Most investment trackers are glorified calculators. You enter your holdings, they show basic gains and losses, and that's it. But tracking investments isn't just about knowing current values—it's about making smarter decisions with your money.

After building investment tracking tools for thousands of users and analyzing what actually moves the needle for long-term wealth building, I've created what I believe is the most comprehensive Google Sheets investment tracker available. This isn't just another portfolio spreadsheet—it's a decision-making system that connects your investments to your life goals.

What makes this different? While other trackers focus on displaying current values, this template actively helps you optimize your portfolio. It identifies rebalancing opportunities, spots tax-loss harvesting potential, and most importantly, shows exactly how your investment progress impacts your timeline to financial independence.

A stupid simple workflow

Don't overdo things. If you're investing long-term, a quarterly workflow to keep track of your portfolio will be just fine.

- Setup the tracker sheet and Google Sheet extension

- Import your transactions from Interactive Brokers and manually input any other holdings

- Aggregate everything in the quarterly overview to review performance and allocation

Here's a quick demo walkthrough:

See the Investment Tracker in Action

Why Google Sheets for Investment Tracking?

Before diving into the template features, let's address why Google Sheets beats expensive portfolio management software for most investors.

Your Data Stays Private: Unlike investment apps that analyze and potentially monetize your portfolio data, everything stays in your Google account. No third-party company can access your holdings, trading patterns, or financial strategies.

Real-Time Automation: Google Finance integration provides automatic price updates every 20 minutes during market hours. Your portfolio values, asset allocation, and performance metrics update without any manual work.

Unlimited Customization: Can't find a tracker that fits your investment style? Build exactly what you need. Value investor focused on fundamentals? Growth investor tracking momentum? International investor managing currency exposure? This template adapts to any strategy. For specialized portfolio templates, check our portfolio tracker template guide.

Zero Subscription Fees: Premium portfolio tracking services charge $10-50 monthly. This solution costs nothing beyond your existing Google account while offering more advanced features than most paid alternatives.

Universal Access: Monitor your investments from any device with internet access. Make rebalancing decisions from your phone during lunch break or review performance metrics on your laptop at home.

Our Financial Freedom Spreadsheet includes a comprehensive investment tracker that provides all these benefits and more, integrating them with your overall financial picture. Start tracking your investments like a pro →

What This Template Actually Provides

This Google Sheets investment tracker delivers a complete foundation for sophisticated portfolio management:

Core Functionality (Built-In):

