Your savings rate is the single most important number in your financial life. Not your salary, not your net worth, not your investment returns—your savings rate. It determines how quickly you build wealth, when you can retire, and how much financial freedom you'll have throughout your life.

Yet most people don't even know what their savings rate is, let alone how to optimize it. After reaching a net worth of $1.6 million by age 36, I can tell you that understanding and maximizing my savings rate was the key driver of that success.

Let me show you how to calculate your true savings rate, interpret what it means for your financial future, and most importantly, how to increase it systematically. Use our spreadsheet to calculate your savings rate in minutes.

What Is a Savings Rate (And Why Most People Calculate It Wrong)

Your savings rate is the percentage of your income that you don't spend—money that goes toward building wealth rather than covering current lifestyle costs.

The Standard Formula: Savings Rate = (Income - Expenses) ÷ Income × 100

But here's where most people mess up: They only count money they actively move to savings accounts, ignoring other forms of wealth building.

The Complete Savings Rate Formula

True Savings Rate = (All Wealth Building) ÷ (Gross Income) × 100

All Wealth Building includes:

- 401k contributions (including employer match)

- IRA contributions

- Taxable investment account contributions

- Extra mortgage principal payments

- Money moved to savings accounts

- Emergency fund contributions

- Any other money that increases your net worth

Gross Income includes:

- Salary or wages (pre-tax)

- Bonuses and commissions

- Side hustle income

- Investment dividends and interest

- Any other money coming in

Example Calculation:

- Gross income: $80,000

- 401k contribution: $8,000

- Employer match: $4,000

- IRA contribution: $6,000

- Additional savings: $4,000

- Total wealth building: $22,000

- True savings rate: 27.5%

Many people would only count the $4,000 in "savings" and report a 5% savings rate, missing the full picture of their wealth building.

