Financial Wellness: Beyond Budgets to True Freedom

Most financial wellness programs are designed to make you a better employee, not a freer human being.

I recently spoke with a woman who'd completed her company's "financial wellness" program. She'd learned to budget, reduced her credit card debt, and started contributing to her KiwiSaver. By every traditional metric, she was "financially well."

Yet she still felt trapped.

She was still working 50-hour weeks at a job she barely tolerated. Still anxious about money despite having an emergency fund. Still felt like she was running on a hamster wheel, just with better spreadsheets.

That conversation made me realize something important: traditional financial wellness misses the point entirely.

Real financial wellness isn't about optimizing your participation in the current system. It's about building the freedom to choose a different system entirely. Our spreadsheet is designed to help you do just that.

Why Traditional Financial Wellness Programs Fail

Most financial wellness programs follow the same predictable formula:

- Create a budget (so you can optimize spending within your current income)

- Pay off debt (so you can take on new debt more efficiently)

- Build an emergency fund (so you can survive temporary income disruptions)

- Invest for retirement (so you can eventually escape the system you're optimizing for)

Notice the pattern? Every step assumes you'll remain dependent on employment income indefinitely.

This approach creates what I call "optimized dependency" - you become very good at managing your finances within someone else's system, but you never build the capability to create your own system.

It's like becoming an expert at navigating traffic jams instead of learning to work from home.

