Six months of emergency savings feels like financial security. It's the "gold standard" recommended by financial advisors, the milestone that separates responsible adults from financial chaos.

But here's what they don't tell you: six months is where most people stop building wealth. They hit the target, breathe a sigh of relief, and shift focus to other goals. Meanwhile, they remain just as dependent on their paycheck as before.

Here's a better approach: use your 6-month emergency fund as the foundation for indefinite financial freedom.

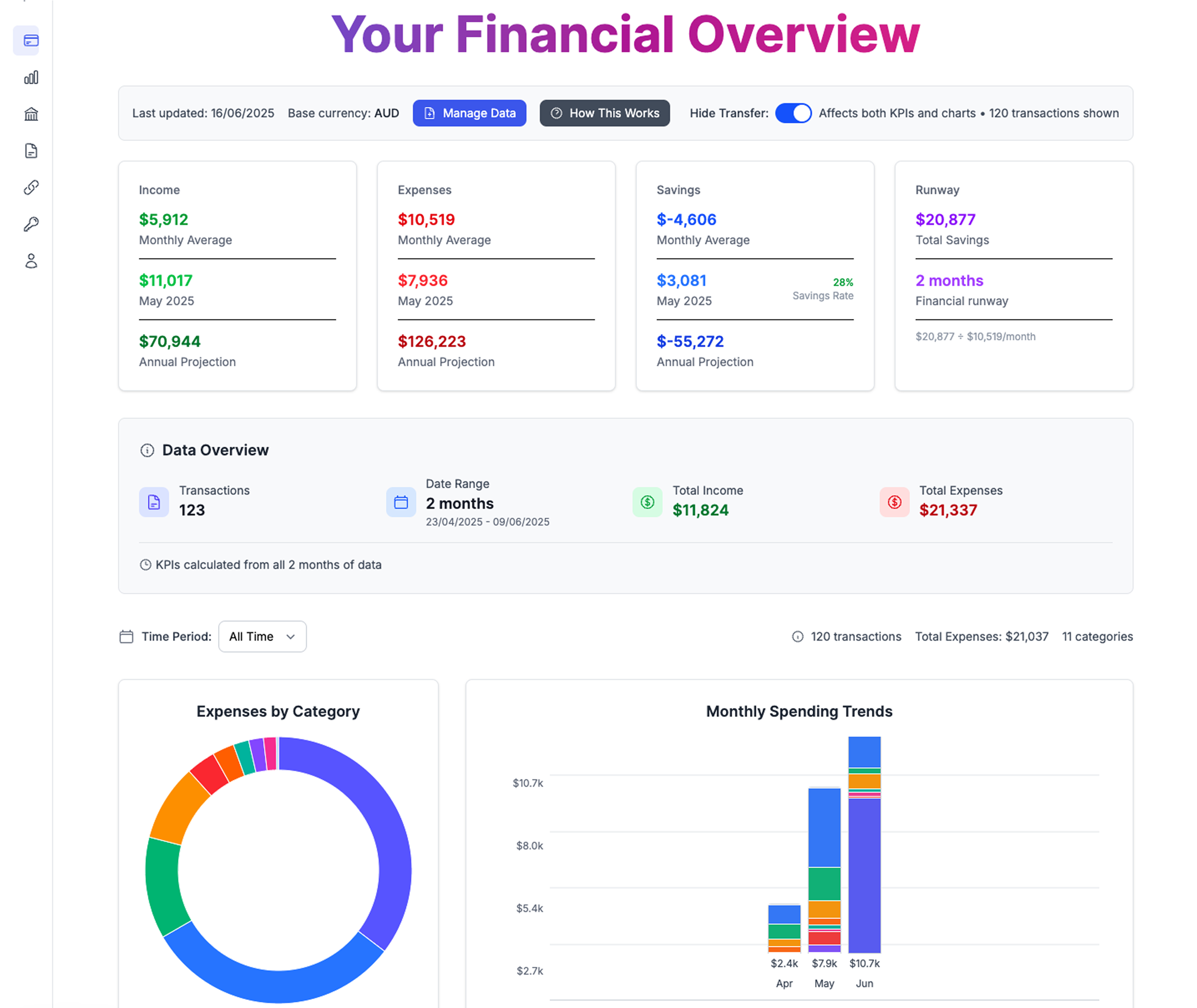

Related: Start with our 6-month emergency fund calculator or financial runway calculator.

