful business, 60% income increase

Jessica's Lifestyle Optimization

Starting point: High expenses, 2-month emergency fund Goal: Extend runway through cost reduction Strategy: Downsized housing, eliminated subscriptions Outcome: 18-month runway on same income

Freedom Fund Milestones and Celebrations

Make progress visible and rewarding:

1-Month Milestone

Celebration: Nice dinner out Benefit: Basic breathing room Next: Focus on automating savings

3-Month Milestone

Celebration: Weekend getaway Benefit: Traditional "emergency fund" security Next: Begin lifestyle optimization

6-Month Milestone

Celebration: Week-long vacation Benefit: Job negotiation leverage Next: Consider career advancement opportunities

12-Month Milestone

Celebration: Extended celebration trip Benefit: Extended career break possible Next: Begin wealth-building focus

24-Month Milestone

Celebration: Whatever you want—you have options Benefit: Complete work flexibility Next: Focus on investment returns

Building Your Freedom Fund: The 24-Month Plan

Months 1-6: Foundation Building

Target: 3-month fund Strategy: Aggressive expense cutting + automation

- Cut obvious waste (subscriptions, dining out)

- Automate 25% of income to savings

- Track progress weekly for motivation

Months 7-12: Acceleration Phase

Target: 6-month fund Strategy: Income optimization + systematic saving

- Negotiate salary or find higher-paying role

- Develop side income streams

- Maintain aggressive savings rate

Months 13-18: Strategic Phase

Target: 12-month fund Strategy: Lifestyle optimization + investment

- Optimize housing and transportation costs

- Begin conservative investment allocation

- Consider geographic arbitrage

Months 19-24: Freedom Phase

Target: 18-24 month fund Strategy: Wealth building focus

- Maximize tax-advantaged contributions

- Build investment knowledge and portfolio

- Plan first strategic deployment of fund

Common Freedom Fund Mistakes

Mistake 1: All or Nothing Thinking

Problem: "I need $50,000 before I start" Solution: Celebrate every milestone, build progressively

Mistake 2: Pure Cash Strategy

Problem: Inflation erodes purchasing power over time Solution: Strategic mix of cash and conservative investments

Mistake 3: Never Using the Fund

Problem: Money sits unused while opportunities pass Solution: Plan strategic deployment for career/business growth

Mistake 4: Lifestyle Inflation

Problem: Increase spending as fund grows Solution: Lock in lifestyle while building toward independence

Integration with Long-Term Wealth Strategy

Your freedom fund is step one of a comprehensive wealth-building plan:

Phase 1: Build Freedom Fund (Months 1-24)

- Achieve 12-24 months of expenses saved

- Establish financial security and flexibility

Phase 2: Optimize Investments (Years 2-5)

- Maximize 401(k), IRA, and HSA contributions

- Build diversified investment portfolio

- Focus on increasing savings rate

Phase 3: Accelerate Wealth Building (Years 5-15)

- Deploy freedom fund strategically for income growth

- Consider real estate or business investments

- Optimize for tax efficiency

Phase 4: Achieve Independence (Years 10-20)

- Reach 25x annual expenses invested

- Work becomes completely optional

- Focus on legacy and contribution

Ready to Transform Your Emergency Fund?

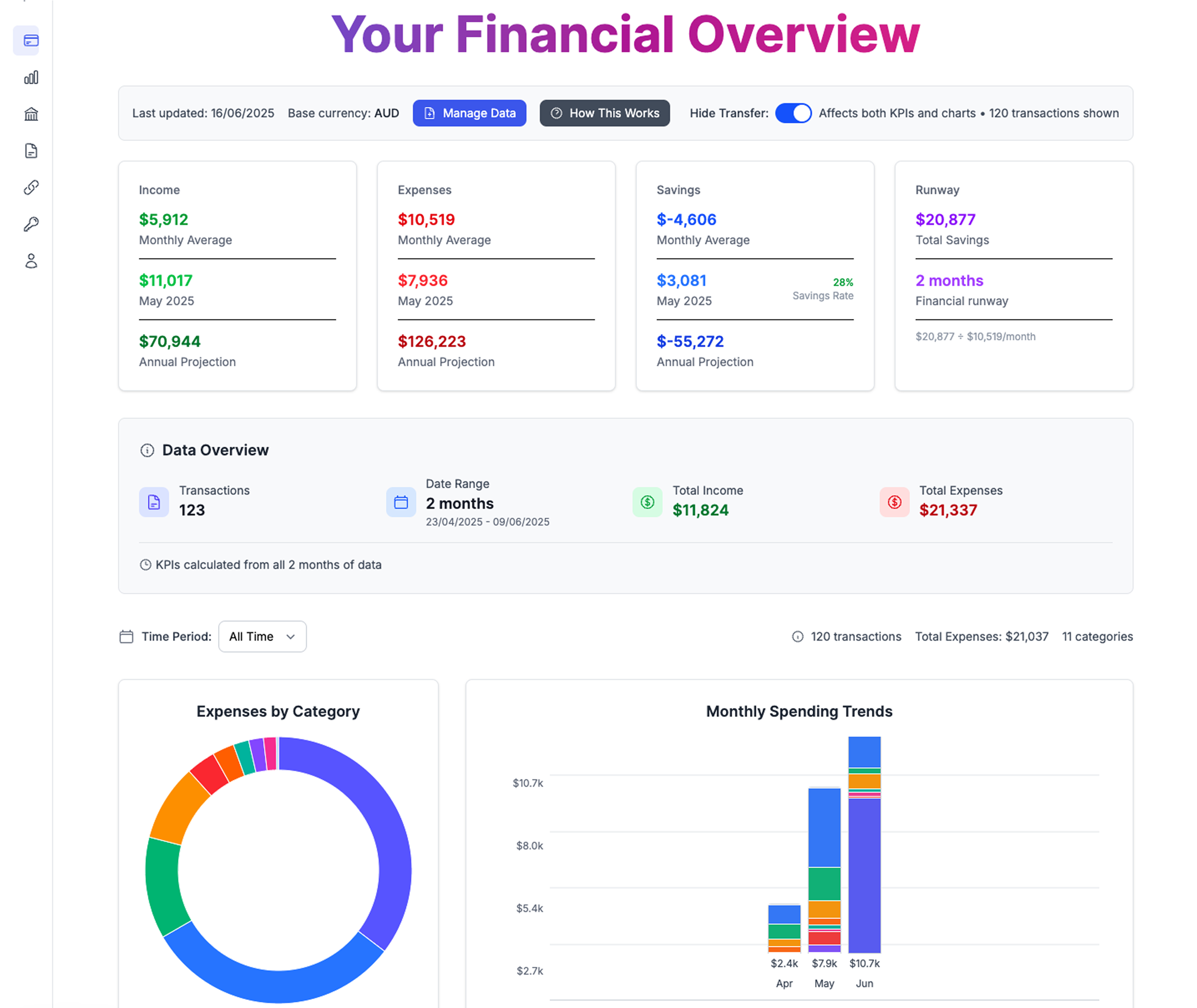

Use Expense Sorted's Financial Runway Calculator to track your progress from emergency fund to freedom fund. Upload your bank statements, get automatic categorization, and see exactly how many months of freedom your money can buy.

Track your freedom progression:

- Current runway calculation

- Phase targets and milestones

- Progress tracking and goal setting

- Strategic deployment planning

Stop building for survival. Start building for freedom.

Your independence isn't 30 years away—it's 24 months of systematic building away.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money