The Time Freedom Framework: A Different Approach

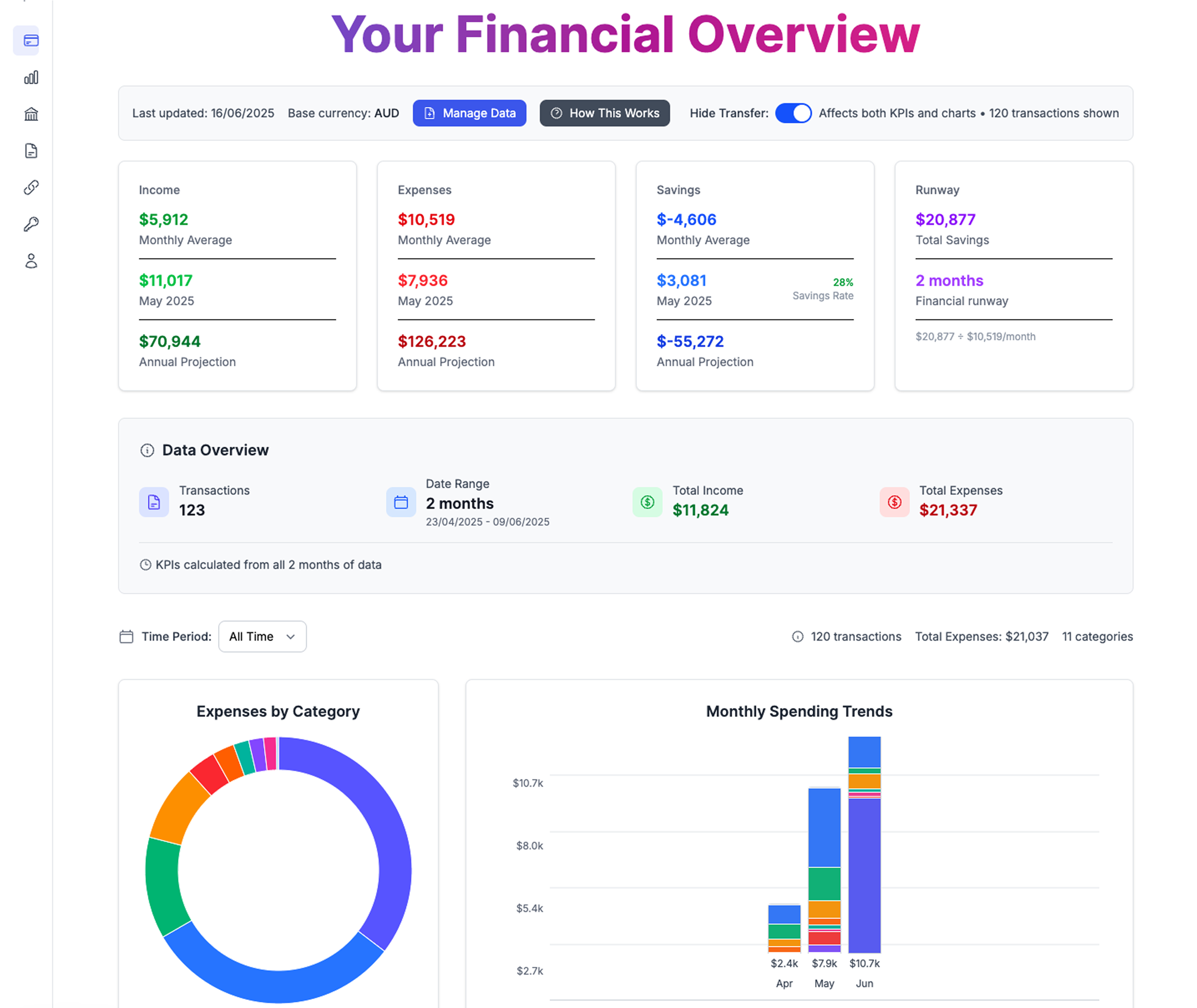

True financial wellness: See your complete financial picture focused on time freedom, not just account balances

True financial wellness: See your complete financial picture focused on time freedom, not just account balances

Our Google Sheet template is built around this time freedom framework.

Real financial wellness starts with a fundamental shift in perspective: time is your most valuable currency, and money is just a tool for purchasing time.

This leads to completely different questions:

Traditional Financial Wellness Asks:

- How can I afford my lifestyle?

- How can I pay off my debts faster?

- How can I save more for retirement?

- How can I optimize my budget?

Time Freedom Financial Wellness Asks:

- How can I buy back my time?

- How can I reduce my required income?

- How can I create location and schedule independence?

- How can I build systems that work without my constant attention?

These different questions lead to completely different strategies. To help you identify which approach aligns with your goals, our personal finance health check evaluates your current financial wellness from a time freedom perspective rather than traditional metrics.

The Four Pillars of True Financial Wellness

Pillar 1: Reduce Your Required Income

Most financial advice focuses on increasing income. Time freedom focuses on decreasing the income you actually need.

Traditional Approach: Make more money so you can afford your lifestyle. Time Freedom Approach: Design a lifestyle that requires less money so you can work less.

Practical Applications:

- Housing: Consider geographic arbitrage, house hacking, or co-living arrangements

- Transportation: Calculate the true cost of car ownership vs alternatives

- Food: Master efficient cooking instead of relying on convenience foods

- Entertainment: Prioritize experiences over things, free activities over paid ones

Case Study: James from Tauranga reduced his required monthly income from $4,500 to $2,800 by:

- Moving to a smaller town (saved $800/month on housing)

- Selling his car and cycling/using public transport (saved $600/month)

- Cooking at home and growing vegetables (saved $300/month)

This $1,700 monthly reduction meant he only needed to earn $20,400 per year instead of $54,000 to maintain his quality of life.

Pillar 2: Build Location Independence

Traditional financial wellness assumes you'll live where your employer wants you to live. Time freedom financial wellness optimizes for location independence.

Why This Matters:

- Housing costs vary dramatically across New Zealand

- Remote work opportunities are expanding rapidly

- Geographic arbitrage can dramatically extend your financial runway

- Location independence provides psychological freedom even if you don't move

Strategies for Building Location Independence:

- Develop remote-work skills in your current role

- Build online income streams that work from anywhere

- Create systems and processes that don't require your physical presence

- Optimize for digital nomad lifestyle even if you stay local

Real Example: Sarah, a graphic designer from Auckland, built location independence by:

- Transitioning her employer to remote work (2 days/week, then full-time)

- Building a client base through online platforms

- Creating template-based services that require less custom work

- Optimizing her workflow for asynchronous communication

Result: She can now live anywhere in New Zealand (or globally) while maintaining her income.

Pillar 3: Create Time-Wealth Instead of Money-Wealth

Traditional wealth-building focuses on accumulating assets that might provide future income. Time-wealth focuses on creating systems that provide current time freedom.

Money-Wealth Thinking: "I need $1 million invested at 4% to replace my $40,000 salary." Time-Wealth Thinking: "I need systems that generate $40,000 without requiring 40 hours per week."

Time-Wealth Strategies:

- Productized services: Turn your expertise into repeatable, scalable offerings

- Digital products: Create once, sell repeatedly

- Automated systems: Build processes that work without constant management

- Efficient workflows: Optimize your time-to-income ratio

Example: Mike, a web developer, built time-wealth by:

- Creating a library of reusable website components

- Building automated client onboarding systems

- Developing maintenance packages that generate recurring revenue

- Training other developers to handle routine work

Result: He reduced his working hours from 50 to 25 per week while maintaining his income.

