Mark, a software engineer at a growing startup, had investments scattered across five different accounts: his 401k, Roth IRA, taxable brokerage, company stock options, and a small crypto portfolio. Every month, he'd spend 2 hours logging into each platform, copying values into a spreadsheet, and trying to calculate his overall performance.

He had no idea if his $500 monthly investment contributions were actually moving him closer to financial independence, or how his portfolio performance affected his overall financial runway.

Today, Mark's Google Sheets portfolio tracker automatically updates his investment values, shows him exactly how his portfolio affects his path to financial freedom, and integrates seamlessly with his expense tracking to give him a complete financial picture.

The difference? A portfolio tracking system designed for people who want comprehensive insights without expensive software or complex tools. Get the integrated template here.

Why Most Portfolio Trackers Miss the Point

The Problem with Standalone Investment Apps

Isolated Investment Data: Personal Capital shows your investments, but not how they relate to your spending, savings rate, or financial freedom timeline. You see performance numbers without context.

No Integration with Daily Finances: Your portfolio might be up 10% this year, but if you're overspending on dining out, you're actually moving backward on your financial freedom journey. Most trackers don't show this connection. Learn more about integrated financial tracking.

Expensive Premium Features: Want detailed analysis, tax optimization, or goal tracking? That'll be $995+ annually for Personal Capital's advisor service or similar premium features elsewhere.

Complex Interfaces: Professional investment platforms are built for day traders, not people who want to track long-term wealth building while managing their complete financial life.

No Business Context: If you're an entrepreneur or side hustler, traditional portfolio trackers don't help you understand how your business cash flow affects your investment strategy.

What You Really Need

Your investments aren't separate from your financial life - they're the engine that powers your financial freedom. You need a portfolio tracker that:

- Connects to your complete financial picture (expenses, income, debt, goals)

- Shows how investments affect your financial runway and time to independence

- Provides business intelligence for optimizing your path to freedom

- Works with tools you already use (Google Sheets) instead of forcing new apps

- Gives you complete data control without expensive subscriptions. Our Google Sheet template does all of this.

Complete Portfolio Tracking in Google Sheets

Beyond Basic Position Tracking

Our Google Sheets portfolio tracker isn't just a list of stocks and their values. It's a comprehensive investment intelligence system that shows:

Portfolio Performance Analysis

- Total portfolio value across all accounts (401k, IRA, taxable, etc.)

- Individual position performance with gain/loss tracking

- Asset allocation analysis with rebalancing recommendations

- Dividend and interest income integrated with your cash flow

Financial Freedom Integration

- How investment growth affects your months of financial runway

- Portfolio withdrawal rate sustainability for early retirement

- Investment contribution impact on your savings rate

- Timeline adjustments based on market performance

For detailed runway calculations, check our financial runway calculator and emergency fund calculator.

Business Intelligence Features

- Tax-advantaged vs taxable account optimization

- Asset location strategy for tax efficiency

- Rebalancing alerts based on your target allocation

- Performance comparison against relevant benchmarks

Real User Success Stories

"I finally understand how my investments fit into my bigger financial picture. The tracker shows me that even though my portfolio is up 12% this year, I need to increase my savings rate to hit my financial independence goal by 40." - Sarah M., Marketing Manager

"As a business owner with irregular income, this tracker helps me see when I can afford to increase my investment contributions and when I need to focus on cash flow. The runway calculator is game-changing." - Tom R., Consultant

"The automatic rebalancing alerts saved me from making emotional investment decisions during market volatility. I can see exactly when my allocation drifts from my target." - Lisa K., Teacher

Portfolio Tracker Features: Complete Investment Intelligence

1. Multi-Account Consolidation

All Investment Accounts in One View:

- 401k and 403b workplace retirement accounts

- Traditional and Roth IRA accounts

- Taxable brokerage accounts

- HSA investments (often overlooked but important)

- Business retirement accounts (SEP-IRA, Solo 401k)

- Alternative investments (REITs, crypto, etc.)

