NZ Expense Tracker for Google Sheets (2025 Edition)

Stop paying monthly fees for budgeting apps when all you really need is a simple way to track where your money goes.

After helping hundreds of Kiwis track their expenses over the past few years, I've learned that most people don't need complex budgeting software. They just need a straightforward way to import their bank transactions, categorize them, and see where their money actually goes.

That's exactly what this Google Sheets expense tracker does. It's designed specifically for the monthly workflow that works best for most New Zealanders: download your bank transactions, categorize them, and understand your financial position.

Best of all? It's completely free, and your financial data stays 100% private. Click here to download your NZ-friendly expense tracker.

What This Template Actually Does

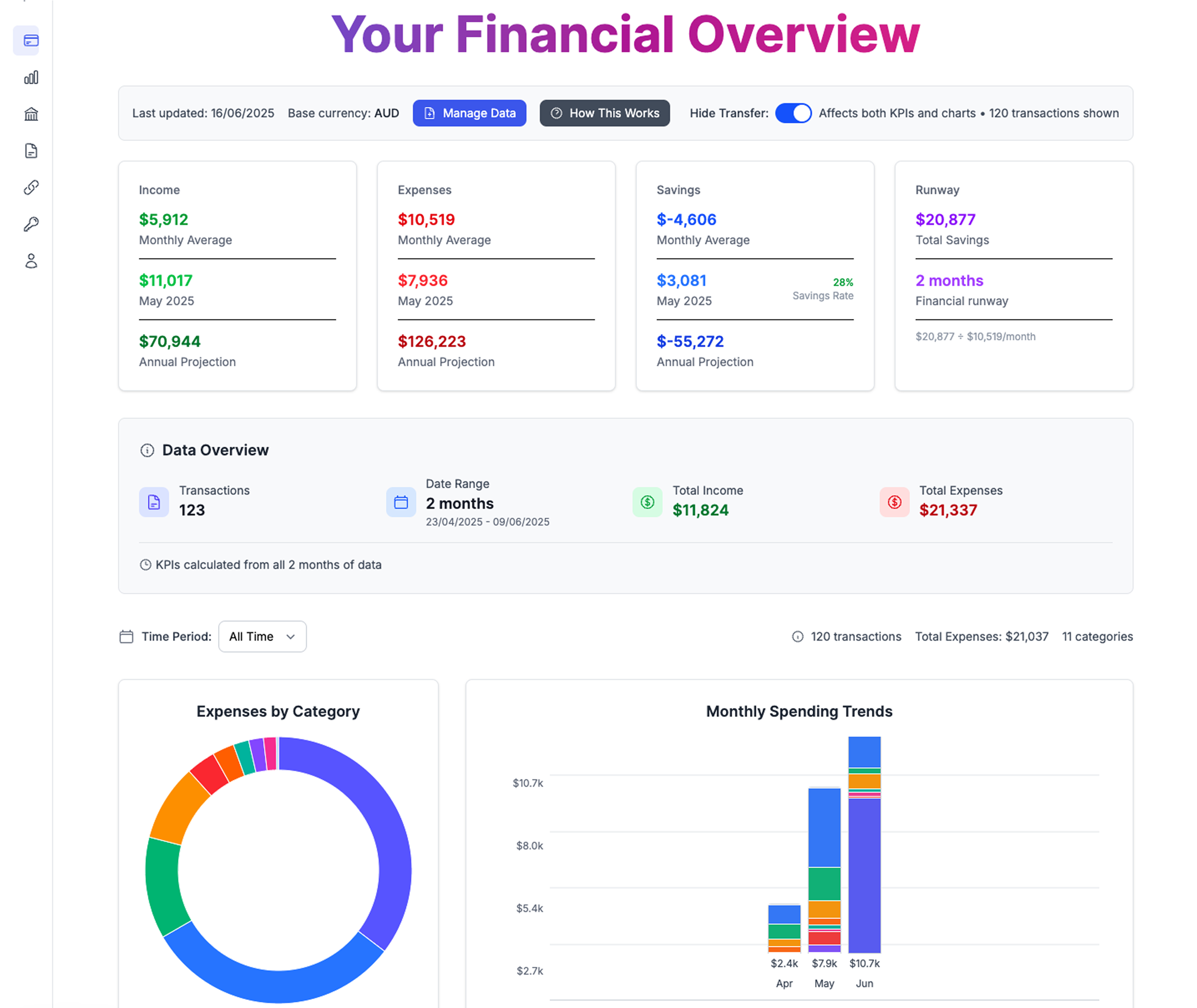

Complete financial overview showing expense tracking, savings rate, and financial runway - everything a Kiwi needs to understand their money