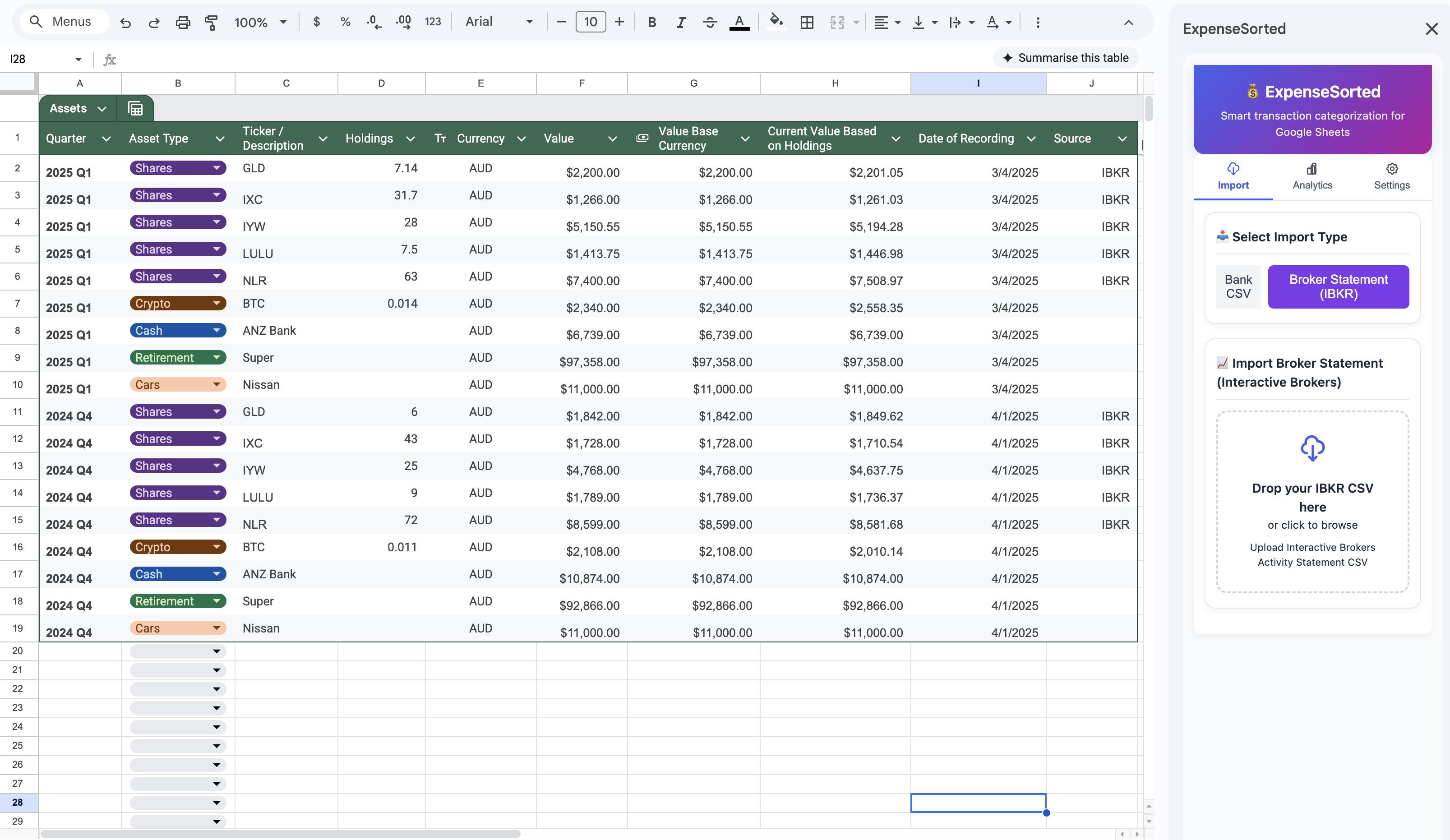

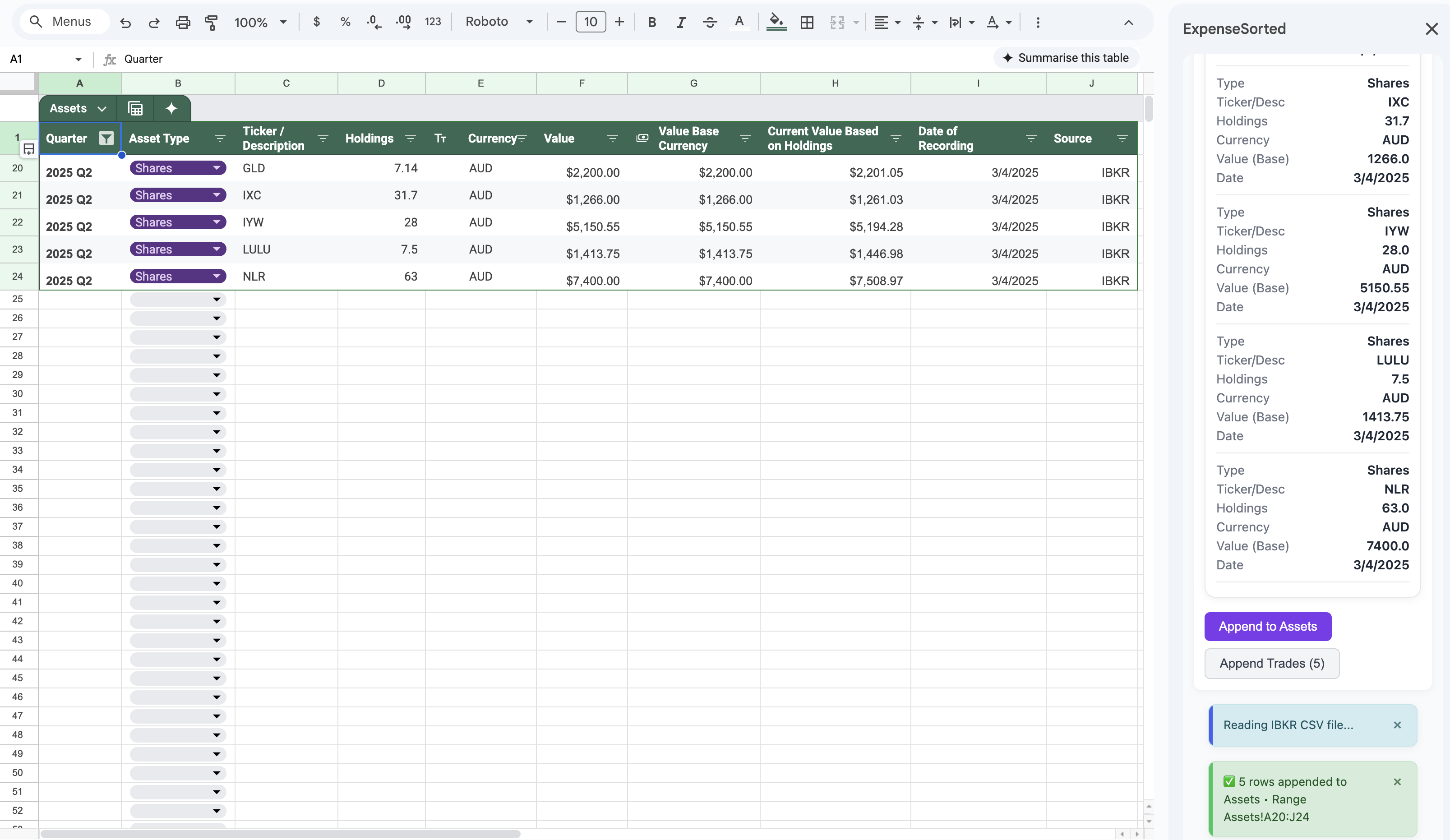

- Interactive Brokers transaction import and processing

- Automatic asset aggregation and current holdings calculation

- Real-time price updates via Google Finance integration

- Portfolio allocation visualization and trends over time