The Savings Rate Calculator

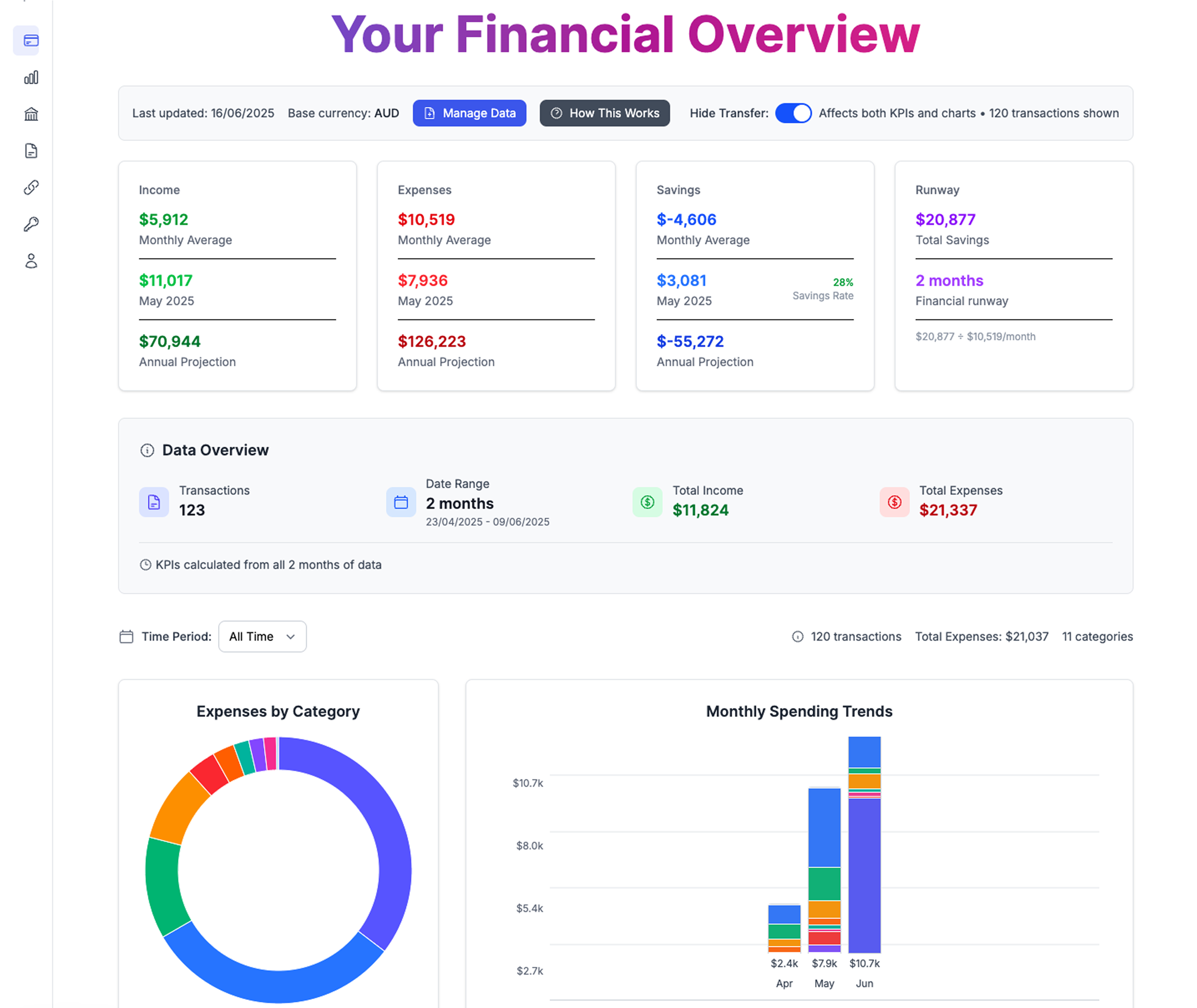

Complete financial overview showing your savings rate, spending patterns, and path to financial independence

Complete financial overview showing your savings rate, spending patterns, and path to financial independence

Want to do this automatically? Our Google Sheet template calculates your true savings rate for you.

Step 1: Calculate Your Monthly Income

Employment Income:

- Monthly gross salary: $______

- Bonuses (monthly average): $______

- Commission (monthly average): $______

- Employer 401k match: $______

Other Income:

- Side hustle income: $______

- Investment dividends/interest: $______

- Rental income (net): $______

- Any other regular income: $______

Total Monthly Income: $______

Step 2: Calculate Your Monthly Wealth Building

Retirement Contributions:

- 401k contribution: $______

- IRA contribution: $______

- Other retirement accounts: $______

Investment Contributions:

- Taxable brokerage accounts: $______

- Index funds: $______

- Individual stocks: $______

Savings Contributions:

- High-yield savings: $______

- Emergency fund: $______

- Goal-specific savings: $______

Debt Reduction (Wealth Building):

- Extra mortgage principal: $______

- Extra payments on good debt: $______

Total Monthly Wealth Building: $______

Step 3: Calculate Your Savings Rate

Monthly Savings Rate = (Monthly Wealth Building ÷ Monthly Income) × 100

Your Monthly Savings Rate: ______%

Interpreting Your Savings Rate

0-10%: Getting Started

- Reality: You're covering basics but not building wealth quickly

- Timeline to FIRE: 40+ years of working

- Priority: Focus on expense reduction and income increases

- Next Goal: Reach 15% as quickly as possible

10-20%: Building Foundation

- Reality: Following conventional financial advice

- Timeline to FIRE: 30-40 years

- Priority: Optimize major expenses and increase earnings

- Next Goal: Push toward 25% for meaningful acceleration

20-30%: Serious Wealth Building

- Reality: Above-average financial discipline

- Timeline to FIRE: 25-35 years

- Priority: Fine-tune optimization and consider income growth

- Next Goal: Reach 30%+ for substantial timeline reduction

30-50%: Accelerated Path

- Reality: Aggressive wealth building with lifestyle optimization

- Timeline to FIRE: 15-25 years

- Priority: Maintain consistency and optimize investments

- Achievement: You're in the top 5% of savers

50%+: FIRE Fast Track

- Reality: Extreme optimization or high income with controlled lifestyle

- Timeline to FIRE: 10-17 years

- Priority: Ensure sustainable lifestyle and tax optimization

- Achievement: You're approaching financial independence rapidly

The FIRE Timeline Calculator

Your savings rate directly determines when you can achieve financial independence:

Years to FIRE by Savings Rate:

- 10% savings rate: 51 years

- 15% savings rate: 43 years

- 20% savings rate: 37 years

- 25% savings rate: 32 years

- 30% savings rate: 28 years

- 40% savings rate: 22 years

- 50% savings rate: 17 years

- 60% savings rate: 12.5 years

- 70% savings rate: 8.5 years

Assumptions: 7% real investment returns, withdrawing 4% annually in retirement

The Math Behind It: These calculations use the formula for financial independence: 25 × Annual Expenses = FIRE Number

If you spend $40,000 annually, you need $1,000,000 to be financially independent at a 4% withdrawal rate.

How I Reached a High Savings Rate (Real Numbers)

Let me share my actual progression to illustrate how savings rates can grow over time:

Years 1-3 (Age 21-24): 15% Savings Rate

- Income: $45,000

- Savings: $6,750/year

- Focus: Building habits, learning basics

Years 4-7 (Age 25-28): 25% Savings Rate

- Income: $65,000

- Savings: $16,250/year

- Changes: Increased 401k, reduced lifestyle inflation

Years 8-12 (Age 29-33): 40% Savings Rate

- Income: $95,000

- Savings: $38,000/year

- Changes: Optimized housing, increased income, automated everything

Years 13-15 (Age 34-36): 55% Savings Rate

- Income: $140,000

- Savings: $77,000/year

- Changes: Peak earning years, controlled lifestyle, focused on FIRE

Key insight: My savings rate increased faster than my income because I treated raises as savings opportunities, not lifestyle upgrades.

Smart suggestions help optimize your spending and identify opportunities to increase your savings rate

Smart suggestions help optimize your spending and identify opportunities to increase your savings rate

Our spreadsheet can help you find these opportunities in your own spending.

Strategies to Increase Your Savings Rate

The Two-Lever Approach

You can increase your savings rate by:

- Reducing expenses (easier to control)

- Increasing income (higher potential impact)

Most people focus entirely on expense reduction, but the highest savings rates come from optimizing both.