Complete financial overview showing expense tracking, savings rate, and financial runway - everything a Kiwi needs to understand their money

Let me be upfront about what you're getting. This isn't a comprehensive financial planning suite—it's a focused expense tracking system that does four things really well:

1. Import Your Bank Transactions

- Upload CSV files from any NZ bank

- Handles multiple accounts and file formats

- Simple copy-paste process that takes minutes

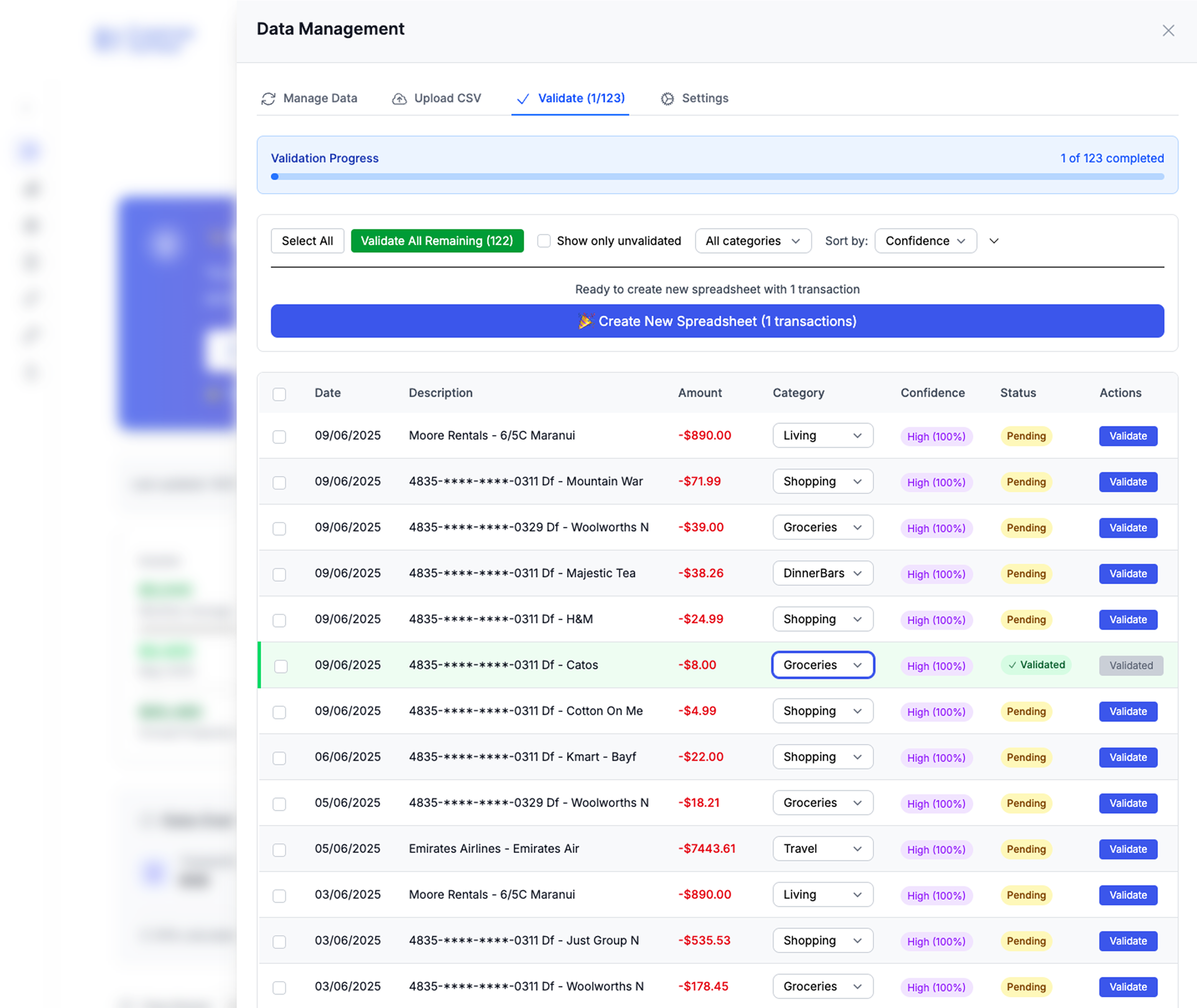

2. Categorize Your Expenses

- Smart categorization tool that learns your spending patterns

- Pre-loaded with common NZ expense categories

- Easily customizable for your specific needs

Smart categorization suggestions that learn your spending patterns and work with any NZ bank

Smart categorization suggestions that learn your spending patterns and work with any NZ bank