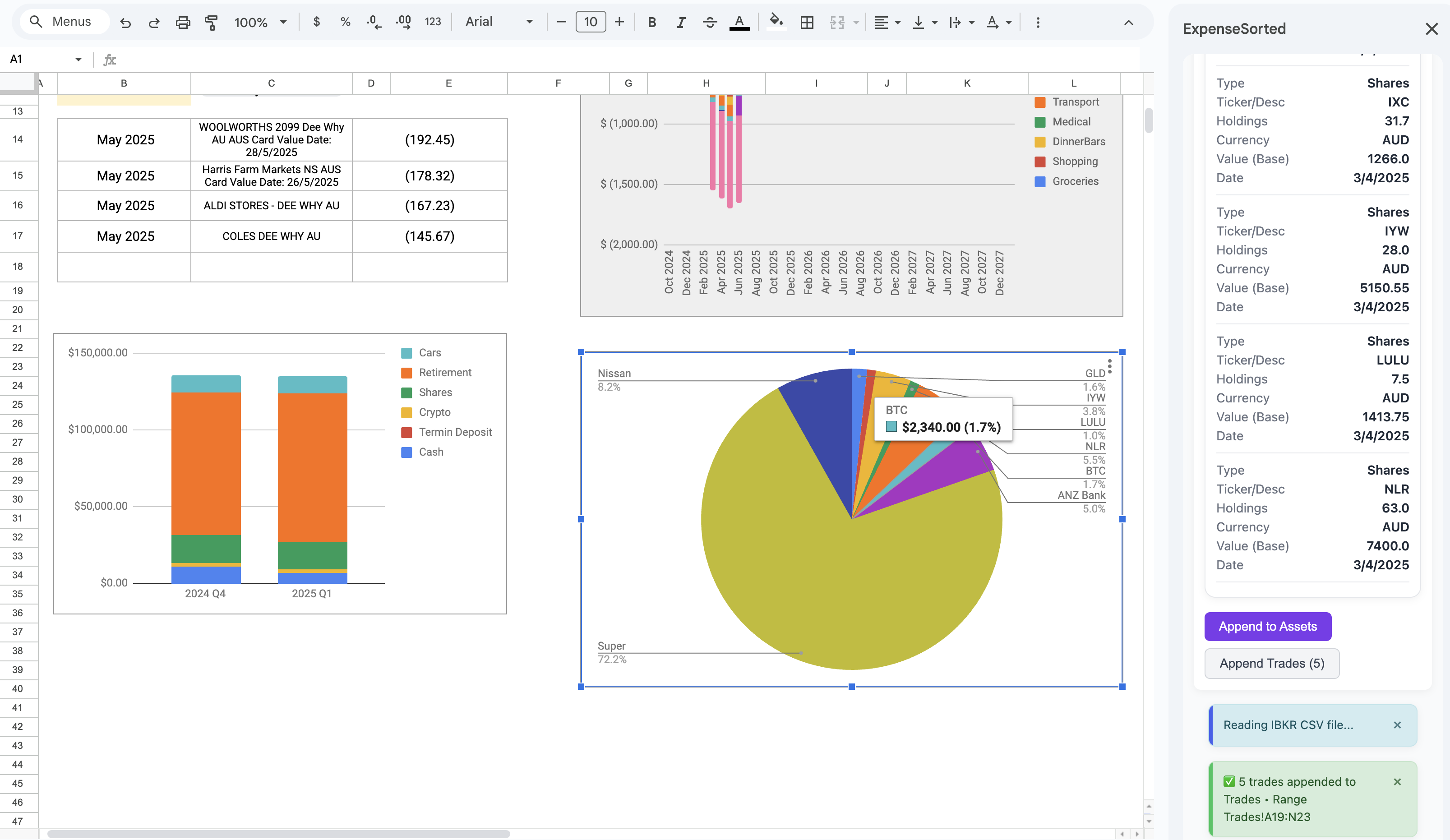

- Integration with expense tracking for complete financial picture

- Cost basis tracking from transaction history

- Multi-currency support with automatic conversion

For a complete setup guide on automating Interactive Brokers imports, see our IBKR portfolio tracker guide.