Why Consolidation Matters:

- See your true asset allocation across all accounts

- Avoid overweighting in company stock or specific sectors

- Understand your complete investment picture for rebalancing

- Calculate accurate withdrawal rates for financial independence planning

Smart Integration:

- Automatic account balance updates (where supported)

- Manual entry options for any investment account

- Historical tracking to see long-term growth trends

- Currency conversion for international investments

2. Performance Analytics Dashboard

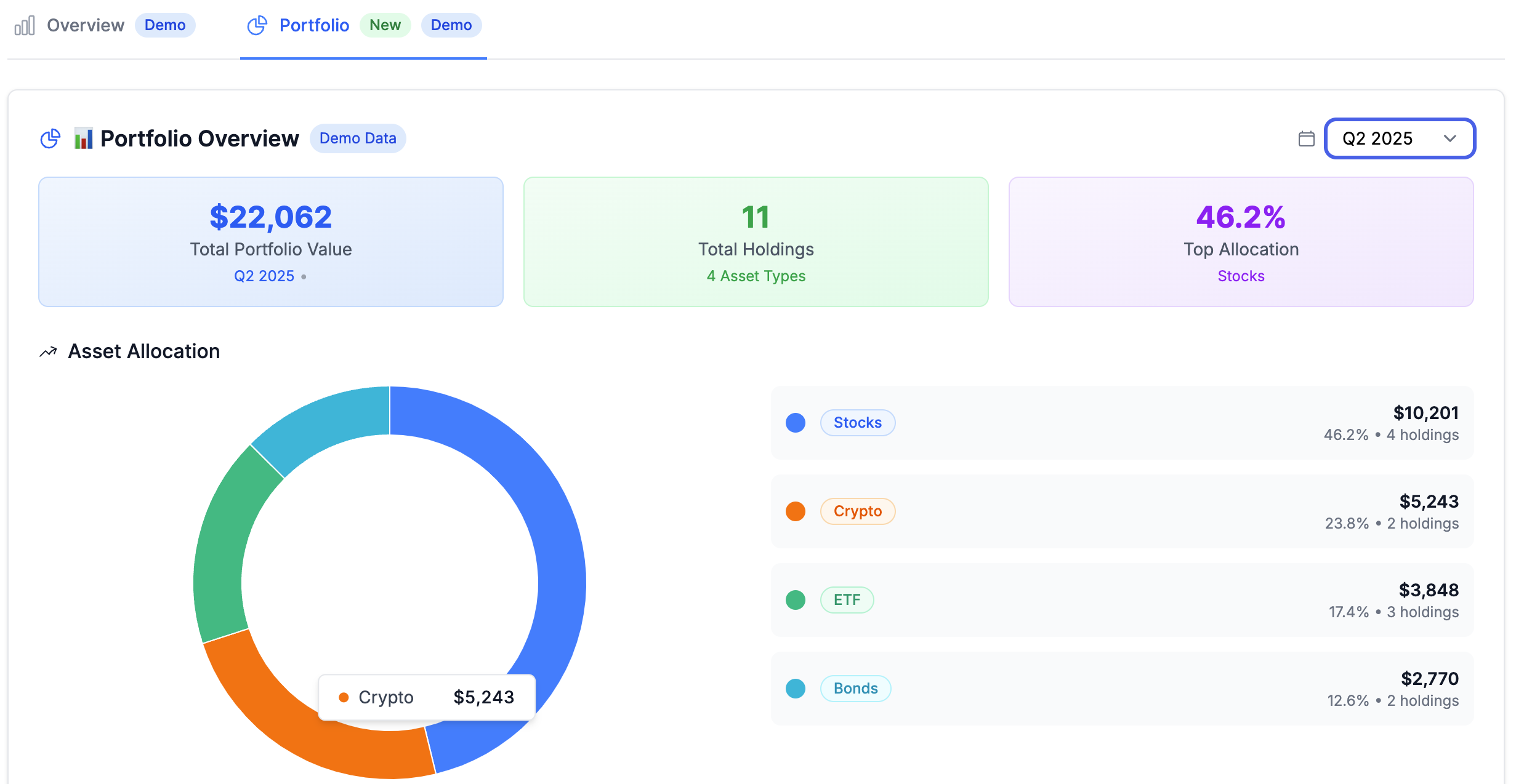

A clear, visual dashboard showing your complete portfolio overview, asset allocation, and key metrics.

A clear, visual dashboard showing your complete portfolio overview, asset allocation, and key metrics.

Portfolio Metrics That Drive Decisions:

- Total portfolio value with growth tracking