Smart financial suggestions help you build anti-fragile systems that adapt and improve over time

Smart financial suggestions help you build anti-fragile systems that adapt and improve over time

Pillar 4: Develop Anti-Fragile Financial Systems

Traditional financial planning optimizes for predictable scenarios. Time freedom financial wellness builds systems that get stronger during chaos.

Fragile: Depends on continuous employment income Resilient: Has emergency funds and backup plans Anti-Fragile: Benefits from economic disruption and uncertainty

Building Anti-Fragile Systems:

- Multiple income streams from different sources and industries

- Skills that become more valuable during disruption (problem-solving, automation, remote work)

- Systems that scale with demand rather than requiring proportional time investment

- Geographic and currency diversification

Crisis-Opportunity Mindset:

- Economic downturns create opportunities for geographic arbitrage

- Industry disruptions create opportunities for new service models

- Technology changes create opportunities for early adopters

- Social changes create opportunities for new solutions

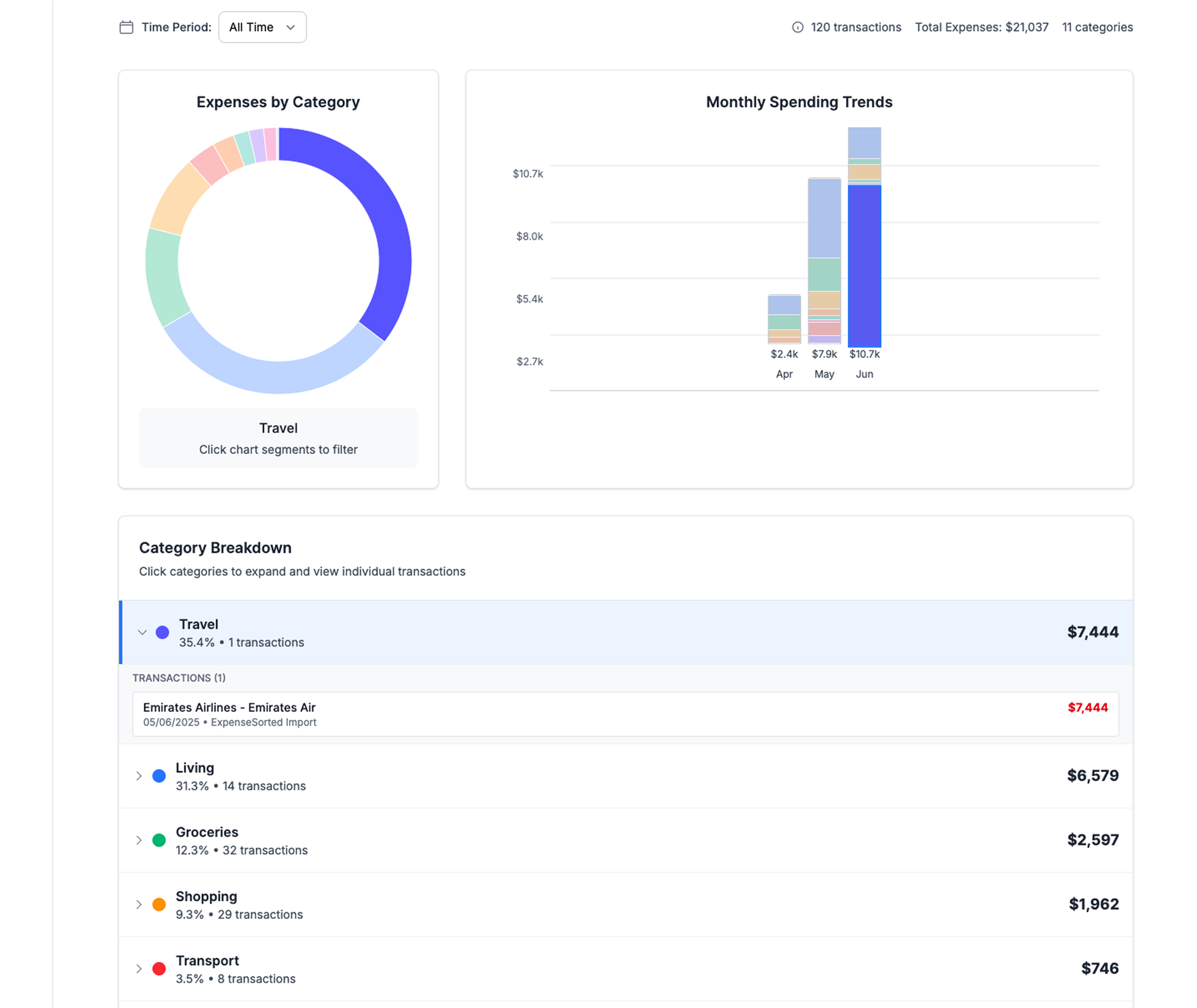

Measuring True Financial Wellness

Traditional financial wellness uses metrics like debt-to-income ratios and savings rates. Time freedom financial wellness uses different metrics. Our spreadsheet helps you track all of these automatically.

