Everyone talks about having 3-6 months of expenses saved for emergencies. But what if I told you that advice is dangerously outdated?

In 2025's economy, 8 months isn't just safer—it's strategic. While others scramble for survival during job transitions, you'll have the luxury of choice. Here's why 8 months has become the new gold standard for financial freedom.

The 3-6 Month Rule is Broken

Traditional emergency fund advice comes from a different era. When financial experts first recommended 3-6 months of expenses, the average job search took 2-3 months and career pivots were rare.

Today's reality is different:

- Average job search: 4-6 months for professional roles

- Industry volatility: Tech layoffs, economic uncertainty, AI disruption

- Remote work competition: You're competing globally, not locally

- Career pivots: Most people change careers 5-7 times in their lifetime

The old advice leaves you vulnerable. Six months feels like safety, but it's actually desperation with a timeline.

The 8-Month Advantage: From Survival to Strategy

Eight months transforms your relationship with work. Instead of accepting the first offer out of desperation, you can:

Be Selective About Opportunities

- Turn down roles that don't align with your values

- Negotiate better compensation packages

- Wait for positions that advance your career, not just pay bills

Invest in Skills During Transitions

- Take courses to upskill during job searches

- Build side projects that could become businesses

- Network strategically instead of frantically

Make Strategic Career Moves

- Leave toxic workplaces without a backup plan

- Start businesses or go freelance without panic

- Take sabbaticals for mental health or family

Eight months isn't just an emergency fund—it's a career freedom fund.

Calculate Your 8-Month Freedom Fund

Use this calculator to determine exactly how much you need for true financial flexibility:

Download our spreadsheet to calculate your freedom number now

Monthly Essential Expenses

- Housing: Rent/mortgage, utilities, insurance

- Food: Groceries and basic dining (not entertainment)

- Transportation: Car payments, fuel, public transit

- Insurance: Health, life, disability (non-employer)

- Debt Minimums: Credit cards, loans (minimum payments only)

- Basic Services: Phone, internet, essential subscriptions

Sample Calculation

Let's say your monthly essentials total $4,200:

- 3 months: $12,600 (desperation territory)

- 6 months: $25,200 (false security)

- 8 months: $33,600 (true freedom)

That extra $8,400 beyond the 6-month mark? It's the difference between taking any job and taking the right job.

The Hidden Costs of Inadequate Emergency Funds

Career Damage: Accepting subpar roles to pay bills can set your career back years. A $10,000 salary reduction taken in desperation costs $100,000+ over a decade.

Health Impact: Financial stress during job loss compounds the already difficult transition. Medical bills from stress-related issues can drain your fund faster.

Relationship Strain: Money arguments peak during unemployment. Having adequate reserves prevents financial stress from destroying relationships.

Opportunity Cost: Without adequate runway, you can't invest in opportunities. That business idea, freelance project, or consulting gig remains unexplored.

Real-World 8-Month Success Stories

Sarah, Software Developer: Laid off in tech downturn. Used 8 months to learn AI/ML, landed role with 40% salary increase.

Mike, Marketing Manager: Quit toxic job without backup. Spent 6 months building freelance practice, now earns 60% more working 30 hours/week.

Jessica, Teacher: Used sabbatical year to transition into instructional design. 8-month fund allowed patient job search, found remote role with 50% pay bump.

The pattern is clear: adequate runway enables strategic decisions that compound financially over decades.

