Here's a uncomfortable truth: 73% of people who download a budgeting app quit using it within three months.

If you've ever enthusiastically downloaded PocketSmith, tried MyBudgetPal, or given MoneyLover a shot only to abandon it weeks later, you're not alone. But here's what no one tells you: your money isn't the real problem—your time is.

The Fatal Flaw in New Zealand's Budgeting App Market

Walk into any Kiwi finance discussion—whether it's r/PersonalFinanceNZ or your local cafe—and you'll hear the same advice: "Just track your expenses!" "Use a budgeting app!" "Categorize everything!"

But here's what I've learned after analyzing dozens of New Zealand budgeting apps and helping hundreds of people take control of their finances: most apps are solving the wrong problem entirely.

They're obsessed with transaction categorization when they should be focused on time liberation.

What Your Current Budgeting App Gets Wrong

Let's be honest about what happens when you use a typical budgeting app:

Week 1: You're motivated. You categorize every coffee, every grocery shop, every fuel stop. Week 2: You're behind on entries. Weekend spending hasn't been logged. Week 3: The app sends you guilt-inducing notifications about uncategorized transactions. Week 4: You ignore the app entirely.

Sound familiar?

The problem isn't your willpower. The problem is that these apps treat symptoms instead of causes. They make you spend more time thinking about money, when what you actually want is more time to live your life.

The Time Currency Revolution

Here's a different way to think about personal finance: Time is your real currency. Money is just the tool that buys it back.

When you spend $5.50 on a flat white at Allpress, you're not just spending money—you're spending the 20 minutes it took you to earn that $5.50 after tax. When you pay your $180 power bill, you're spending roughly 6 hours of your working life.

This shift in perspective changes everything.

Instead of asking "Can I afford this?", you start asking "Is this worth X hours of my life?"

Instead of obsessing over expense categories, you focus on systems that give you time back. Our Google Sheet template is designed around this philosophy.

Want a privacy-focused alternative? See our YNAB alternative guide or NZ budgeting apps privacy analysis.

How to Evaluate NZ Budgeting Apps the Right Way

Most reviews of New Zealand budgeting apps focus on features: "Does it sync with ANZ?" "Can it categorize automatically?" "What about the interface?"

These are the wrong questions.

Here's how you should actually evaluate any financial tool:

The Time ROI Framework

Before you choose any budgeting app, ask these four questions:

1. Time Investment Required

- How many minutes per week will this actually take?

- Include setup time, daily logging, and monthly reviews

- Be brutally honest—most people underestimate by 300%

2. Time Savings Generated

- Will this help you make faster financial decisions?

- Does it eliminate time-wasting money conversations with your partner?

- Can it help you spot subscription creep automatically?

3. Privacy Cost

- What data are you giving up?

- Could you achieve the same result with a simple spreadsheet?

- Are you trading convenience for surveillance?

4. Freedom Outcome

- Does this move you closer to working less or working differently?

- Will you stress less about money?

- Can you "set and forget" the system?

The Current NZ App Landscape Through This Lens

Let me be frank about the main players in New Zealand:

PocketSmith: Powerful but overwhelming. High time investment, high functionality. Good if you're a CFO-type personality who enjoys financial modeling. Terrible if you want simplicity.

MyBudgetPal (Booster): Clean interface, decent automation. But it's designed to funnel you toward Booster's investment products. Your financial data becomes their sales intelligence.

MoneyLover: Pretty interface, but no NZ bank feeds. You'll spend more time manually entering transactions than you'll save in insights.

Bank Apps (ASB Track My Spending, etc.): Limited but free. Good starting point if your financial life is simple and you trust your bank with behavioral analysis.