Primary Metrics

- Financial Runway: How long can you maintain your lifestyle without income?

- Location Independence Score: What percentage of your income is location-independent?

- Time Freedom Ratio: How much income do you generate per hour worked?

- System Automation Level: What percentage of your income requires active work?

Secondary Metrics

- Skill Diversification: How many different ways can you generate income?

- Crisis Resilience: How would different economic scenarios affect your income?

- Stress-to-Income Ratio: How much anxiety does your financial system create?

- Lifestyle Design Alignment: How well does your financial system serve your life goals?

The Financial Wellness Assessment

Rate yourself honestly on each dimension (1-10 scale):

Income Security

- I have multiple income streams (not just employment)

- My income would survive if my industry were disrupted

- I can generate income from multiple geographic locations

- My income doesn't require constant active work

Expense Optimization

- I've optimized my expenses for time freedom, not just cost reduction

- My lifestyle doesn't require a high-income location

- I can maintain my quality of life on significantly less income if needed

- My expenses align with my actual values, not social expectations

System Resilience

- I have systems that work without my constant attention

- My financial situation would improve during certain types of economic disruption

- I have skills that become more valuable during uncertainty

- My financial systems reduce rather than increase my stress levels

Time Freedom

- I control my daily schedule

- I can take time off without income disruption

- My work enhances rather than detracts from my life quality

- I'm building toward more freedom, not just more income

Scoring:

- 32-40: Excellent time freedom financial wellness

- 24-31: Good progress toward financial freedom

- 16-23: Traditional financial wellness but limited freedom

- Below 16: Optimized dependency - financially stable but not free

Building Your Financial Wellness Plan

Phase 1: Foundation (Months 1-3)