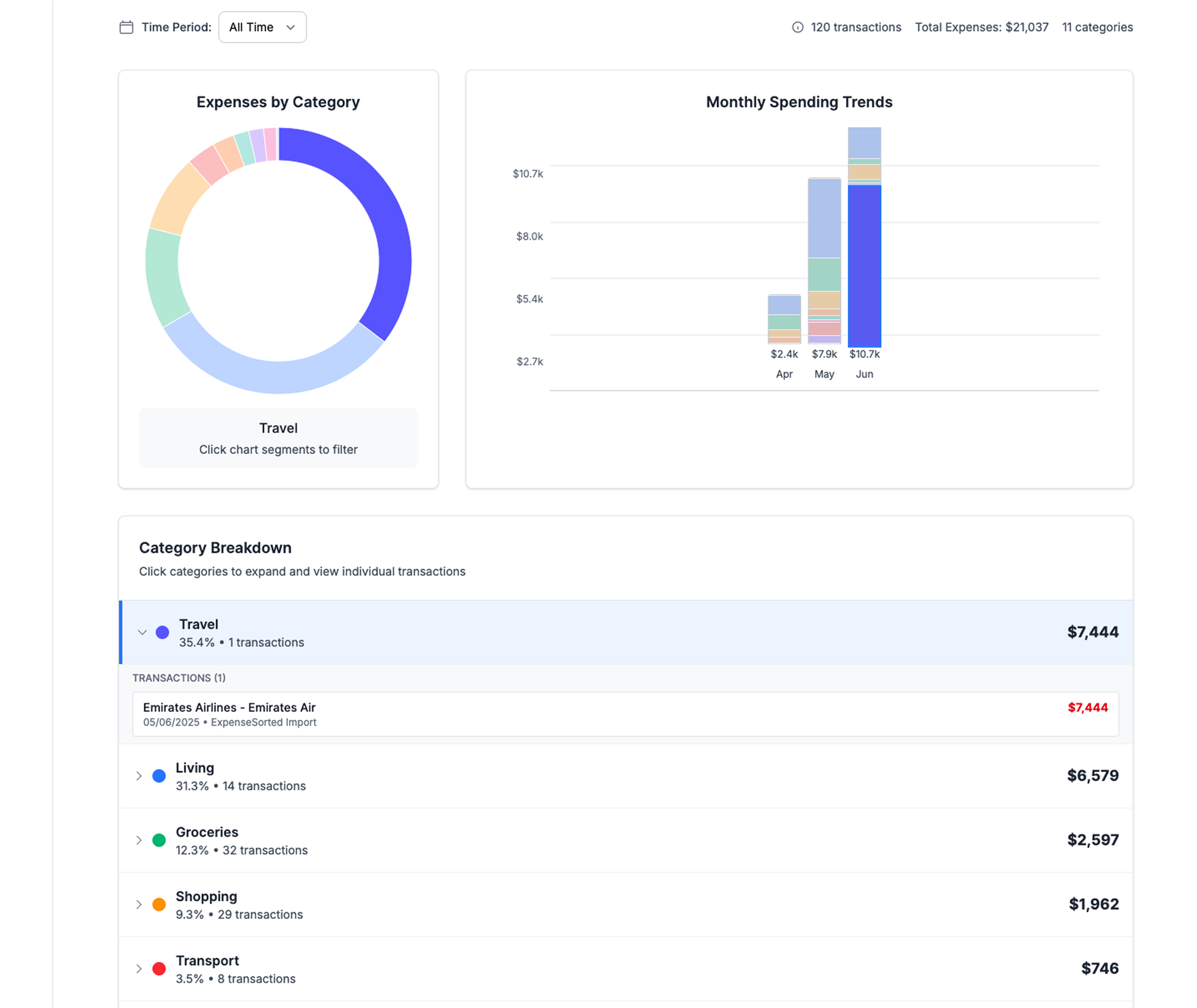

3. Track Monthly Spending Patterns

- Automatic monthly rollups of all your categories

- Compare month-to-month trends

- Calculate your savings rate automatically

4. Monitor Your Financial Runway

- See how long your money would last without income

- Track your cash flow trends

- Monitor savings vs spending balance

Why Google Sheets Beats Expense Tracking Apps

Before diving into the template, here's why this approach makes sense for most Kiwis:

Complete Privacy Protection

Your transaction data never leaves your Google account. No third-party companies analyzing your spending habits, no data breaches, no targeted advertising based on your financial behavior.

Zero Ongoing Costs

Budgeting apps charge $10-30 monthly. This template costs nothing, ever. Over five years, you'll save $600-1,800 that can go toward your actual financial goals.

Works with Any Bank

Compatible with CSV exports from ANZ, ASB, Westpac, BNZ, Kiwibank, and any other New Zealand bank. No waiting for app integrations or dealing with broken connections.

Unlimited Customization

Add categories that match your actual spending. Modify calculations for your specific situation. Scale complexity as your needs change.

The Monthly Workflow (15 Minutes)

This template is built around a simple monthly routine that most people can stick to:

Week 1 of Each Month:

- Download transactions from your bank(s) for the previous month

- Import the CSV into the Expense Detail tab

- Run the categorization tool to assign categories to each transaction

- Review and adjust any miscategorized items

That's It.

The Monthly Expenses tab automatically calculates your spending by category, savings rate, and financial runway. The Expense vs Savings tab shows your overall financial trend.

Total time investment: 15 minutes monthly after initial setup.

Template Overview: What's Actually Included

This template has four main tabs that work together:

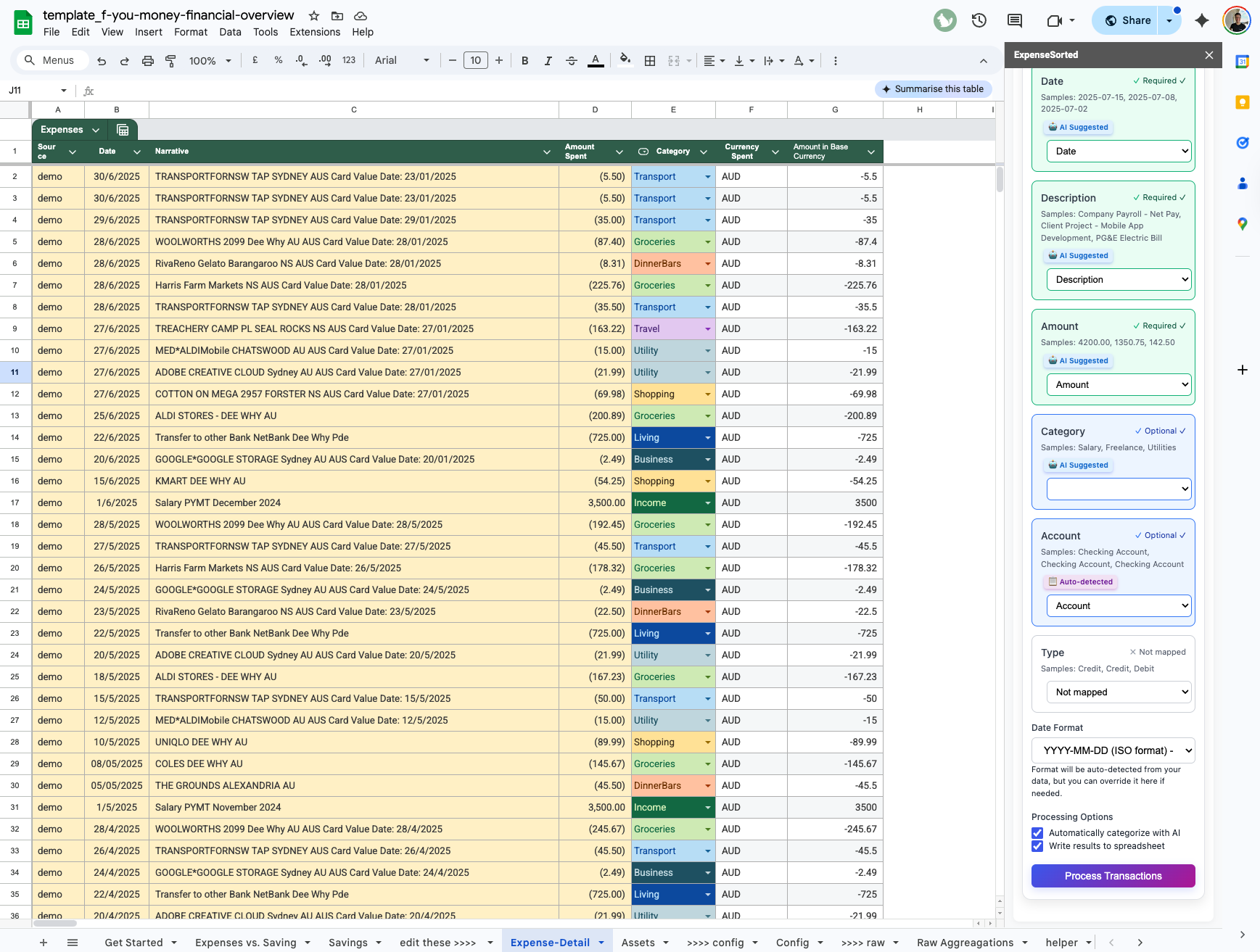

Tab 1: Expense Detail

Your transaction import center:

- Upload bank transaction CSV files

- Categorization tool with smart suggestions

- Manual override for any transactions

- Handles multiple accounts and currencies

Tab 2: Monthly Expenses

Automatic aggregation of your spending:

- Monthly totals by category

- Month-over-month comparisons

- Savings rate calculations

- Income vs expense tracking

Tab 3: Expense vs Savings

Your financial dashboard:

- Current cash flow analysis

- Financial runway calculation (months of expenses covered)

- Savings trend tracking

- Overall financial health overview

Tab 4: Savings

Track your assets and investments:

- Savings account balances

- Investment portfolio values

- KiwiSaver balance

- Quarterly update workflow

New Zealand-Specific Features

Bank CSV Compatibility

Pre-configured to handle transaction formats from:

- ANZ, ASB, Westpac, BNZ

- Kiwibank, TSB, SBS Bank

- Credit unions and building societies

NZ Expense Categories

Ready-to-use categories that match how Kiwis actually spend:

- Housing: Rent/mortgage, rates, insurance, maintenance

- Transport: Vehicle costs, public transport, fuel

- Utilities: Power, internet, mobile, water

- Food: Groceries, dining out, takeaways, coffee

- Insurance: Health, life, contents, vehicle

- Personal: Healthcare, clothing, personal care

- Entertainment: Streaming, activities, sports, hobbies

Comprehensive category management with NZ-specific categories that match how Kiwis actually spend their money

Comprehensive category management with NZ-specific categories that match how Kiwis actually spend their money

Currency and Tax Considerations

- Handles GST-inclusive pricing for contractors

- Supports multiple currencies for overseas spending

- Compatible with NZ tax year (April 1 - March 31)

Setting Up Your Template (Step-by-Step)

Step 1: Get Your Copy

- Click here to get your copy of the template

- Click "File → Make a Copy" to create your personal version

- Rename it to something like "My Expense Tracker 2025"

Step 2: Download Your First Month

- Log into your online banking

- Export last month's transactions as CSV

- Save the file to your computer (remember the location)