What You Can Build On This Foundation: Advanced analysis, specialized metrics for different investment styles, custom alerts, and sophisticated modeling—all powered by clean, organized data.

Automatic Data Integration

Real-Time Price Feeds: Stocks, ETFs, mutual funds, and major cryptocurrencies update automatically via Google Finance. No more manually updating values or dealing with stale data. Upload Interactive Broker account statements for detailed transaction reports and asset breakdowns.

Multi-Currency Support: Track international holdings with automatic currency conversion. Perfect for investors diversifying globally or expats managing portfolios across multiple countries.

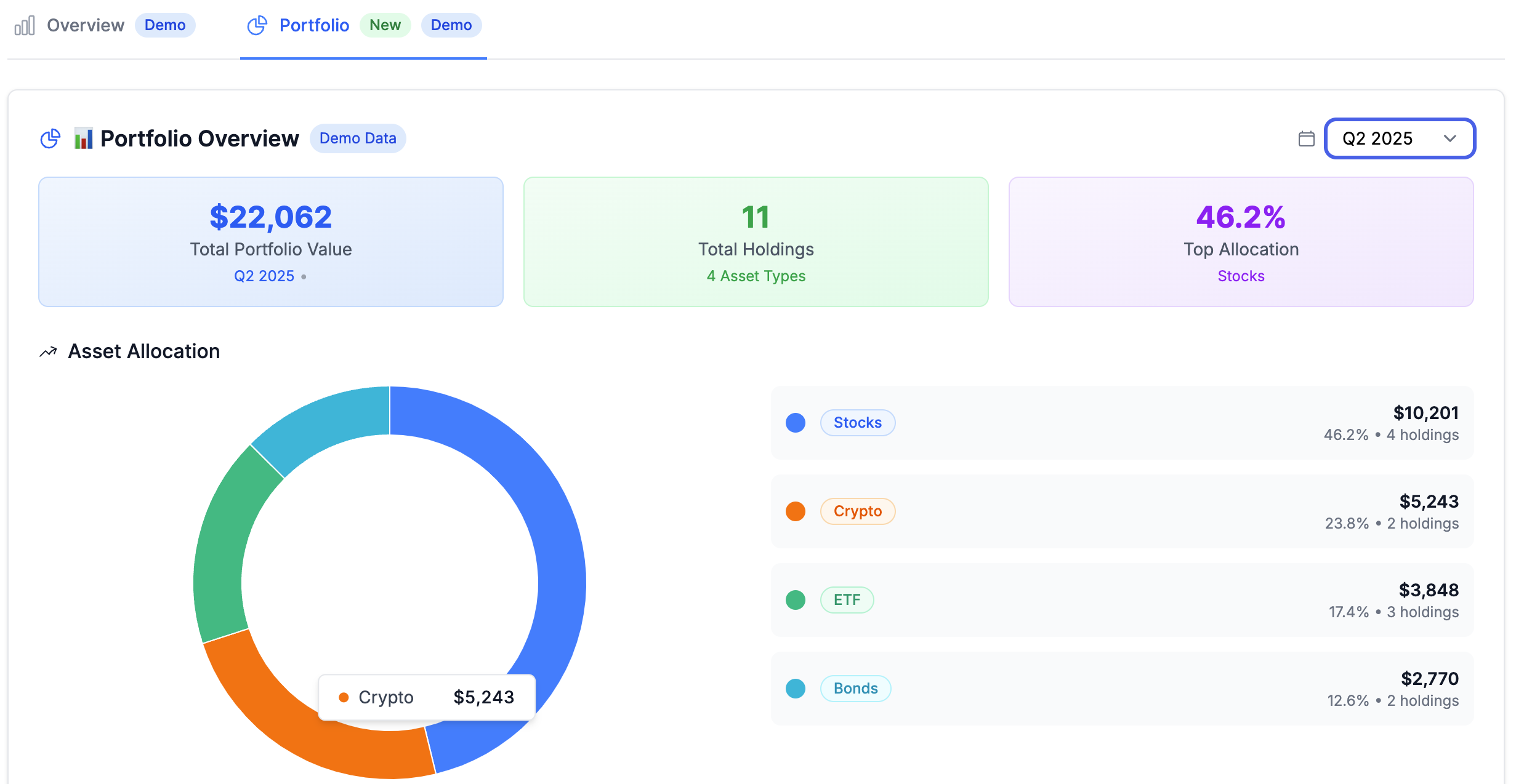

Advanced Portfolio Analytics

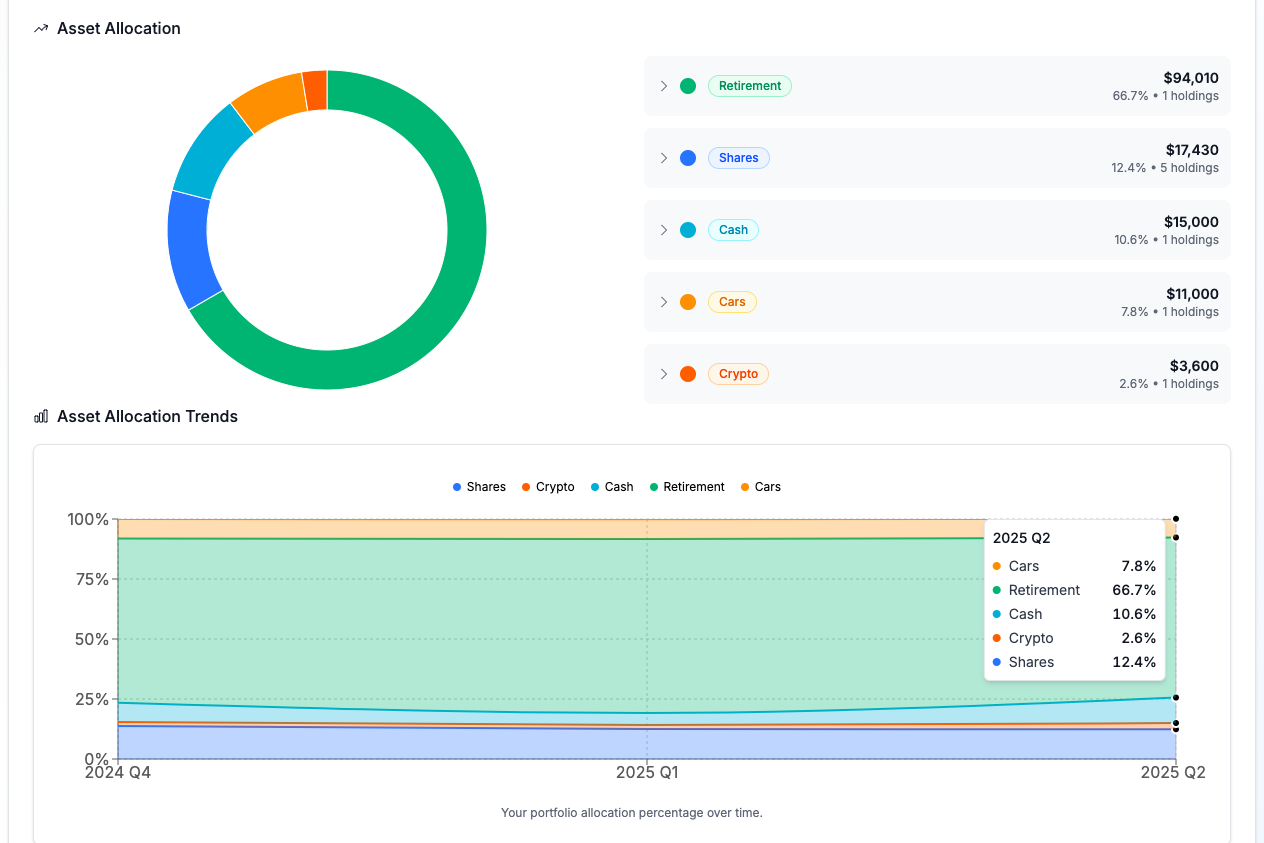

Asset Allocation Monitoring: Visual dashboard shows your current allocation in grouped and detailed view, giving you insights into how diversified your portfolio is.

A clear, visual dashboard showing your complete portfolio overview, asset allocation, and key metrics.

A clear, visual dashboard showing your complete portfolio overview, asset allocation, and key metrics.

Asset Allocation over time: Simple but powerful insights into how your asset allocation has been changing over time. Simply make changes based on this to keep your desired ratio.

Track how your asset allocation changes over time to ensure you stay aligned with your long-term strategy.

Track how your asset allocation changes over time to ensure you stay aligned with your long-term strategy.