Expense Optimization Strategies

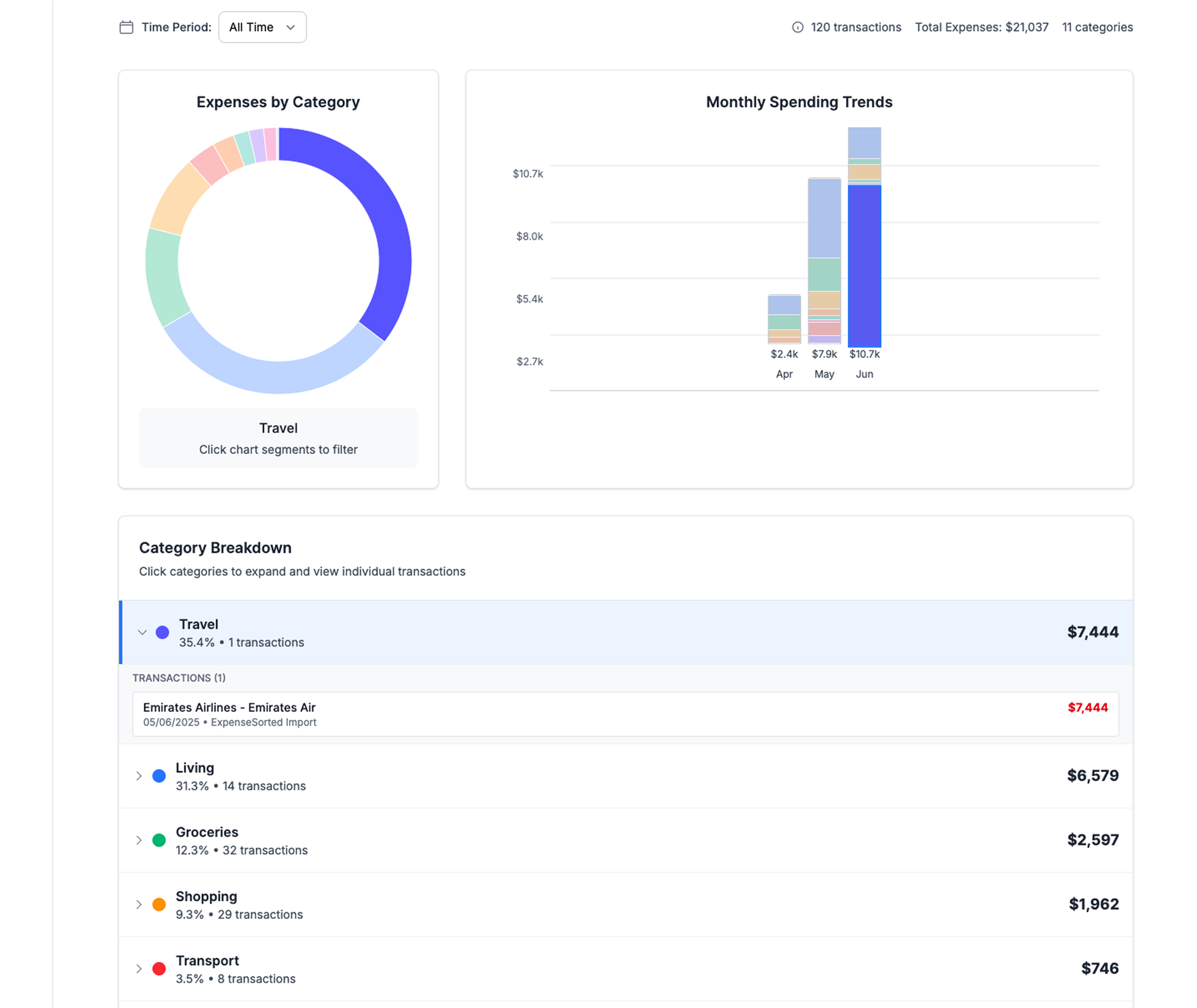

Intelligent expense categorization helps identify the biggest opportunities for increasing your savings rate

Intelligent expense categorization helps identify the biggest opportunities for increasing your savings rate

The Big Three (Focus Here First):

-

Housing (Typically 25-35% of income)

- Consider house hacking (rent out rooms)

- Move to a lower-cost area if possible

- Downsize if you're over-housed

- Refinance or pay extra principal

-

Transportation (Typically 10-20% of income)

- Buy reliable used cars with cash

- Consider one car for couples

- Live closer to work to reduce commuting costs

- Use public transportation where viable

-

Food (Typically 10-15% of income)

- Cook at home more frequently

- Meal plan to reduce waste

- Focus on cost-effective, healthy staples

- Limit restaurant spending to social occasions

The Smaller Wins:

- Cancel unused subscriptions

- Negotiate insurance rates annually

- Optimize utilities and phone plans

- Reduce discretionary shopping

Income Optimization Strategies

Career Development:

- Negotiate salary increases annually

- Develop high-value skills

- Change jobs strategically for 10-20% raises

- Pursue promotions aggressively

Side Income:

- Freelance or consult in your expertise area

- Start a side business

- Rent out assets (car, tools, space)

- Create passive income streams

Investment Income:

- Focus on dividend-growing investments

- Real estate investment (REITs or direct)

- Build income-producing assets

Advanced Savings Rate Optimization

Tax-Advantaged Account Prioritization

Order of Operations:

- 401k up to employer match (free money)

- High-yield savings for emergency fund

- IRA contribution (traditional or Roth)

- Max out 401k ($23,000 in 2024)

- Taxable investment accounts

- Additional tax-advantaged accounts (HSA, etc.)