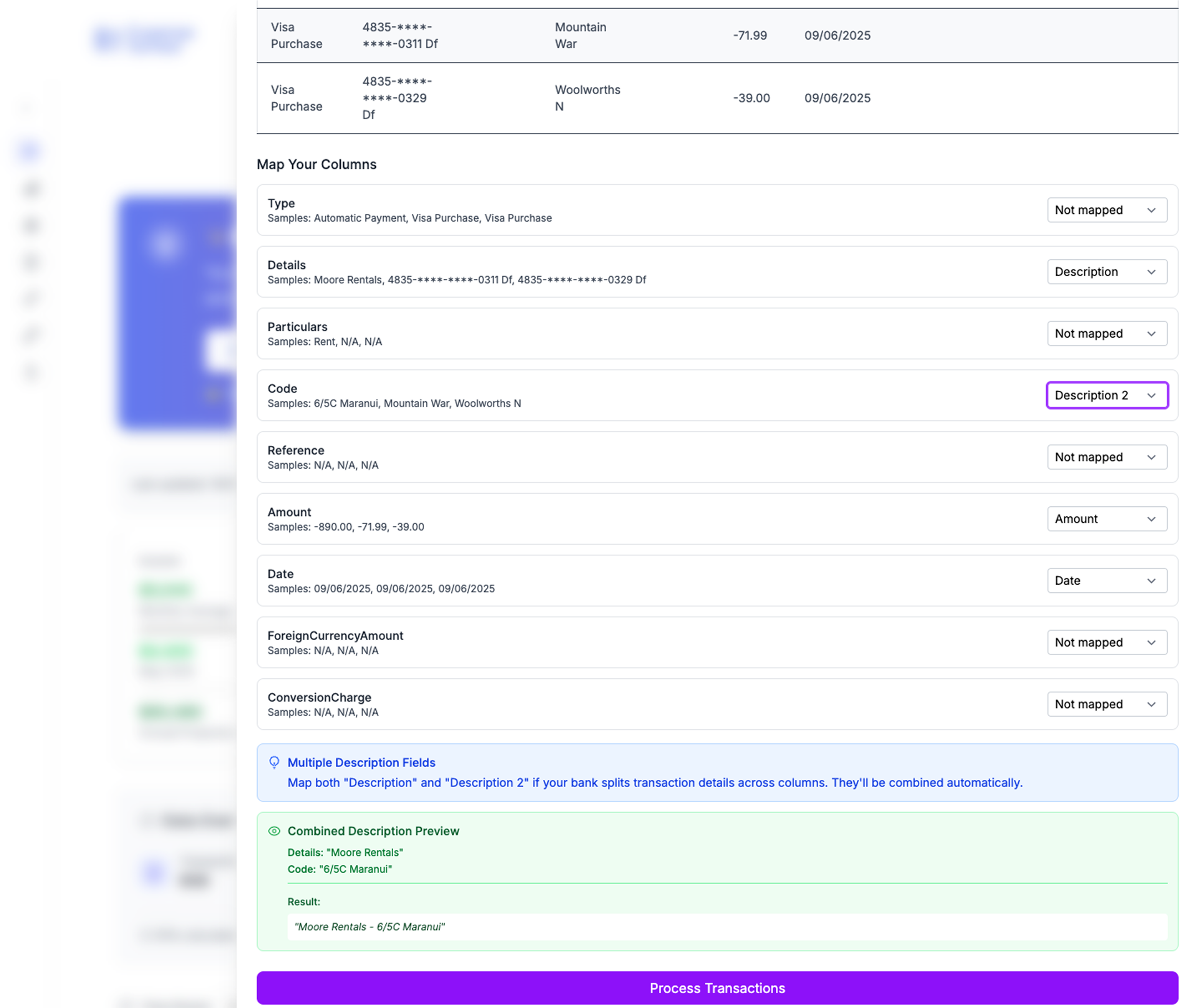

Streamlined CSV import process that works with all major NZ banks - ANZ, ASB, Westpac, BNZ, and more

Streamlined CSV import process that works with all major NZ banks - ANZ, ASB, Westpac, BNZ, and more

Step 3: Import and Categorize

- Open the Expense Detail tab in your template

- Copy-paste your transactions from the CSV file

- Run the categorization tool (instructions included in the sheet)

- Review and adjust any categories that seem wrong

Step 4: Check Your Results

- Monthly Expenses tab shows your spending breakdown

- Expense vs Savings tab shows your overall financial position

- Update your savings in the Savings tab if needed

Common Questions (And Honest Answers)

"Is this actually easier than using a budgeting app?"

For most people, yes. Apps require constant account linking, often break when banks update their systems, and charge ongoing fees. This template requires 15 minutes monthly and costs nothing.

"What if I have multiple bank accounts?"

The template handles multiple accounts easily. Just import each CSV file and the categorization tool will handle them all together.