Goal: Establish basic financial security without lifestyle inflation

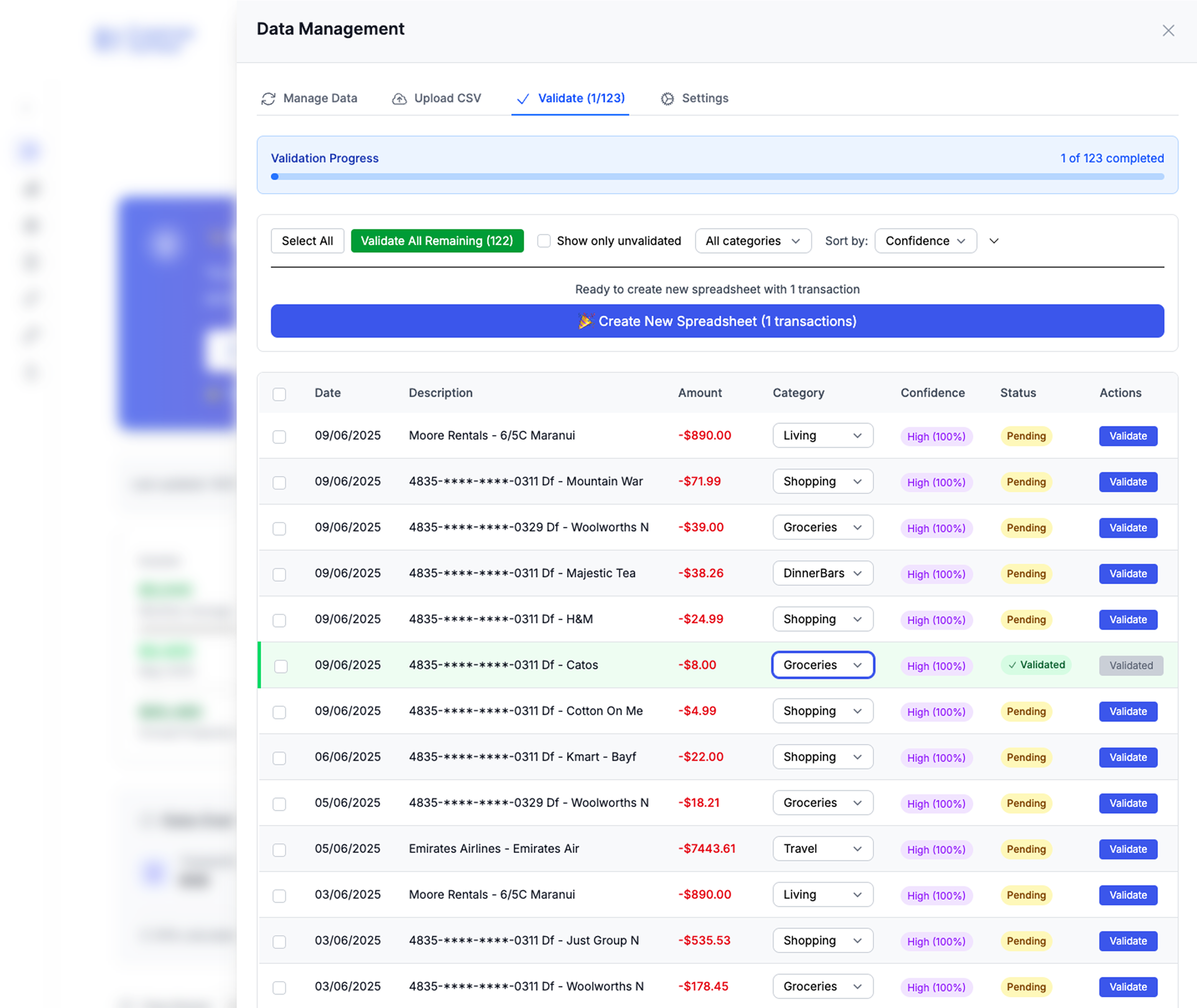

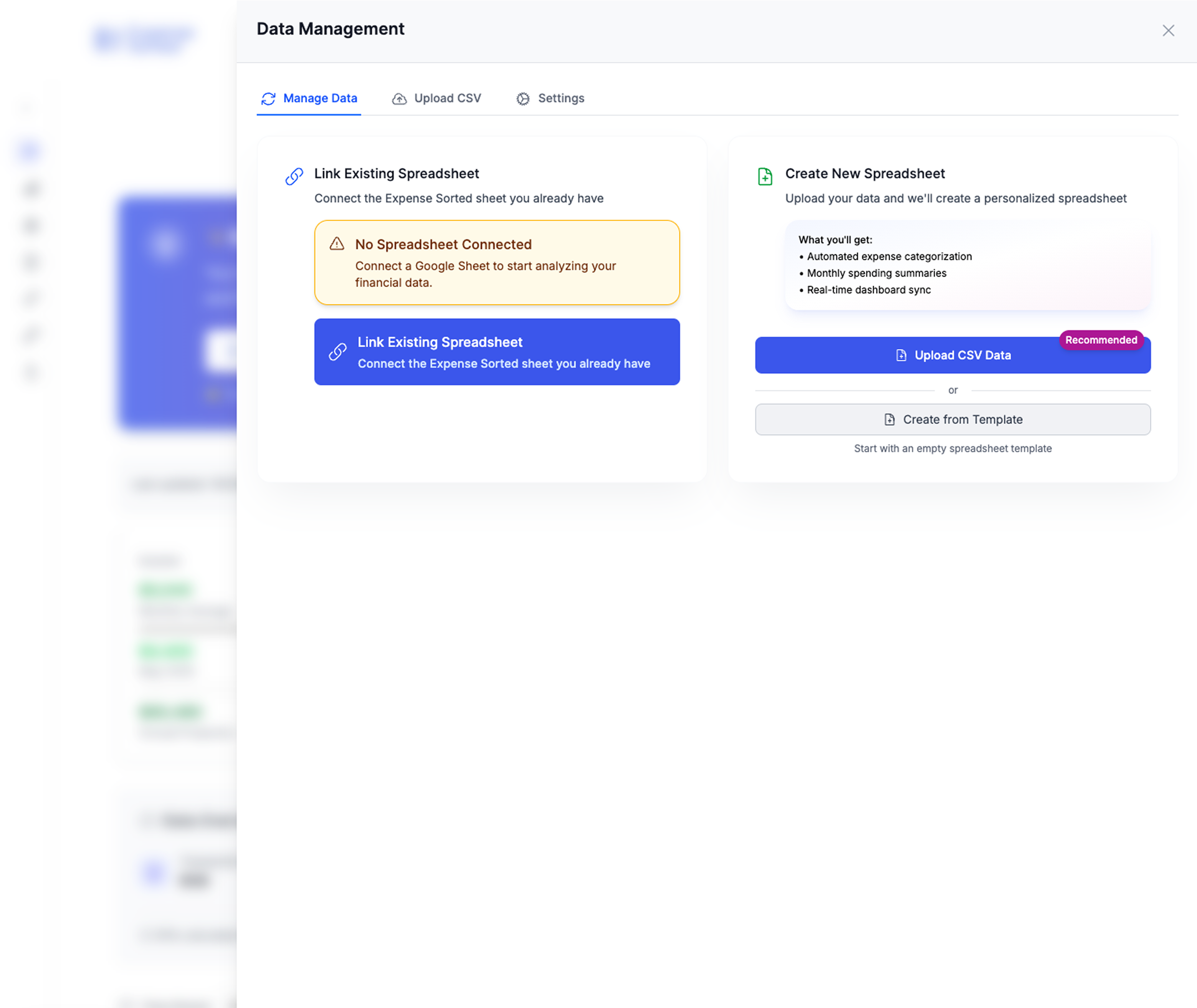

Comprehensive data management makes tracking your true expenses and building financial independence effortless

Comprehensive data management makes tracking your true expenses and building financial independence effortless

Actions:

- Calculate your actual required income (not your current income)

- Identify expense categories that don't improve your life quality

- Build a 3-month expense buffer (not emergency fund - expense buffer)

- Audit your skills for remote work and location independence potential

Success Metrics:

- Required income calculated and documented

- Monthly expenses reduced by at least 10% without quality-of-life reduction

- Basic expense buffer established

Phase 2: Liberation (Months 4-12)

Goal: Begin building location and time independence

Actions:

- Develop one location-independent income stream

- Optimize your current work for remote/flexible arrangements

- Build systems that reduce the time-to-income ratio

- Experiment with geographic arbitrage (even within NZ)

Success Metrics:

- At least 25% of income is location-independent

- Work arrangement is more flexible than 12 months ago

- Time-to-income ratio has improved measurably

Phase 3: Expansion (Year 2+)

Goal: Build anti-fragile systems that provide true time freedom

Actions:

- Develop multiple scalable income streams

- Build systems that benefit from economic uncertainty

- Create location and schedule independence

- Focus on time-wealth rather than money-wealth

Success Metrics:

- Multiple income streams from different sources

- Financial systems that reduce stress and increase freedom

- Ability to maintain lifestyle with significantly reduced active work

Common Obstacles (And How to Overcome Them)

"I Can't Reduce My Expenses Without Sacrificing Quality of Life"

Reality Check: Most people confuse lifestyle inflation with quality of life improvement.