The Four-Input Alternative That Actually Works

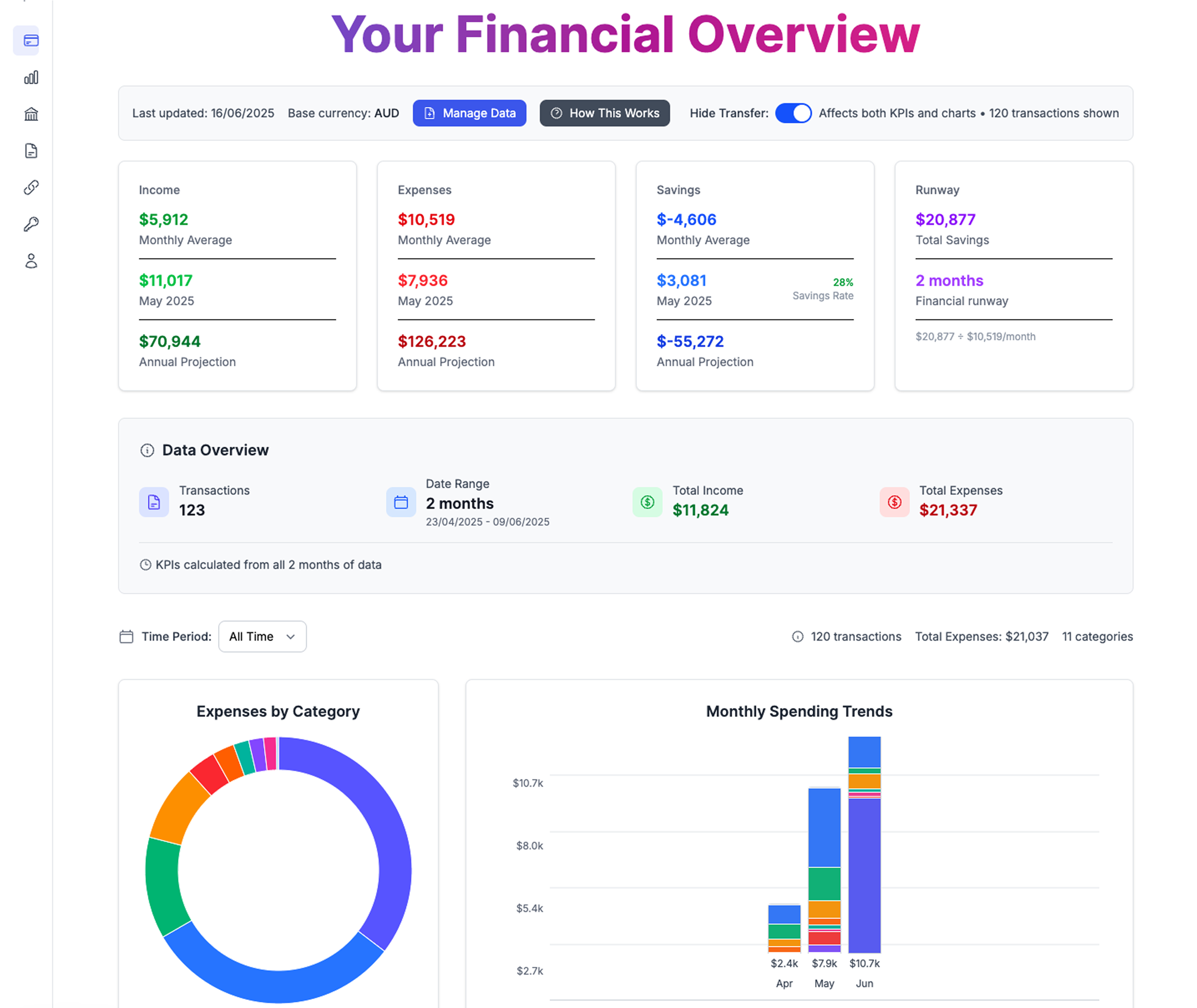

Simple, powerful financial overview that gives you clarity in minutes, not hours

Simple, powerful financial overview that gives you clarity in minutes, not hours

Here's what I've discovered after years of financial coaching: You don't need to track every transaction to achieve financial clarity.

You need four numbers, updated monthly:

- Monthly income (after tax)

- Monthly essential spending (rent, power, groceries, minimums)

- Current liquid savings

- Where that money sits (term deposits, savings accounts, etc.)

That's it.

With just these four inputs, you can calculate:

- Your survival timeline (how long you could last without income)

- Your financial runway (months until you hit zero)

- Your savings velocity (how quickly you're building freedom)

- Your opportunity cost for any major purchase

To see these calculations in action and track them effortlessly, check out our Financial Freedom Spreadsheet – it's designed around this exact principle.