- Asset allocation breakdown (stocks, bonds, alternatives)

- Individual position performance ranking

- Sector and geographic diversification analysis

- Cost basis tracking for tax planning

Advanced Performance Analysis:

- Time-weighted returns vs dollar-weighted returns

- Performance attribution (what's driving your returns)

- Volatility analysis and risk assessment

- Correlation analysis between different holdings

- Tax-adjusted returns for taxable accounts

Benchmark Comparisons:

- S&P 500 and total market index comparisons

- Target-date fund performance benchmarking

- Risk-adjusted returns (Sharpe ratio calculations)

- Custom benchmark creation for unique portfolios

3. Asset Allocation & Rebalancing

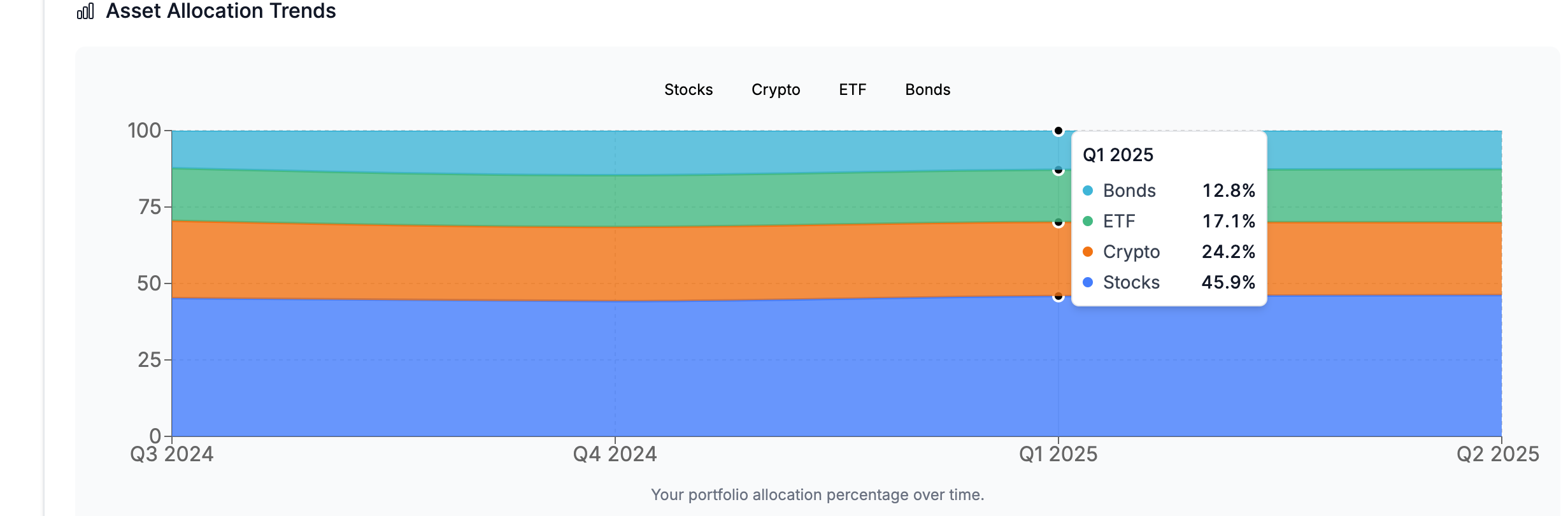

Track how your asset allocation changes over time to ensure you stay aligned with your long-term strategy.