Solution: Audit your expenses for their actual impact on your well-being. Often you'll find that the most expensive parts of your lifestyle provide the least actual satisfaction.

Framework: For each expense category, ask: "Does this expense buy me time, freedom, health, or genuine happiness?" If not, it's a candidate for reduction.

Intelligent expense categorization helps you analyze which spending truly contributes to your time freedom and life satisfaction

Intelligent expense categorization helps you analyze which spending truly contributes to your time freedom and life satisfaction

"I Don't Have Skills That Work Remotely"

Reality Check: Almost every skill can be adapted for remote work or transformed into a location-independent service.

Solution: Focus on translating your current expertise into digital formats rather than learning completely new skills.

Examples:

- Plumber → Online consulting for DIY home repairs

- Teacher → Online tutoring or course creation

- Manager → Virtual assistant services or process consulting

- Tradesperson → Video-based training or remote project management

"I Can't Build Multiple Income Streams While Working Full-Time"

Reality Check: You don't need to build everything at once. Start with optimizing your current situation.

Solution: Focus on increasing the efficiency and flexibility of your current income before adding new streams.

Progression:

- Optimize current role for remote/flexible work

- Develop systems that make your current work more efficient

- Use freed-up time to build complementary income streams

- Gradually shift from employment-dependent to system-dependent income

"This Sounds Risky Compared to Traditional Financial Planning"

Reality Check: Traditional financial planning is actually much riskier because it depends entirely on systems outside your control.

Risk Comparison:

- Traditional: Single income source, location-dependent, employer-dependent

- Time Freedom: Multiple income sources, location-flexible, system-dependent

The perceived safety of traditional employment is largely illusory in our rapidly changing economy.