"Will this help me budget better?"

This template shows you where your money goes, which is the first step to better financial decisions. But it's not a budgeting tool—it's an expense tracking tool. Once you understand your spending patterns, you can make informed choices about where to cut back.

"How accurate is the categorization?"

The tool gets smarter as you use it. Initially, you might need to manually categorize 20-30% of transactions. After a few months, it should handle 80-90% automatically.

"What if I mess something up?"

Google Sheets automatically saves version history. You can always revert to an earlier version if needed. Plus, you're working with copies of your data, not the originals.

"Is this the same as the Financial Freedom spreadsheet?"

Yes, this is a version of our popular Financial Freedom spreadsheet, specifically tailored with examples and categories that are relevant for New Zealanders. You get all the powerful features with a local touch.

Your First Month Setup Plan

Week 1: Initial Setup

- Make your copy of the template

- Download last month's transactions from all accounts

- Import transactions into the Expense Detail tab

- Run initial categorization

Week 2: Refinement

- Review and adjust any miscategorized transactions

- Add any custom categories you need

- Update your savings balances in the Savings tab

- Check your financial runway calculation

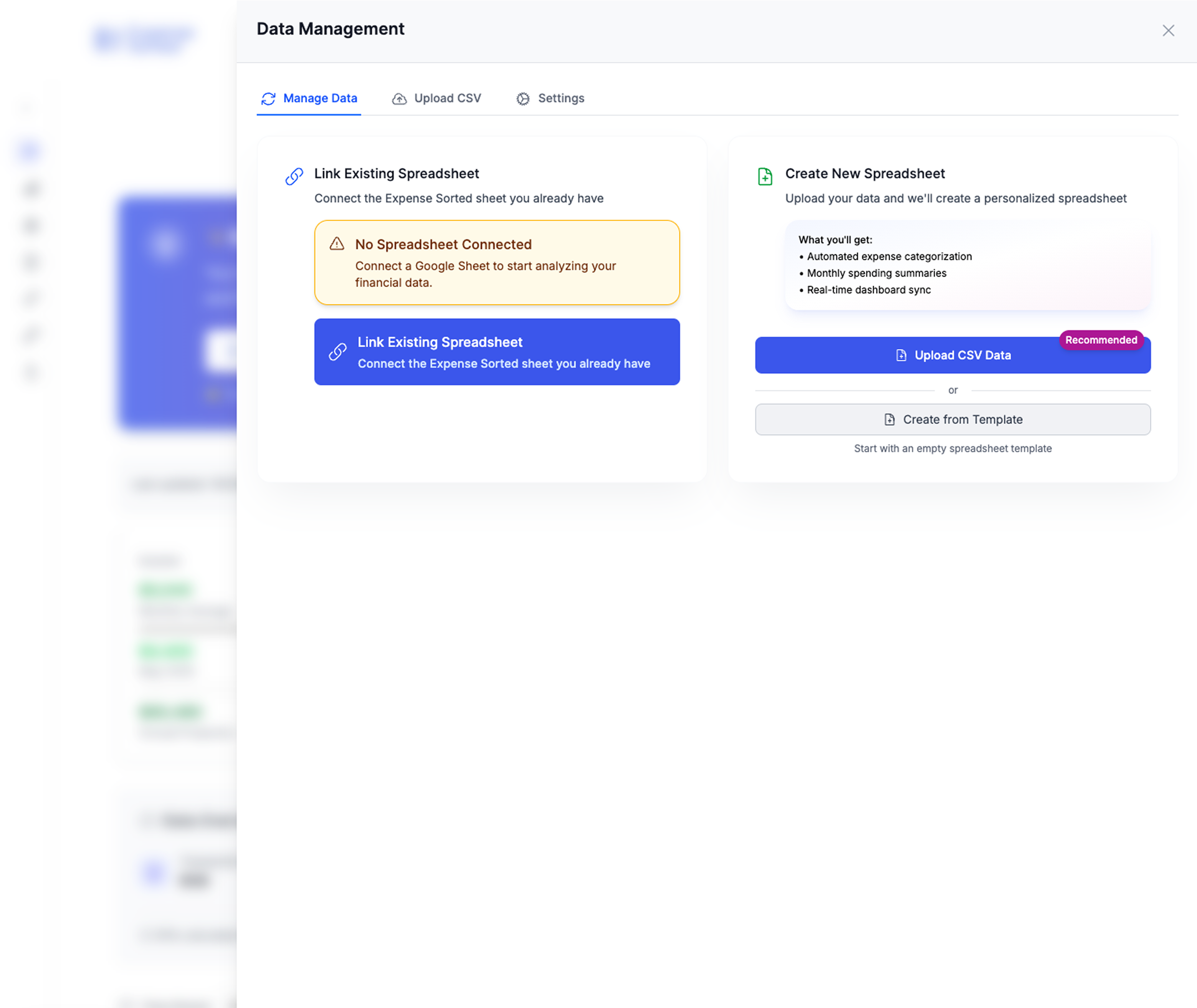

Comprehensive data management interface that makes tracking multiple accounts and categories effortless

Comprehensive data management interface that makes tracking multiple accounts and categories effortless

Week 3: Analysis

- Review your Monthly Expenses breakdown

- Identify your biggest spending categories

- Look for any surprising patterns or outliers

- Set up your monthly routine going forward

Week 4: Routine

- Plan your monthly 15-minute update routine

- Set a calendar reminder for next month's import

- Consider any spending adjustments based on what you learned

What This Won't Do (Being Realistic)

This template focuses on expense tracking and financial awareness. Here's what it doesn't include:

No Complex Budgeting Features: If you want detailed budget planning with multiple scenarios, this isn't for you. It tracks what you spend, not what you plan to spend.

No Investment Analysis: While you can track investment balances, it won't analyze portfolio performance or provide investment advice.

No Bill Management: It doesn't track bill due dates or send payment reminders. It shows you what you spent, not what you owe.

No Goal Planning: It calculates your financial runway but doesn't help plan specific savings goals or retirement projections.

The Real Cost Comparison

Popular Expense Tracking Apps (Annual Cost)

- PocketSmith: $199

- YNAB: $199

- MoneyLover Premium: $71

- Mint (discontinued, but was $120/year for premium)