Geographic Arbitrage

Your savings rate can increase dramatically by optimizing your location:

- High income, low cost area: Maximum savings potential

- Remote work: Access high-paying jobs from low-cost areas

- International arbitrage: Earn US wages, live in lower-cost countries

The Automation Strategy

High savings rates require automation:

- Direct deposit split: Send savings directly to investment accounts

- Automatic investments: Dollar-cost average into index funds

- Automatic bill pay: Reduce decision fatigue on fixed expenses

- Savings rate increases: Automatically increase contributions with raises

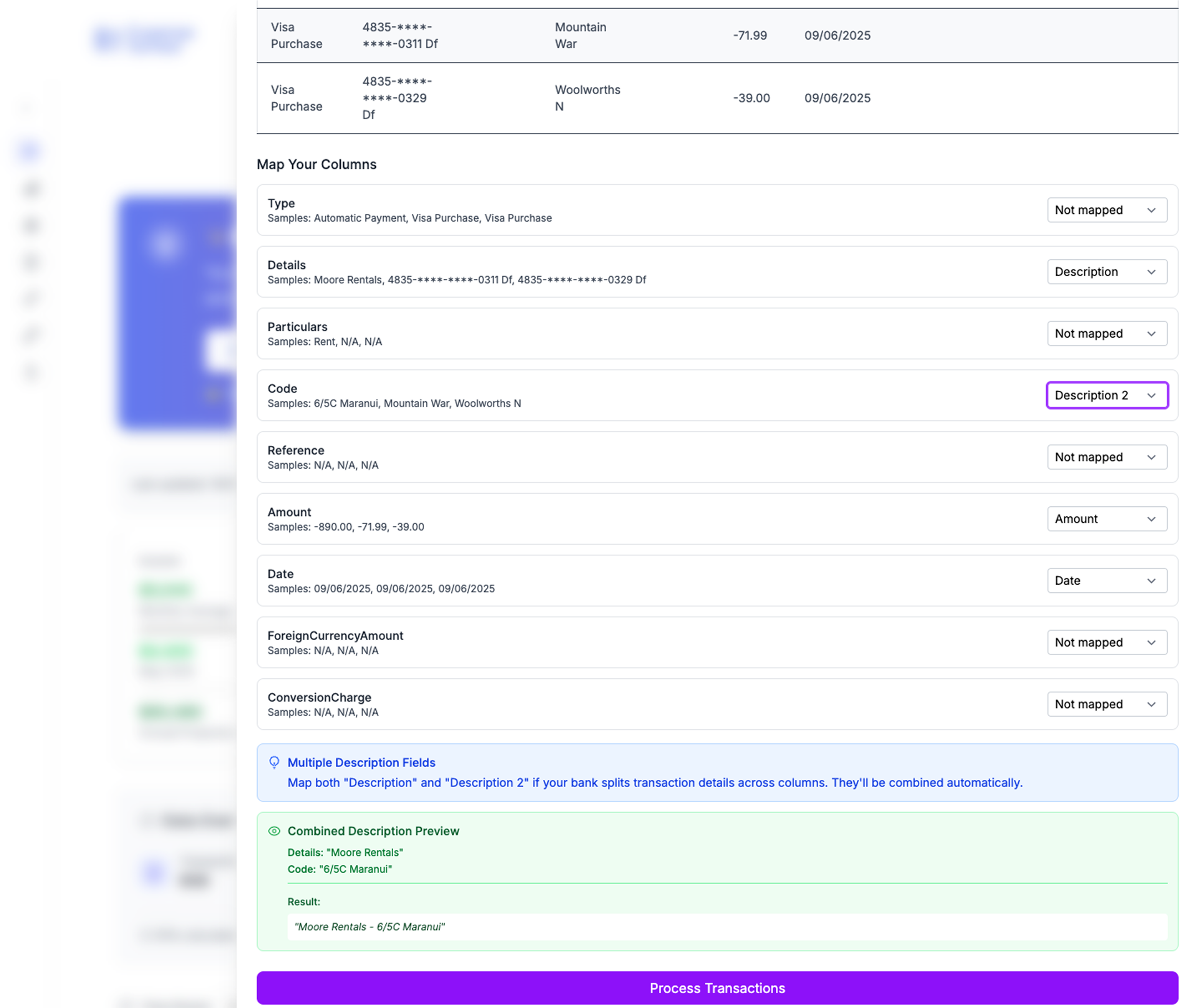

Seamless bank data import ensures your savings rate calculations stay accurate with minimal effort

Seamless bank data import ensures your savings rate calculations stay accurate with minimal effort

Common Savings Rate Mistakes

Mistake 1: Focusing on Percentages Too Early

If your income is very low, focus on increasing income before optimizing percentages. A 50% savings rate on $30,000 income builds wealth slower than a 25% savings rate on $80,000 income.

Mistake 2: Ignoring Quality of Life

Extreme savings rates that make you miserable aren't sustainable. Find the highest rate you can maintain long-term.

Mistake 3: Not Adjusting for Life Changes

Your optimal savings rate changes with:

- Income level

- Family situation

- Age and health

- Career stability

Mistake 4: Comparing to Others