Learn more: See how to calculate your financial runway or build an automated budget tracker.

Why This Works Better Than Traditional Budgeting

Traditional budgeting asks you to predict and control the future. "I'll spend exactly $150 on groceries this month."

The four-input system acknowledges reality: Life is unpredictable, but your financial trajectory doesn't have to be.

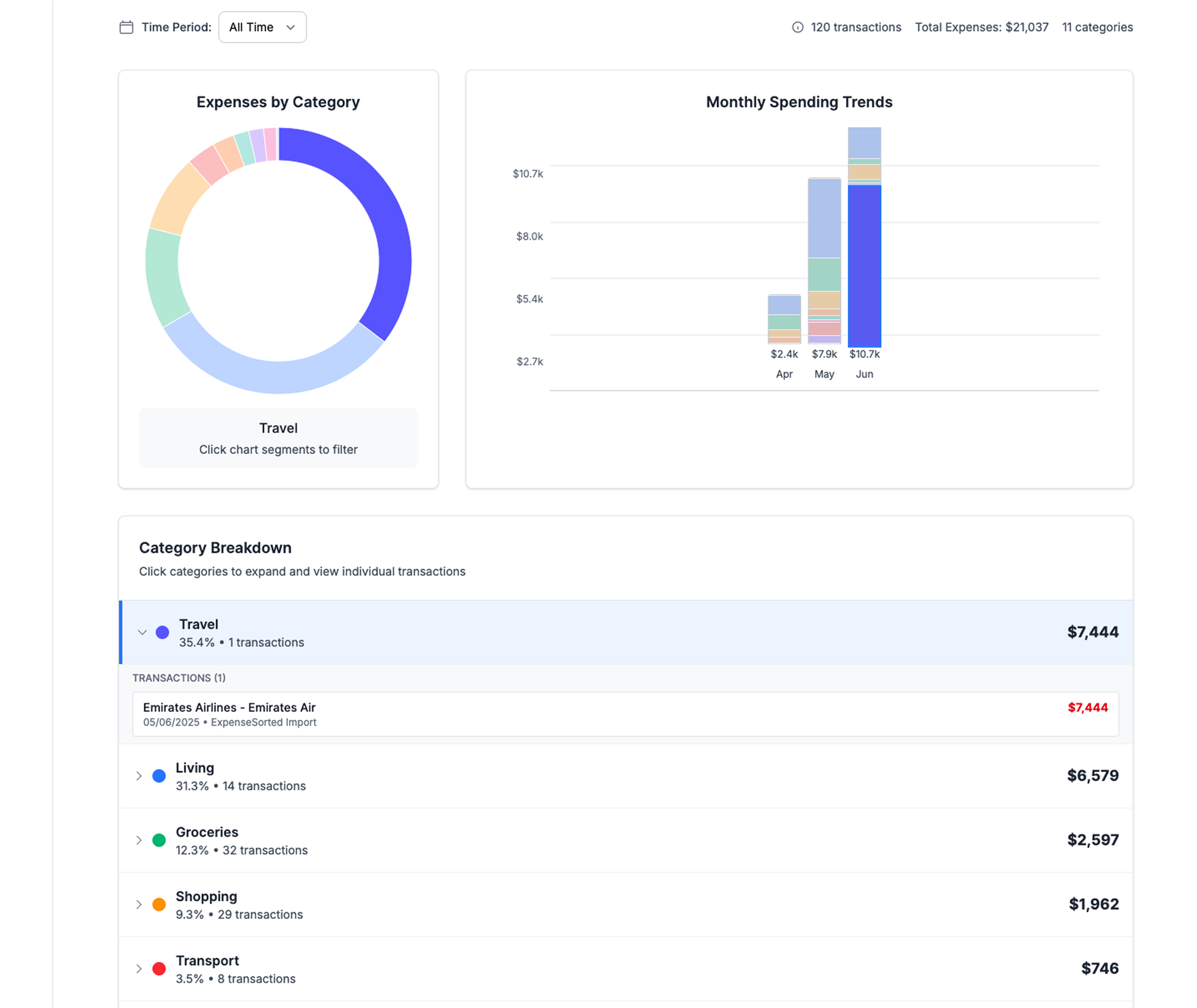

Smart suggestions that help you make better time-value decisions without micromanaging every transaction

Smart suggestions that help you make better time-value decisions without micromanaging every transaction

Instead of micromanaging categories, you optimize for the one thing that matters: increasing the gap between income and essential spending.