How to Build Your 8-Month Fund (Without Living Like a Monk)

Phase 1: Foundation (Months 1-2)

Target: $2,000-3,000 Strategy: Cut obvious waste, automate savings

- Cancel unused subscriptions

- Cook more meals at home

- Save all windfalls (tax refunds, bonuses)

Phase 2: Acceleration (Months 3-8)

Target: One month of expenses saved Strategy: Increase income, optimize spending

- Side gigs or freelance work

- Sell items you don't need

- Negotiate bills (insurance, phone, internet)

Phase 3: Momentum (Months 9-18)

Target: 3-4 months of expenses Strategy: Systematic approach

- Automate 20% of income to emergency fund

- Track progress weekly to maintain motivation

- Consider high-yield savings for growth

Phase 4: Freedom (Months 19-24)

Target: 8 months of expenses Strategy: Optimize and protect

- Max out high-yield savings accounts

- Keep 2 months in checking, 6 months in savings

- Never touch this money except for true emergencies

Where to Keep Your 8-Month Fund

Liquidity is king. Your emergency fund needs to be accessible within 24-48 hours without penalties.

Recommended Structure:

- 2 months: High-yield checking account (immediate access)

- 4 months: High-yield savings account (1-day transfer)

- 2 months: Money market or short-term CDs (2-7 day access)

Current Top Rates (2025):

- Marcus by Goldman Sachs: 4.25% APY

- Ally Bank Online Savings: 4.20% APY

- Capital One 360: 4.15% APY

Even at 4% APY, your 8-month fund generates $1,300+ annually in interest—meaningful returns while maintaining liquidity.

Beyond Emergency: The Freedom Fund Mindset

Stop thinking of this as money sitting idle. Your 8-month fund is:

Career Insurance: Protection against industry downturns and bad bosses Opportunity Capital: Funding for business ideas, courses, networking Peace of Mind: Mental clarity that comes from true financial security Relationship Protection: Prevents money stress from damaging partnerships

The goal isn't to use this money—it's to sleep well knowing you could.