Tools and Resources for Implementation

Financial Planning Tools

- Runway Calculator: How long your money lasts without income

- Geographic Arbitrage Calculator: Cost-of-living comparisons across locations

- Time-Freedom Ratio Calculator: Income per hour worked across different activities

- Expense Optimization Audit: Template for analyzing expense-to-wellbeing ratios

Skill Development Resources

- Remote Work Transition Guide: Step-by-step plan for location independence

- Digital Service Creation Template: Turn expertise into scalable offerings

- System Automation Framework: Build processes that work without constant attention

- Crisis-Opportunity Matrix: Identify how disruption could benefit your situation

Community and Support

- Time Freedom Community: Connect with others building location and financial independence

- Monthly Challenges: Structured activities for building financial wellness

- Success Story Database: Real examples of people who've built time freedom

- Expert Interviews: Learn from people who've successfully made the transition

The Psychology of Financial Wellness

Shifting from Scarcity to Abundance Mindset

Traditional financial wellness often reinforces scarcity thinking: "There's not enough money, so I need to optimize my participation in the current system."

Time freedom financial wellness develops abundance thinking: "There are infinite ways to create value, so I can design systems that serve my life goals."

Moving from External to Internal Validation

Traditional financial wellness measures success through external metrics: salary, net worth, debt ratios.

Time freedom financial wellness measures success through internal metrics: stress levels, time autonomy, alignment with values.

Building Identity Around Freedom Rather Than Work

Traditional financial wellness reinforces work-based identity: "I am a [job title] who happens to have financial goals."

Time freedom financial wellness builds freedom-based identity: "I am a free person who happens to do [work] to support my chosen lifestyle."

Advanced Strategies for High Achievers

The Lifestyle Business Model

Instead of building a business to sell, build a business designed to provide ongoing time freedom:

- Optimize for cash flow rather than valuation

- Build systems that work without your constant presence

- Focus on recurring revenue and automated processes

- Design for lifestyle enhancement rather than maximum growth

The Portfolio Career Approach

Instead of single employment, develop multiple complementary income sources:

- Combine employment with consulting/freelancing

- Mix active work with passive income streams

- Develop skills that are valuable across multiple industries

- Build redundancy without over-complexity

The Geographic Arbitrage Strategy

Systematically optimize your income-to-cost-of-living ratio:

- Work for high-income markets while living in lower-cost areas

- Develop global income sources with local expenses

- Use technology to access opportunities regardless of location

- Build systems that benefit from geographic flexibility

Your 90-Day Financial Wellness Action Plan

Days 1-30: Assessment and Foundation

- Complete the financial wellness assessment

- Calculate your true required income vs current income

- Identify top 3 expense categories that don't enhance life quality

- Audit current skills for location independence potential

- Set up basic tracking systems for time-to-income ratios

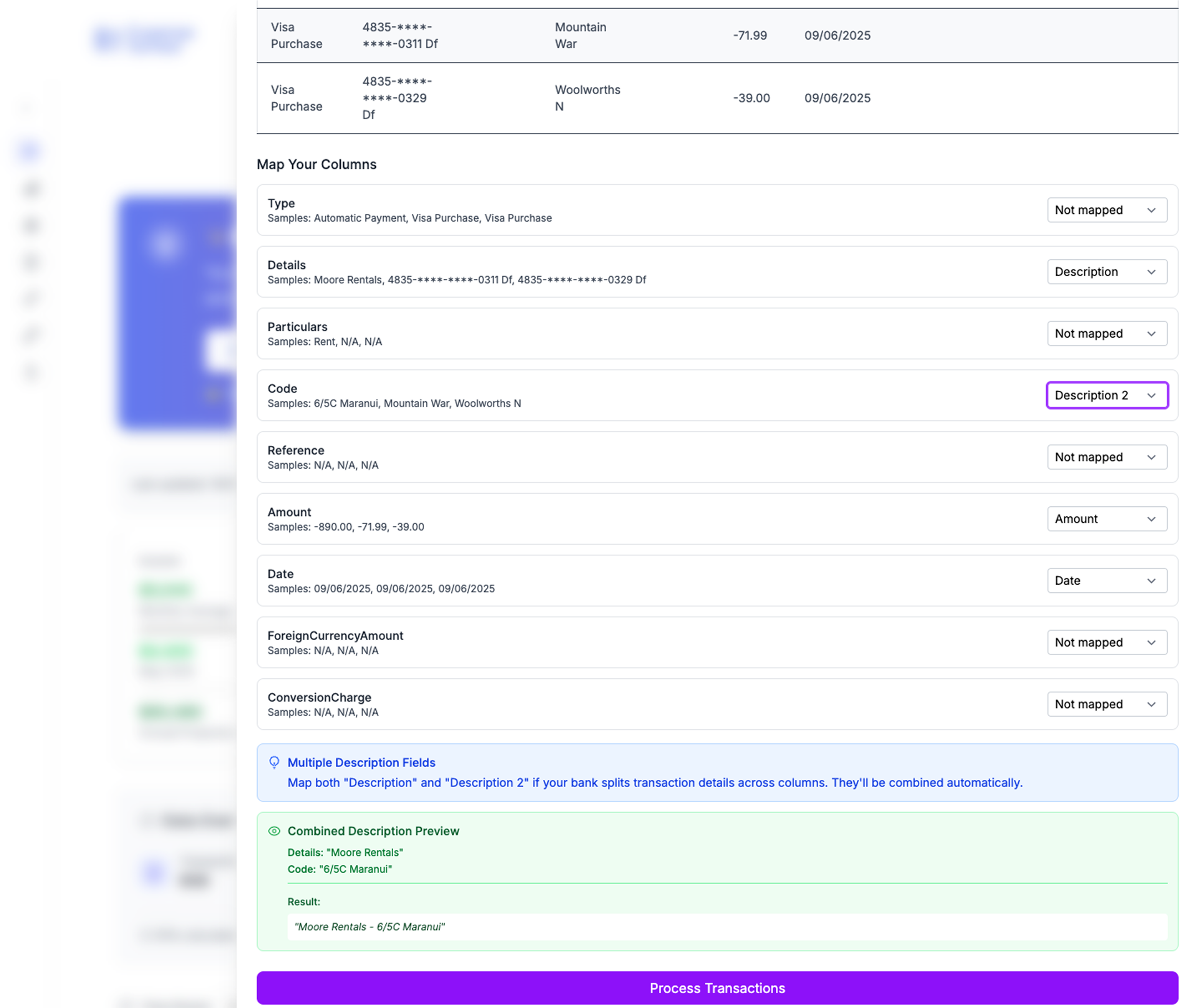

Streamlined bank data import makes the foundation phase effortless - get your complete financial picture in minutes

Streamlined bank data import makes the foundation phase effortless - get your complete financial picture in minutes

Days 31-60: Optimization and Experimentation

- Reduce identified wasteful expenses by 50%

- Negotiate remote work arrangements or flexible schedule

- Identify one skill that could become location-independent income

- Begin building systems to automate current work processes

- Experiment with one form of geographic arbitrage

Days 61-90: System Building and Expansion

- Launch first location-independent income experiment

- Build automation systems for current income sources

- Create processes that work without constant attention

- Develop anti-fragile elements in your financial system

- Plan next 90-day cycle for continued development

Measuring Your Progress

Monthly Check-ins

- Financial runway length

- Percentage of location-independent income

- Time-to-income ratio improvement

- Stress levels related to money

- Progress toward time freedom goals

Quarterly Reviews

- System resilience during unexpected events

- Skill development and capability building

- Geographic and income source diversification

- Alignment between financial systems and life goals

- Identification of next optimization opportunities

Annual Assessment

- Complete re-evaluation using the financial wellness framework

- Comparison with traditional financial wellness metrics

- Assessment of anti-fragile system development

- Planning for next year's time freedom objectives

The Compound Effect of True Financial Wellness

Here's what happens when you optimize for time freedom instead of just money accumulation:

Year 1: Basic systems and expense optimization create breathing room Year 2: Location independence and skill development provide flexibility Year 3: Multiple income streams and automation systems create resilience Year 5: Anti-fragile systems that benefit from uncertainty and change Year 10: Complete time freedom with financial systems that serve your life goals

Unlike traditional financial planning that promises freedom "someday," time freedom financial wellness begins providing benefits immediately.

Conclusion: Your Financial Wellness Revolution

Traditional financial wellness programs are designed to make you a more efficient participant in someone else's economic system. True financial wellness is about building your own system—one that serves your time, your values, and your definition of a life well-lived.

The choice isn't between financial security and financial freedom. The choice is between optimized dependency and genuine independence.

Every month you spend optimizing your participation in systems that don't serve your deepest goals is a month you're not building systems that do.

Your time is finite. Your potential for freedom is not.

The question isn't whether you can afford to pursue true financial wellness.

The question is: can you afford not to?

Ready to move beyond traditional budgeting to build real financial wellness?

Next Steps:

- Take the Financial Wellness Assessment - Get a personalized roadmap for your time freedom journey

- Download the Time Freedom Calculator

- Join the Financial Independence Community

- Start your 90-day action plan

Related Reading:

- The Time Freedom Calculator: Beyond Traditional Budgeting

- Geographic Arbitrage in New Zealand: A Complete Guide

- Building Location-Independent Income: A Step-by-Step Guide

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money