Your optimal savings rate depends on your goals, timeline, and circumstances. A 25% rate might be perfect for your situation even if someone else saves 50%.

Savings Rate by Life Stage

Early Career (20s)

- Target: 15-25%

- Focus: Build habits, increase income, avoid lifestyle inflation

- Priority: Emergency fund, then retirement accounts

Peak Earning (30s-40s)

- Target: 25-40%

- Focus: Maximize high-income years, optimize taxes

- Priority: Max retirement accounts, taxable investments

Pre-Retirement (50s+)

- Target: 30-50%

- Focus: Catch-up contributions, reduce risk

- Priority: Bridge accounts for early retirement

Want to track your savings rate and financial runway automatically? Check out our Financial Freedom Spreadsheet for a hands-on tool to monitor your progress and optimize your path to financial independence.

The Compound Effect of High Savings Rates

Here's why your savings rate matters more than investment returns:

Scenario A: Low Savings Rate, Great Returns

- 10% savings rate, 10% investment returns

- Timeline to FIRE: 46 years

Scenario B: High Savings Rate, Average Returns

- 40% savings rate, 6% investment returns

- Timeline to FIRE: 25 years

The high savings rate wins by over 20 years, even with significantly lower investment returns.

Why This Happens:

- You need less money to retire (lower expenses)

- You accumulate money faster (higher contributions)

- You have more money working for you sooner (compound growth)