Track how your asset allocation changes over time to ensure you stay aligned with your long-term strategy.

Target Allocation Management:

- Set your ideal asset allocation percentages

- Track current allocation vs targets

- Visual alerts when allocation drifts significantly

- Historical allocation tracking over time

Intelligent Rebalancing Recommendations:

- Identify which positions to buy/sell for rebalancing

- Tax-efficient rebalancing strategies (use new contributions first)

- Account-specific rebalancing (rebalance within 401k to avoid taxes)

- Threshold-based rebalancing (only when drift exceeds 5%)

Asset Location Optimization:

- Tax-efficient placement recommendations

- Bond placement in tax-advantaged accounts

- International funds in taxable accounts for tax credits

- REIT placement optimization for tax efficiency

4. Financial Freedom Integration

Investment Impact on Financial Runway:

- How portfolio growth extends your financial runway

- Safe withdrawal rate calculations for your specific situation

- Monte Carlo analysis for retirement sustainability

- Sequence of returns risk assessment

Goal-Based Investment Tracking:

- Track progress toward financial independence number

- Adjust timeline based on market performance

- Scenario planning for different market conditions

- Contribution requirement calculations for specific goals

Cash Flow Integration:

- Investment contributions as part of expense tracking

- Dividend and interest income in cash flow analysis

- Capital gains realization planning

- Tax withholding optimization

Setup Guide: Portfolio Tracker in 30 Minutes

Step 1: Download and Customize Your Tracker (10 minutes)

Get Started:

- Download Template: Get the complete Google Sheets portfolio tracker

- Make Your Copy: File → Make a Copy to your Google Drive

- Initial Setup: Add your name and investment preferences

Account Configuration:

- Account Types: Set up categories for 401k, IRA, taxable, etc.

- Asset Classes: Define your investment categories (US stocks, international, bonds, alternatives)

- Benchmarks: Choose comparison indices relevant to your strategy

- Goals: Set your financial independence target and timeline

Step 2: Add Your Investment Accounts (15 minutes)

Account Integration:

- Workplace Retirement: Add 401k/403b with current balances and contribution rates

- IRAs: Include traditional and Roth IRAs with current values

- Taxable Accounts: Add brokerage accounts and individual stock positions

- Alternative Investments: Include REITs, crypto, or other non-traditional investments

Position Entry:

- Stock Positions: Enter ticker symbols, shares, and cost basis

- Mutual Funds: Add fund symbols and current values

- Bond Holdings: Include individual bonds or bond funds

- Cash Positions: Track cash allocation within investment accounts

Historical Data:

- 6-Month History: Enter monthly values for trend analysis

- Cost Basis: Add purchase dates and prices for tax planning

- Contribution History: Track regular contributions and one-time investments

Step 3: Enable Automation and Integration (5 minutes)

Automatic Updates:

- Market Data: Connect to free financial APIs for daily price updates

- Portfolio Values: Automatic calculation of total portfolio value

- Performance Metrics: Auto-calculated returns and allocation percentages

- Rebalancing Alerts: Automatic notifications when allocation drifts

Integration with Financial Dashboard:

- Link to Expense Tracker: Connect investment contributions to monthly expenses

- Runway Calculator: Integrate portfolio value with financial freedom calculations

- Cash Flow Analysis: Include dividend income in monthly cash flow

- Net Worth Tracking: Automatic portfolio value updates in net worth calculation

Quick Setup Checklist:

- Portfolio tracker template downloaded and customized

- All investment accounts added with current balances

- Target asset allocation percentages defined

- Historical data entered for trend analysis

- Automation features enabled and tested

- Integration with main financial dashboard completed

Advanced Features for Serious Investors

Tax Optimization Tools

Tax-Efficient Investing:

- Asset Location: Optimize which investments go in which account types

- Tax-Loss Harvesting: Identify opportunities to realize losses for tax benefits

- Rebalancing Strategy: Tax-efficient rebalancing using new contributions

- Withdrawal Planning: Optimize withdrawal order for tax efficiency in retirement

Business Owner Enhancements:

- Solo 401k Tracking: Specialized tracking for self-employed retirement accounts

- Business Investment Integration: Track business-related investments

- Cash Flow Coordination: Coordinate business cash flow with investment timing

- Tax Planning: Investment strategies that complement business tax planning

Advanced Analytics

Risk Assessment:

- Portfolio Volatility: Calculate and track your portfolio's risk level

- Correlation Analysis: Understand how your investments move together

- Stress Testing: See how your portfolio performs in different market scenarios

- Diversification Scoring: Quantify how well-diversified your portfolio is

Performance Attribution:

- Sector Performance: Which sectors are driving your returns

- Asset Class Analysis: Performance breakdown by stocks, bonds, alternatives

- Security Selection: How individual picks perform vs index funds

- Market Timing: Impact of contribution timing on returns

Goal-Based Investing

Multiple Goal Tracking:

- Retirement: Traditional retirement planning with timeline flexibility

- Financial Independence: Early retirement goal tracking

- Major Purchases: House down payment, education funding

- Business Investment: Funding for business opportunities or side hustles

Dynamic Allocation:

- Age-Based Adjustments: Automatic allocation changes as you approach goals

- Risk Tolerance Changes: Adjust allocation based on life circumstances

- Goal Priority Weighting: Allocate investments across multiple priorities

- Scenario Planning: How different life changes affect your investment strategy

ROI Analysis: Why This Tracker Pays for Itself

Cost Comparison

Professional Investment Advisory:

- Personal Capital Premium: $995/year

- Vanguard Personal Advisor: 0.30% annually (on $500k = $1,500/year)

- Financial Advisor: 1.0% annually (on $500k = $5,000/year)

- Total Annual Cost: $995-$5,000+

Portfolio Tracker Solution:

- Google Sheets: Free

- Expense Sorted Integration: $49/year

- Template and Updates: Included

- Total Annual Cost: $49

Annual Savings: $946-$4,951 while maintaining complete control

Time Savings Calculation

Before Portfolio Tracker:

- Monthly account login and data collection: 2 hours

- Performance calculation and analysis: 1 hour

- Rebalancing research and decisions: 1 hour (quarterly = 20 minutes monthly)

- Tax planning and optimization research: 30 minutes

- Total: 4.5 hours monthly = 54 hours annually

After Portfolio Tracker:

- Review automated updates and alerts: 15 minutes

- Make rebalancing decisions based on recommendations: 10 minutes

- Tax optimization review: 5 minutes

- Total: 30 minutes monthly = 6 hours annually

Time Saved: 48 hours annually (equivalent to $2,400+ at $50/hour)

Investment Performance Improvements

Better Decision Making:

- Rebalancing Discipline: Systematic rebalancing improves returns by 0.5-1.5% annually

- Tax Optimization: Proper asset location saves 0.2-0.8% annually in taxes

- Cost Awareness: Fee optimization saves 0.1-0.5% annually

- Emotional Discipline: Data-driven decisions reduce emotional investing mistakes

Estimated Annual Benefit: 0.8-2.8% improved returns On a $500k portfolio, this equals $4,000-$14,000 additional annual growth.

Ready to Take Control of Your Investment Portfolio?