Risk Analysis: Monitor portfolio concentration, sector exposure, and geographic diversification.

Tax Optimization Foundation

Cost Basis Tracking: The Interactive Brokers import automatically captures cost basis data for tax purposes, especially important for investments with multiple purchase dates or dividend reinvestment. This eliminates the tedious process of manually extracting and consolidating complex broker reports.

FIRE Integration

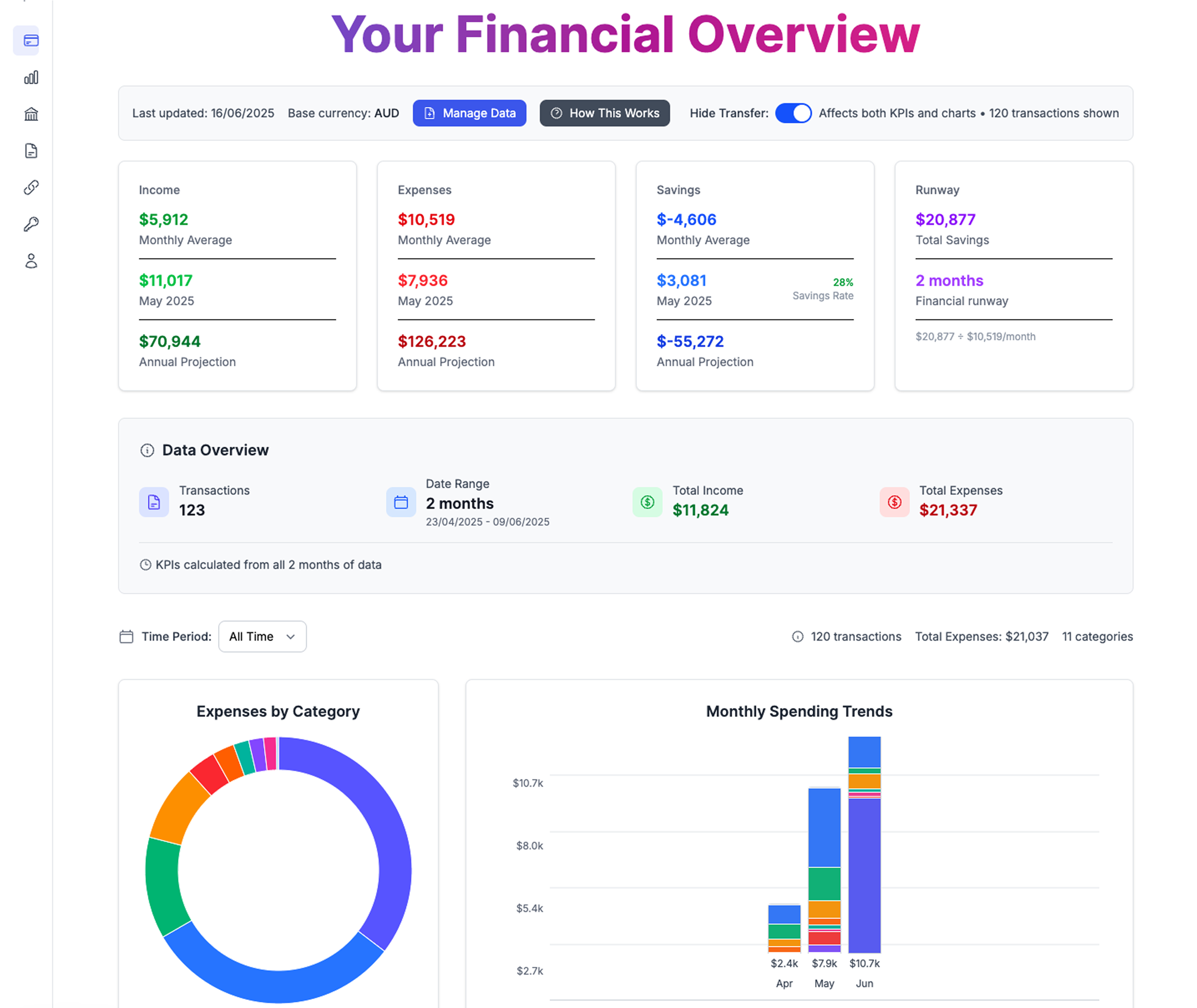

The ultimate goal of investing is financial freedom. Our Financial Freedom Spreadsheet is built from the ground up to track your progress toward FIRE, connecting your portfolio directly to your financial independence timeline. See how close you are to financial freedom →

Retirement Timeline Impact: See how current portfolio value and growth rate affect your financial independence timeline. Small changes in savings rate or investment returns can dramatically alter your retirement date.