Why 6 Months Isn't Actually Safe

The False Security of Traditional Emergency Funds

Job Loss Reality: Average job search for professionals takes 4-6 months, not 2-3 months like the old advice assumes. Your 6-month fund gets you to "desperate territory" just as interviews start happening.

Medical Emergencies: Health insurance deductibles, lost work time, ongoing treatment costs easily exceed 6 months of basic expenses. Cancer treatment can last years, not months.

Economic Downturns: During recessions, unemployment extends to 12+ months for many industries. Your 6-month fund becomes 3 months when you factor in extended job searches.

Multiple Emergencies: Life doesn't wait for you to rebuild your emergency fund. Job loss during a health crisis, or major home repairs during unemployment, compound the problem.

Inflation Impact: Your 6-month fund today covers 5.5 months next year, 5 months the year after. Static savings lose purchasing power.

The Progressive Emergency Fund Philosophy

Instead of building to 6 months and stopping, build systematically toward complete independence:

Level 1: Basic Security (1-3 Months)

Goal: Handle minor emergencies without debt Mindset: "I won't panic over car repairs" Timeline: Months 1-6 of saving

Level 2: Job Transition Buffer (3-6 Months)

Goal: Survive job loss without desperation Mindset: "I can be selective about my next role" Timeline: Months 6-12 of saving

Level 3: Strategic Flexibility (6-12 Months)

Goal: Make major life changes without financial stress Mindset: "I can take calculated risks" Timeline: Months 12-24 of saving

Level 4: Career Independence (12-24 Months)

Goal: Extended breaks from traditional employment Mindset: "Work is optional for extended periods" Timeline: Months 24-48 of saving

Level 5: Complete Freedom (24+ Months)

Goal: Permanent financial independence Mindset: "I work because I choose to, not because I have to" Timeline: Years 3-10 of systematic building

Calculate Your Progressive Emergency Fund Path

Download our spreadsheet to calculate your freedom number now

Step 1: Determine Your Monthly Essential Expenses

Include only true necessities:

- Housing (rent/mortgage, utilities, property taxes)

- Food (groceries, not dining out)

- Transportation (car payment, insurance, gas, maintenance)

- Insurance (health, life, disability)

- Debt minimums (required payments only)

- Basic communications (phone, basic internet)

Example calculation:

- Housing: $2,000

- Food: $600

- Transportation: $500

- Insurance: $400

- Debt minimums: $300

- Communications: $100 Total: $3,900/month

Step 2: Calculate Your Progressive Targets

Level 1 (3 months): $3,900 × 3 = $11,700 Level 2 (6 months): $3,900 × 6 = $23,400 Level 3 (12 months): $3,900 × 12 = $46,800 Level 4 (18 months): $3,900 × 18 = $70,200 Level 5 (24 months): $3,900 × 24 = $93,600

Step 3: Track Your Current Freedom Level

Current savings: $28,000 Current level: Level 2+ (7.2 months) Next milestone: Level 3 (12 months) = $46,800 Progress: 60% toward Level 3 Remaining: $18,800 to reach Level 3

The Psychology of Progressive Building

Each level unlocks new psychological freedom:

Level 1 Psychology: Confidence

- Reduced daily financial anxiety

- Ability to handle minor setbacks

- Foundation for taking on new challenges

Level 2 Psychology: Leverage

- Negotiation power with employers

- Ability to quit toxic situations

- Freedom to be selective about opportunities

Level 3 Psychology: Strategic Thinking

- Long-term planning becomes possible

- Ability to invest in skill development

- Freedom to take calculated risks

Level 4 Psychology: Independence

- Work becomes optional for extended periods

- Ability to pursue passion projects

- Freedom from traditional employment cycles

Level 5 Psychology: Complete Autonomy

- Money becomes a tool, not a master

- Work becomes creative expression

- Freedom to contribute without constraint

Strategic Deployment at Each Level

Your progressive emergency fund isn't just insurance—it's investment capital:

Level 2 Deployment: Career Investment

Safe to invest: 25% of fund (keeping 4.5 months liquid) Examples:

- Professional certification programs

- Graduate degree or specialized training

- Networking events and industry conferences

- Equipment for freelance/consulting work

Level 3 Deployment: Business Building

Safe to invest: 33% of fund (keeping 8 months liquid) Examples:

- Start side business with calculated risk

- Purchase rental property with adequate reserves

- Invest in partnership opportunities

- Fund business partnerships or franchises

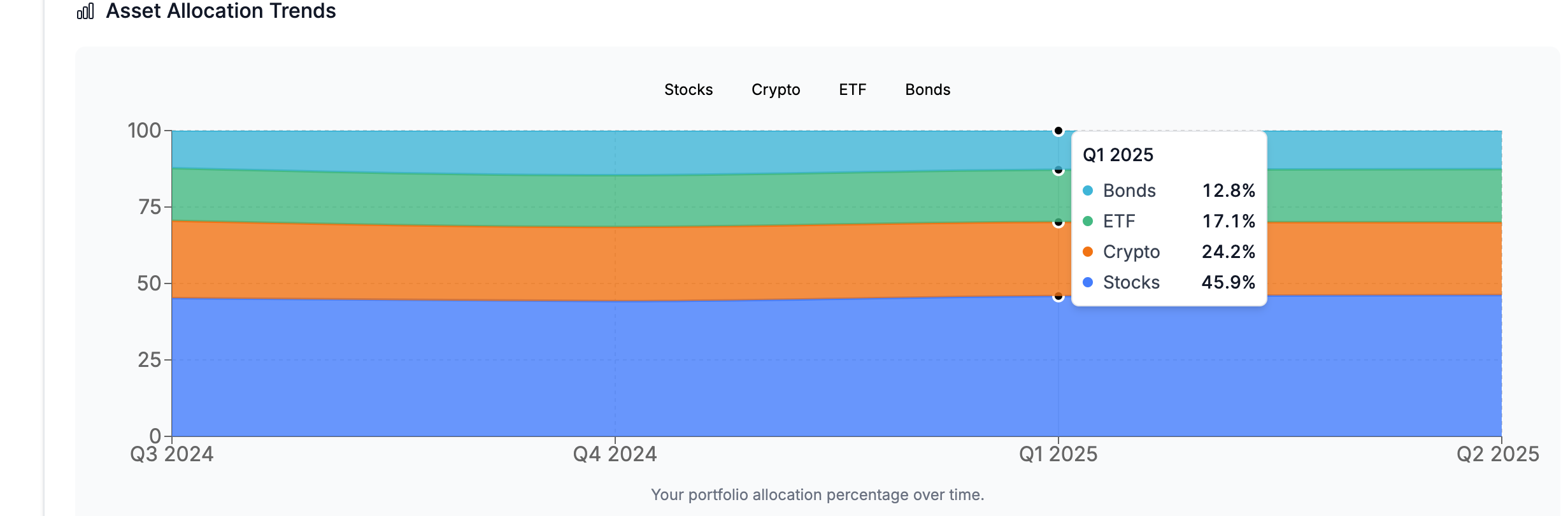

Level 4 Deployment: Wealth Acceleration

Safe to invest: 50% of fund (keeping 12 months liquid) Examples:

- Angel investing in early-stage companies

- Real estate investment and development

- Business acquisition opportunities

- Aggressive portfolio rebalancing

Level 5 Deployment: Legacy Building

Safe to invest: 75% of fund (keeping 6 months liquid) Examples:

- Philanthropic investments

- Family office structure

- Private equity and alternative investments

- Impact investing aligned with values

Advanced Progressive Strategies

The Ladder Strategy

Instead of one large fund, create multiple buckets with different access requirements:

Immediate Access (1 month): High-yield checking Short-term Access (3 months): High-yield savings Medium-term Access (6 months): Money market or CDs Long-term Growth (12+ months): Conservative investment portfolio

The Income Replacement Strategy

Calculate based on income replacement, not just expenses:

Basic: 6 months expenses = survival mode Enhanced: 6 months full income = maintain lifestyle Strategic: 12 months full income = opportunity creation Independent: 24+ months full income = complete autonomy

The Geographic Arbitrage Strategy

Build your fund based on high-cost area, then move to lower-cost area to extend runway:

Example:

- Build $60,000 fund based on $5,000/month San Francisco expenses

- Move to Austin where $3,000/month covers same lifestyle

- Instantly extend runway from 12 months to 20 months

Common Progressive Building Mistakes

Mistake 1: Linear Thinking

Problem: "I need to save $93,600 before I have any freedom" Solution: Recognize that each level unlocks new possibilities

Mistake 2: All-Cash Strategy

Problem: Keeping everything in savings accounts earning 4% Solution: Strategic mix of cash and conservative investments

Mistake 3: Lifestyle Inflation

Problem: Increasing expenses as fund grows Solution: Lock in current expense level, extend runway instead

Mistake 4: Never Deploying Capital

Problem: Hoarding money without strategic investment Solution: Calculated deployment at appropriate levels

Real-World Progressive Success Stories

Maria: Teacher to Tech Executive

Starting point: $8,000 saved (Level 1) Strategy: Built to Level 3, invested in coding bootcamp Outcome: 300% salary increase, now at Level 5

David: Corporate to Consulting

Starting point: $25,000 saved (Level 2) Strategy: Built to Level 4, launched consulting practice Outcome: 2x income with 50% fewer working hours

Lisa: Employee to Real Estate Investor

Starting point: $50,000 saved (Level 3) Strategy: Deployed 33% for first rental property Outcome: Real estate portfolio generating passive income

Building Your Progressive Fund: The 5-Year Plan

Year 1: Foundation (Levels 1-2)

Target: 6 months expenses Strategy: Aggressive expense reduction + income optimization Savings rate: 25-30% of income

Year 2: Acceleration (Level 2-3)

Target: 12 months expenses Strategy: Career advancement + side income development Savings rate: 30-35% of income

Year 3: Strategic Deployment (Level 3)

Target: Maintain 12 months + strategic investments Strategy: Deploy 25-33% for career/business development Focus: Income growth through strategic risk-taking

Year 4: Wealth Building (Level 3-4)

Target: 18 months expenses + growing investments Strategy: Compound returns from strategic deployments Focus: Multiple income streams and asset building

Year 5: Independence Approach (Level 4-5)

Target: 24+ months expenses + significant investment portfolio Strategy: Optimize for sustainable independence Focus: Work becomes optional, not necessary

Beyond Emergency: The Freedom Fund Mindset

Stop thinking about emergency funds. Start thinking about freedom funds.

Emergency thinking: "What if something bad happens?" Freedom thinking: "What amazing things become possible?"

Emergency planning: Survive worst-case scenarios Freedom planning: Thrive in all scenarios

Emergency psychology: Fear-based, defensive Freedom psychology: Opportunity-based, offensive

Your 6-month emergency fund isn't the destination—it's mile marker 2 on a 26-mile marathon toward complete financial independence.

Take Action: Calculate Your Progressive Path

Use Expense Sorted's Progressive Emergency Fund Calculator to map your journey from 6-month security to indefinite freedom.

Track your progression:

- Current emergency fund level (1-5)

- Time to next level at current savings rate

- Strategic deployment opportunities at each level

- Path to complete financial independence

Included tools:

- Progressive target calculator

- Strategic deployment planner

- Freedom milestone tracker

- Independence timeline projector

Don't stop at 6 months. That's where financial mediocrity begins and true wealth building ends.

Start your progressive journey today. Your future independent self will thank you.

Related Articles

Emergency Fund Calculators:

- 6 Month Emergency Fund Calculator: How Much Do You Actually Need?

- Emergency Fund Calculator: How Much Do You Really Need? (2025 Updated)

- Emergency Fund Calculator: How Many Months of Freedom Can You Buy?

Financial Runway:

- Financial Runway Calculator: How Long Can You Last Without Income?

- Financial Runway Calculator: How Many Months of Freedom Can You Buy?

Freedom Planning:

- Emergency Fund to Freedom Fund: Calculate Your Path to Financial Independence

- Financial Freedom vs Financial Independence: What I Wish I'd Known 10 Years Ago

- The Complete Guide to Planning (and Funding) Your Career Sabbatical

Templates:

- Expense Tracker Google Sheets Template: Complete Setup Guide (2025)

- YNAB Alternative: Why Google Sheets Gives You More Control (And Costs Less)

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money