What You Get with the Complete Portfolio Tracker

Immediate Access:

- Comprehensive Google Sheets portfolio tracker template

- Setup tutorial with screen-by-screen guidance

- Asset allocation optimization guide

- Complete documentation and customization instructions

Advanced Features:

- Multi-account consolidation across all investment types

- Automatic performance calculations and benchmark comparisons

- Tax optimization tools and asset location recommendations

- Integration with complete financial dashboard for holistic planning

Ongoing Support:

- Monthly investment strategy tips and market insights

- Template updates with new features and capabilities

- Community access for investment discussions and strategy sharing

- Priority support for setup questions and customization help

Three Portfolio Tracker Options

Option 1: Complete Investment Management System

Best for: Serious investors with complex portfolios

- Portfolio tracker with all advanced features

- Integration with financial dashboard and expense tracking

- AI-powered insights and recommendations

- Tax optimization and asset location tools Investment: $149 (includes 1-year of premium features)

Option 2: Portfolio Tracker Template

Best for: DIY investors comfortable with spreadsheet setup

- Complete portfolio tracker template with formulas

- Setup documentation and video tutorials

- Basic automation and calculation features Investment: $49 (one-time purchase)

Option 3: Basic Investment Tracker

Best for: New investors getting started

- Simple portfolio tracking template

- Basic performance calculations

- Getting started guide for investment principles Investment: Download

Frequently Asked Questions

Q: Will this work with my investment accounts? A: Yes. The tracker works with any investment account - 401k, IRA, brokerage, international accounts, crypto, etc. You can manually enter data or use automation where available.

Q: How often are portfolio values updated? A: Daily for automated connections, or as frequently as you manually update. The tracker calculates performance metrics automatically whenever values change.

Q: Can I track complex investments like options or futures? A: The standard template handles stocks, bonds, mutual funds, and ETFs. Custom modifications can accommodate more complex investments.

Q: Does this replace my need for a financial advisor? A: The tracker provides data and analysis tools. Whether you need an advisor depends on your comfort with investment decisions and complexity of your situation.

Q: How secure is my investment data? A: Your data stays in your personal Google Drive. We never see your portfolio information. Automation features use read-only connections where possible.

Start Optimizing Your Investment Portfolio Today

Your investment portfolio is the engine of your financial freedom. Every month you track your investments manually, make emotional decisions, or pay high fees is money and time lost forever.

The choice is clear: continue with scattered investment tracking and expensive advisory fees, or take control with a comprehensive system that saves time and money while improving your investment outcomes.

Join thousands of investors who have already optimized their portfolio management with this integrated tracking system.

Ready to get started?

Download Complete Portfolio Tracker →

Full setup in 30 minutes. Start optimizing your investments immediately.

Try Full Financial Dashboard →

Portfolio tracker integrated with complete financial management system.

Get Your Portfolio Tracker Template →

Free guide to building a portfolio that supports your financial freedom goals.

Take control of your investments today. Your financial freedom depends on it.

Related Articles

Portfolio Tracking & Investment:

- Google Sheets Portfolio Tracker with Interactive Brokers Import

- The Ultimate Google Sheets Investment Tracker (2025)

- The Ultimate Google Sheets Financial Dashboard: Track Everything in One Place

Interactive Brokers & Automation:

- Interactive Brokers CSV Hell: Why Your Trading Data is a Mess (And How to Fix It)

- The 15-Minute Setup That Eliminates Monthly Statement Wrestling Forever

- How to Auto-Import CSV to Google Sheets (No Coding Required)

Financial Freedom & Planning:

- Financial Runway Calculator: How Long Can You Last Without Income?

- 6-Month Emergency Fund Calculator: How Much Do You Really Need?

- Financial Freedom vs Financial Independence: What's the Real Difference?

- Progressive Emergency Fund Strategy: From 6 Months to Indefinite Freedom

Expense Tracking:

Calculate Your Financial Freedom Number

Find out exactly how much money you need to achieve financial independence.

Calculate Now