Withdrawal Rate Analysis: Your runway is the best indication here. Find out how long your savings will last based on past incom and spending analysis

Get Your Professional Investment Tracker Today

Step 1: Get Your Copy

Simple Setup Process:

- Click the button above to get instant access

- The system automatically creates your personalized tracker

- Import your broker data with one click

- Start making smarter investment decisions immediately

Step 2: Initial Configuration

Set Your Base Currency: Choose your primary currency in the Settings tab. All calculations will use this as the base, with automatic conversion for foreign holdings.

Install Expense Sorted Extension: Get the extension to automate IBKR imports and supercharge analytics.

Step 3: Add Your Holdings

Manual Entry: Input each holding with ticker symbol, number of shares, and purchase date. Google Finance automatically pulls current prices and company information.

CSV Import Option: Most brokerages allow CSV export of holdings. Import these files to quickly populate large portfolios without manual entry.

Advanced Use Cases

For FIRE Pursuers

Transforms investment tracking into retirement planning:

Timeline Optimization: See exactly how different savings rates and investment returns affect your financial independence date. A 1% higher return or 5% higher savings rate can shave years off your working career. The sheet gives you the flexible foundation for this.

Withdrawal Strategy Modeling: Test different retirement withdrawal strategies (4% rule, bond ladder, dividend-focused) to find the approach that maximizes portfolio longevity.

Coast FIRE Calculation: Determine the portfolio value where you could stop saving and still reach financial independence by traditional retirement age through compound growth alone.

For Tax-Conscious Investors

Tax-Loss Harvesting Foundation: With detailed broker transaction data imported and organized, you can build analysis to identify tax implications and harvesting opportunities.

For International Investors

Multi-Currency Tracking: Monitor portfolios spanning multiple countries with automatic currency conversion and local tax considerations.

Customization Potential for Different Investment Styles

The Google Sheets foundation provides the core transaction import, asset aggregation, and portfolio tracking functionality. With your portfolio data properly organized, you can extend the template to match your specific investment approach:

Value Investors

Build upon the foundation by adding fundamental analysis columns:

- Price-to-Earnings (P/E) ratios

- Price-to-Book (P/B) ratios

- Dividend yield and growth rates

- Debt-to-equity ratios

With your asset holdings already tracked, you can create formulas to automatically flag when holdings become overvalued relative to historical metrics.

Growth Investors

Enhance the base tracking with growth-specific metrics:

- Revenue growth rates

- Earnings growth trends

- Market share expansion

- Price momentum indicators

Dividend Investors

Expand the dividend data already captured from transactions:

- Enhanced dividend yield calculations

- Payment date calendars

- Dividend growth rate analysis

- Coverage ratio monitoring

Real Estate Investors

Adapt the core template for REITs and direct property tracking:

- Funds From Operations (FFO) calculations

- Cap rate tracking for direct property

- Geographic diversification analysis

- Interest rate sensitivity monitoring

Integration with Your Financial System

Connecting to Expense Tracking

Link this investment tracker with your complete financial dashboard for complete financial visibility:

- See how investment gains affect your savings rate

- Track the percentage of expenses covered by dividend income

- Model how investment growth reduces required savings for FIRE

Tax Preparation Integration Potential

With your transaction data organized, you can build exports for tax software:

- Capital gains and losses summary from transaction history

- Dividend income totals from imported data

- Foreign tax credit calculations using transaction details

- Cost basis tracking already captured from broker imports

Estate Planning Coordination Possibilities

Use the portfolio foundation to build estate planning oversight:

- Account type optimization for inheritance tax efficiency

- Beneficiary allocation tracking across all holdings

- Step-up basis considerations for taxable accounts

Common Mistakes to Avoid

Over-Diversification Trap

The Problem: Buying 50+ individual stocks or 20+ ETFs thinking more diversification equals better returns.

The Solution: Focus on broad market index funds that provide instant diversification. The template helps identify overlapping holdings and unnecessary complexity.

Ignoring Fees and Taxes

The Problem: Focusing only on gross returns while ignoring expense ratios, trading costs, and tax implications.

The Solution: The template calculates after-fee, after-tax returns for accurate performance comparison. A fund with 0.5% higher fees needs to outperform by more than 0.5% to be worthwhile.

Emotional Trading

The Problem: Making buy/sell decisions based on daily market movements or news headlines.

The Solution: The template emphasizes long-term trends and systematic rebalancing over emotional reactions. Set rules for when to trade and stick to them.

Neglecting Asset Location

The Problem: Randomly placing investments in different account types without considering tax efficiency.

The Solution: The template suggests optimal account placement. Generally: bonds and REITs in tax-advantaged accounts, growth stocks in taxable accounts.