Track Your Progress: Months of Freedom Calculator

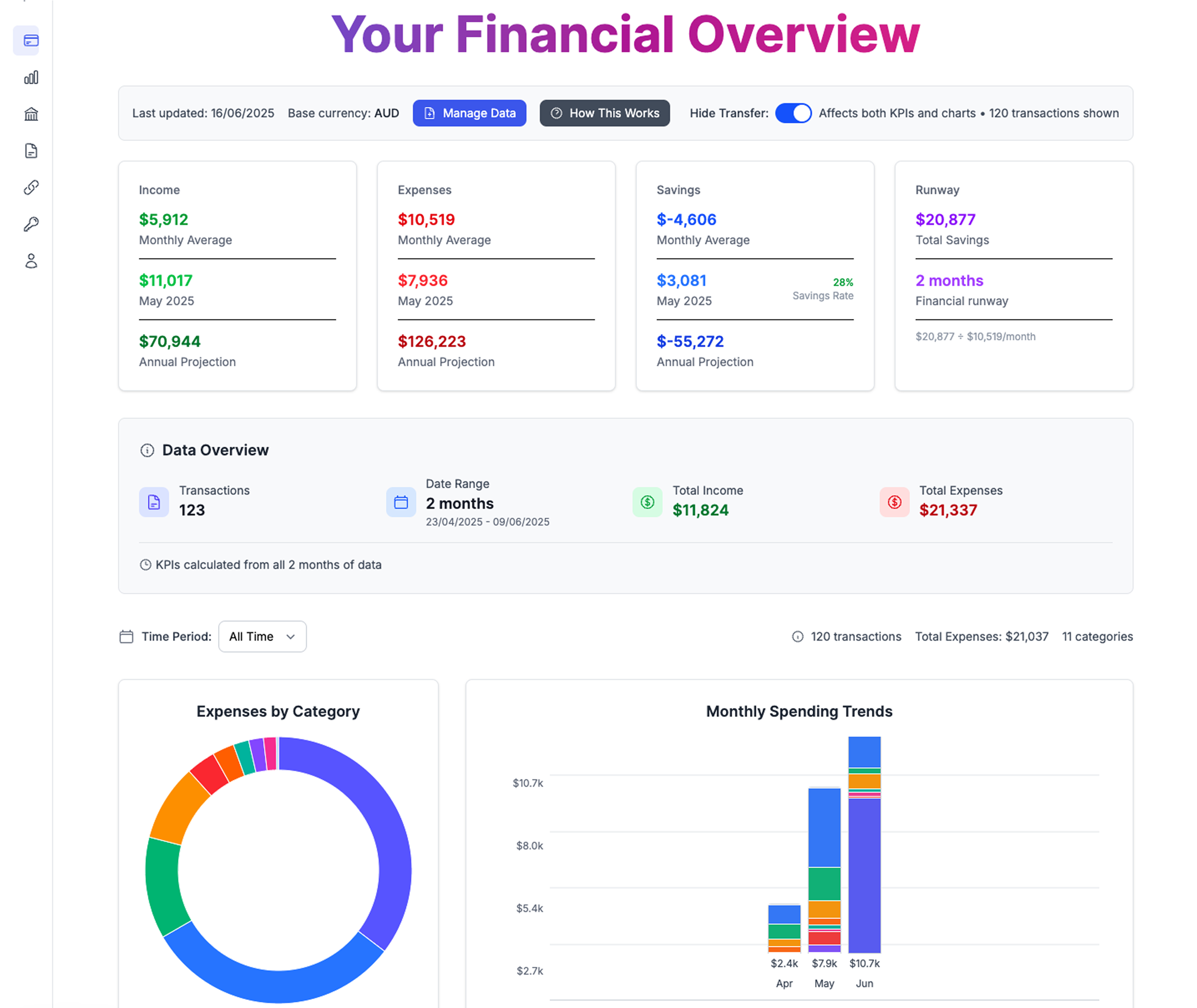

Instead of thinking in dollars, think in time. Use this simple formula:

Months of Freedom = Total Savings ÷ Monthly Essential Expenses

Freedom Milestones:

- 1 month: Basic breathing room

- 3 months: Traditional "emergency fund"

- 6 months: False security (most people stop here)

- 8 months: True career flexibility

- 12+ months: Complete work optional

Track this number monthly. Watch it grow from 0.5 months to 8+ months. Each increment represents increased life choices and decreased desperation.

Common Objections (And Why They're Wrong)

"I can't afford to save 8 months" You can't afford not to. One bad career decision from inadequate runway costs more than years of aggressive saving.

"What about investment returns?" Emergency funds aren't investments—they're insurance. The "return" is career flexibility and peace of mind.

"8 months is too conservative" Conservative for whom? For career freedom and life flexibility, 8 months is aggressive optimization.

"I have a stable job" No job is stable. Companies fail, industries change, AI disrupts everything. Your stability comes from your savings, not your employer.

Integration with Your Financial Freedom Plan

Your 8-month emergency fund is foundation, not destination. Once established:

- Increase savings rate for long-term investments

- Calculate total financial runway (emergency fund + investments ÷ expenses)

- Build multiple income streams to reduce reliance on single employer

- Optimize lifestyle costs to extend runway further

The emergency fund enables everything else. Without it, you're always one crisis away from financial chaos.

Take Action: Your 8-Month Freedom Plan

This Week:

- Calculate your true monthly essential expenses

- Determine your 8-month target ($33,600 in our example)

- Open high-yield savings account if needed

- Set up automatic transfer for initial $500

This Month:

- Cut obvious expenses and automate savings

- Track current "months of freedom" number

- Set calendar reminder for monthly progress check

This Year:

- Build complete 8-month fund through systematic saving

- Experience the mental shift from financial anxiety to career confidence

- Start making work decisions from position of strength

Ready to Calculate Your Freedom Fund?

Use Expense Sorted's Financial Runway Calculator to see exactly how many months of freedom your current savings can buy. Upload your bank statements, get AI-powered expense categorization, and track your progress toward true financial independence.

Start with our Google Sheets template:

- Automatic transaction categorization

- Real-time runway calculation

- Progress tracking and goal setting

Your 8-month freedom fund isn't just money in the bank—it's the foundation for every important life decision you'll make in your career.

Stop planning for survival. Start building for freedom.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money