Your Savings Rate Action Plan

Week 1: Calculate Your Current Rate

- Gather all income and expense data

- Calculate your true savings rate using the complete formula

- Determine your current FIRE timeline

- Set improvement targets

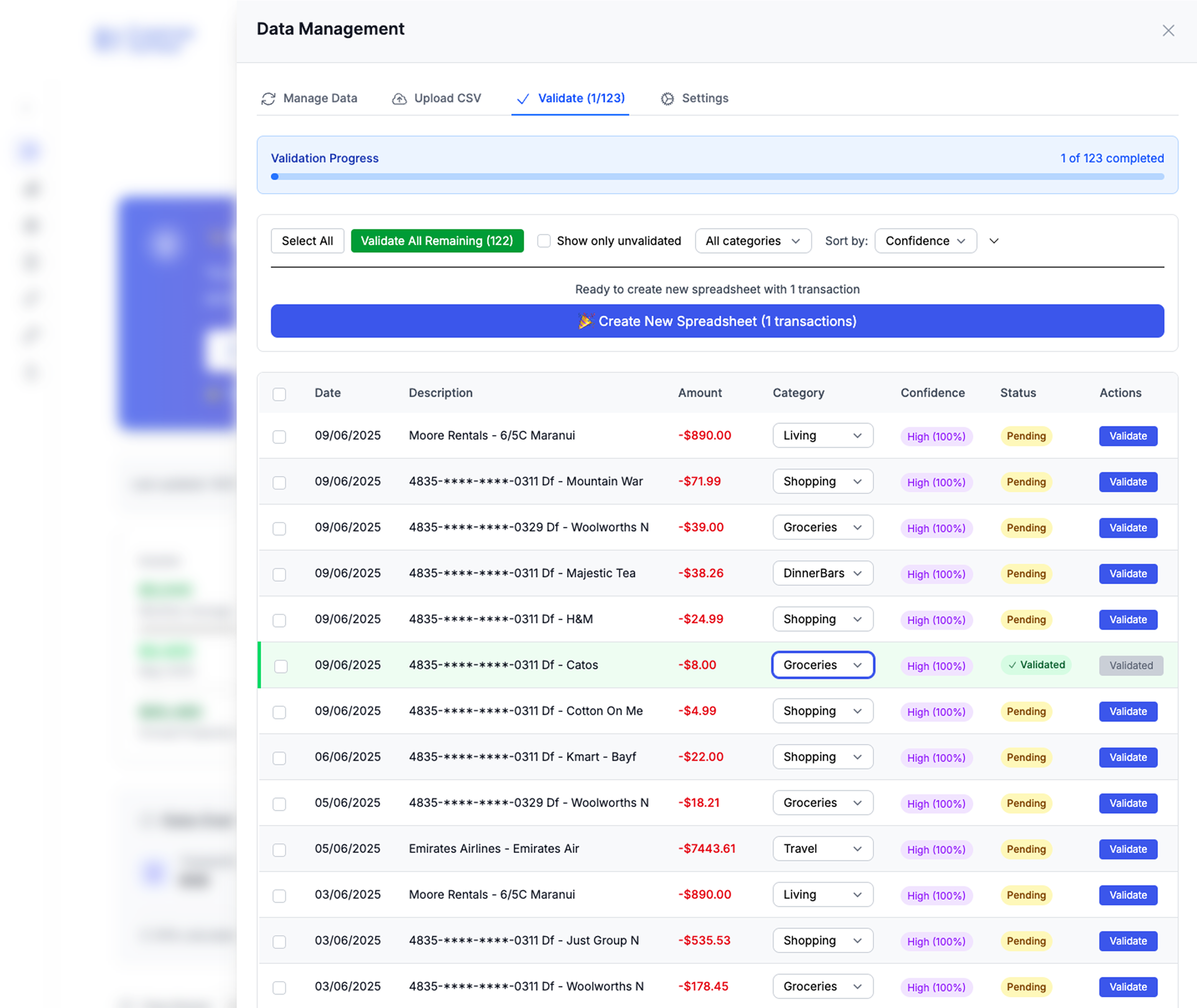

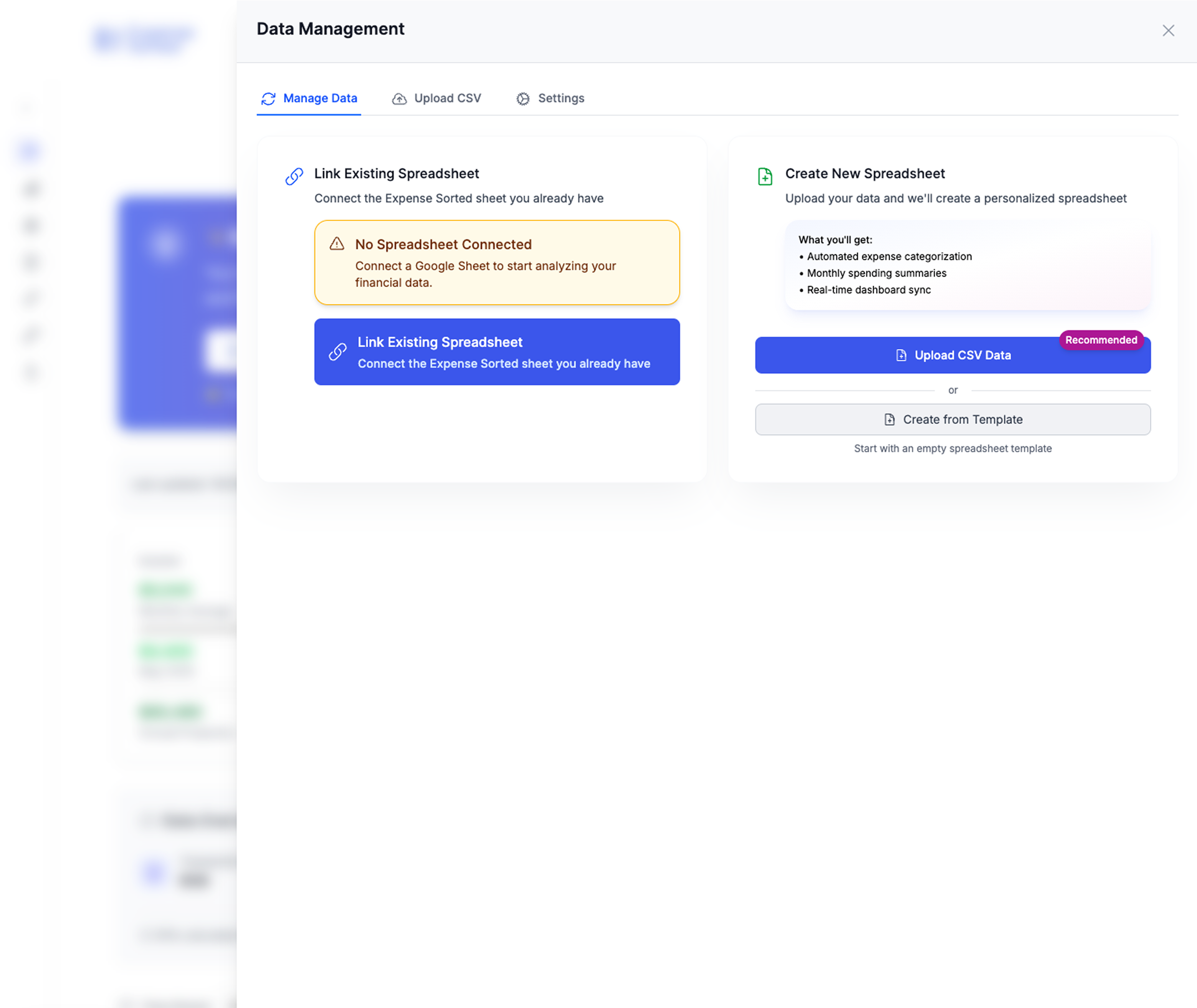

Comprehensive data management makes calculating and tracking your savings rate effortless

Comprehensive data management makes calculating and tracking your savings rate effortless

Week 2: Optimize the Big Three

- Analyze housing costs and alternatives

- Review transportation expenses

- Track food spending for one week

- Identify the biggest optimization opportunities

Week 3: Automate Everything

- Set up automatic transfers to investment accounts

- Increase 401k contributions

- Automate bill payments

- Create systems that make high savings rates effortless

Week 4: Plan Income Growth

- Research salary benchmarks in your field

- Identify skills that command higher pay

- Explore side income opportunities

- Set income growth targets for the next year

The Long-Term Perspective

Your savings rate isn't just about reaching FIRE—it's about creating options throughout your life:

- Career flexibility: High savings rates mean you can take risks, change directions, or weather industry downturns

- Family security: Financial cushions let you handle emergencies and support loved ones

- Life design: When money isn't a constraint, you can design your life around your values rather than financial necessity

The goal isn't to save as much as possible—it's to save enough to live the life you want, when you want to live it.

What's your target savings rate, and what will it make possible in your life?

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation.

Calculate Your Financial Freedom Number

Find out exactly how much money you need to achieve financial independence.

Calculate Now