Lifestyle Inflation Blindness

The Problem: Increasing spending as investment balances grow, extending the time to financial independence.

The Solution: Integration with expense tracking shows whether lifestyle inflation is sabotaging FIRE goals.

Advanced Extension Possibilities for Power Users

The core Google Sheets template handles Interactive Brokers transaction imports, asset aggregation, and integration with your overall financial picture. For power users, this foundation enables sophisticated customizations:

Options Trading Extensions

Once your basic trading data is imported, you can build tracking for complex strategies:

- Premium income tracking from your transaction history

- Strike price management workflows

- Expiration date monitoring systems

- Assignment probability calculations

Cryptocurrency Integration Potential

The multi-asset foundation supports expansion into digital assets:

- Manual entry for crypto holdings alongside traditional investments

- Custom formulas for staking reward tracking

- DeFi protocol yield calculations

- Tax-loss harvesting analysis for crypto positions

Alternative Investment Adaptations

The flexible structure accommodates non-traditional assets:

- Private equity and venture capital investment tracking

- Collectibles and art valuation monitoring

- Precious metals holdings integration

- Peer-to-peer lending return analysis

Note: These advanced features require custom Google Sheets development beyond the base template. The foundation provides the data structure and integration points to build these capabilities.

Frequently Asked Questions

Q: How often should I update the tracker? A: Prices update automatically every 20 minutes during market hours. Review allocation and rebalancing needs monthly, but avoid daily obsessing over values.

Q: Can I track retirement accounts and taxable accounts together? A: Absolutely. The template separates accounts for tax optimization while providing combined portfolio views. This is essential for comprehensive financial planning.

Q: What about international tax implications? A: The template includes foreign tax credit tracking and withholding tax calculations. For complex international situations, consult with a tax professional familiar with expat taxation.

Q: How secure is my financial data? A: Your data stays in your Google account with the same security as Gmail. Never share your Google credentials, and consider two-factor authentication for additional security.

Q: Can I share this with my financial advisor? A: Yes, financial advisors often prefer clients who actively track their portfolios. The standardized format makes professional review straightforward.

Growing Your Investment Tracking Foundation

This template provides the essential infrastructure that grows with your financial sophistication. With your transaction data properly imported and aggregated, you can build advanced analysis layers:

Behavioral Finance Integration: Use your transaction history to track patterns in investment mistakes and emotional decisions, enabling better future decision-making.

Monte Carlo Analysis: Leverage your current portfolio allocation data to model thousands of potential market scenarios and understand portfolio success probability under different conditions.

Factor Investing: Build upon your asset holdings to track exposure to value, momentum, size, and quality factors for more sophisticated portfolio construction.

ESG Integration: Enhance your holdings data with environmental, social, and governance scores for investors focused on sustainable investing.

The foundation handles the complex work of data import, cleansing, and aggregation—you focus on the analysis that matters to your investment strategy.

Your Investment Data Belongs to You

In an era where financial companies monetize user data, maintaining control over your investment information isn't just about privacy—it's about financial independence. When you understand your portfolio deeply, you make better decisions. When you own your data completely, you're never locked into a platform that might change its terms or disappear.

This investment tracker embodies the same philosophy as our expense tracking tools: the best financial systems give you more control, not less. Your money, your data, your investment decisions.

The path to financial independence isn't just about saving more or earning higher returns—it's about making informed decisions based on complete information. This tracker provides that information while keeping you in complete control of your financial future.

Your future financial independence depends on the decisions you make today. Don't let another month pass tracking your investments with outdated tools or spreadsheets that don't give you the insights you need.

The most successful investors aren't the ones with the highest returns—they're the ones who consistently make informed decisions based on complete data. Get the system that gives you that advantage.

Related Articles

Portfolio Tracking:

- Google Sheets Portfolio Tracker with Interactive Brokers Import

- Portfolio Tracker Google Sheets Template: Monitor All Your Investments in One Place

- The Ultimate Google Sheets Financial Dashboard: Track Everything in One Place

Interactive Brokers & Automation:

- Interactive Brokers CSV Hell: Why Your Trading Data is a Mess (And How to Fix It)

- The 15-Minute Setup That Eliminates Monthly Statement Wrestling Forever

- How to Auto-Import CSV to Google Sheets (No Coding Required)

Financial Freedom & Planning:

- Financial Runway Calculator: How Long Can You Last Without Income?

- 6-Month Emergency Fund Calculator: How Much Do You Really Need?

- Financial Freedom vs Financial Independence: What's the Real Difference?

Expense & Budget Tracking:

Calculate Your Financial Freedom Number

Find out exactly how much money you need to achieve financial independence.

Calculate Now