Google Sheets Template (Annual Cost)

- Template: $0

- Google Sheets: $0 (free tier sufficient)

- Your time: ~3 hours annually (15 minutes × 12 months)

- Total cost: $0

Even if you value your time at $50/hour, you'll save $150+ annually compared to premium apps.

Success Stories: Real Results

David from Wellington: "I thought I was good with money until I used this template. Turns out I was spending $400 monthly on food delivery that I didn't even realize. Just seeing the numbers was enough to change my habits."

Sarah from Auckland: "After my budgeting app kept disconnecting from my bank, I switched to this template. It's actually more reliable and I like having control over my own data."

Mike from Christchurch: "I was spending $20 monthly on a budgeting app when all I really needed was to see where my money was going. This template does exactly that, nothing more, nothing less."

Getting Help and Support

Template Issues

If you run into technical problems with the template, email me directly. I respond to every question within 24 hours.

Bank Import Problems

Different banks format their CSV files differently. If your bank's format doesn't work perfectly, let me know and I'll help you adjust the import process.

Intelligent bank statement mapping handles different CSV formats from all major NZ banks automatically

Intelligent bank statement mapping handles different CSV formats from all major NZ banks automatically

Categorization Questions

The categorization tool improves with use, but everyone's spending patterns are different. I'm happy to help you set up custom categories for your specific situation.

Your Next Steps

Ready to take control of your expense tracking without paying monthly subscription fees?

1. Download Your Template

→ Get the NZ Expense Tracker Here

2. Start Your First Month

Download last month's transactions and follow the setup guide. Most people have their first month categorized within 30 minutes.

3. Establish Your Routine

Set a monthly calendar reminder to spend 15 minutes importing and categorizing your transactions.

4. Make Informed Decisions

Use your spending insights to make conscious choices about where your money goes.

The Bottom Line

This template won't revolutionize your finances overnight. It won't automatically budget for you or give you investment advice.

What it will do is show you exactly where your money goes each month, calculate how long your savings would last, and do it all while keeping your financial data completely private.

Sometimes that's exactly what you need.

Ready to start tracking your expenses the private way?

Download the NZ Expense Tracker →

Next Steps:

Looking for more advanced financial tracking? Check out our automated expense categorization tool that works alongside your Google Sheets template.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money