Building Your Time-Focused Financial System

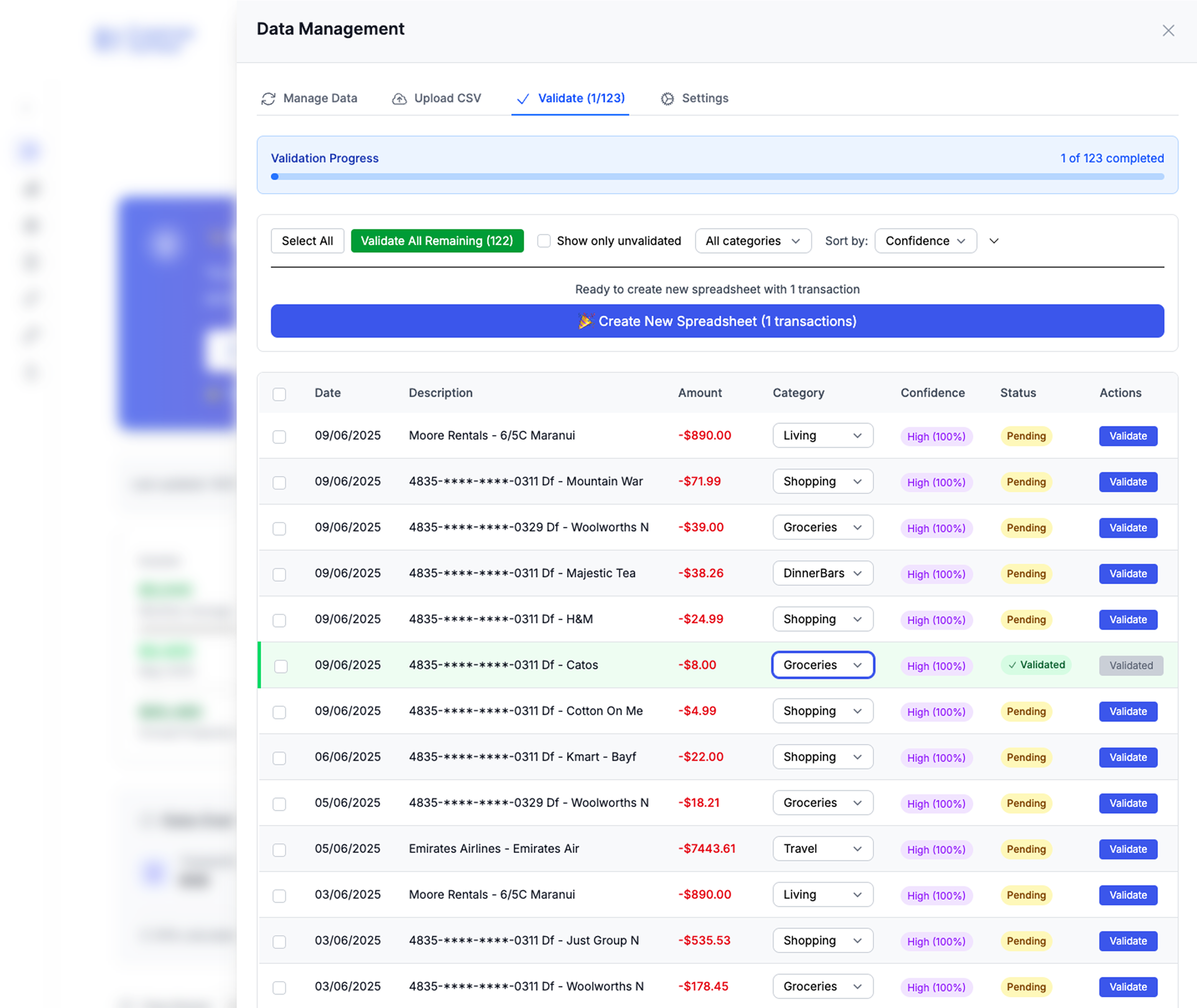

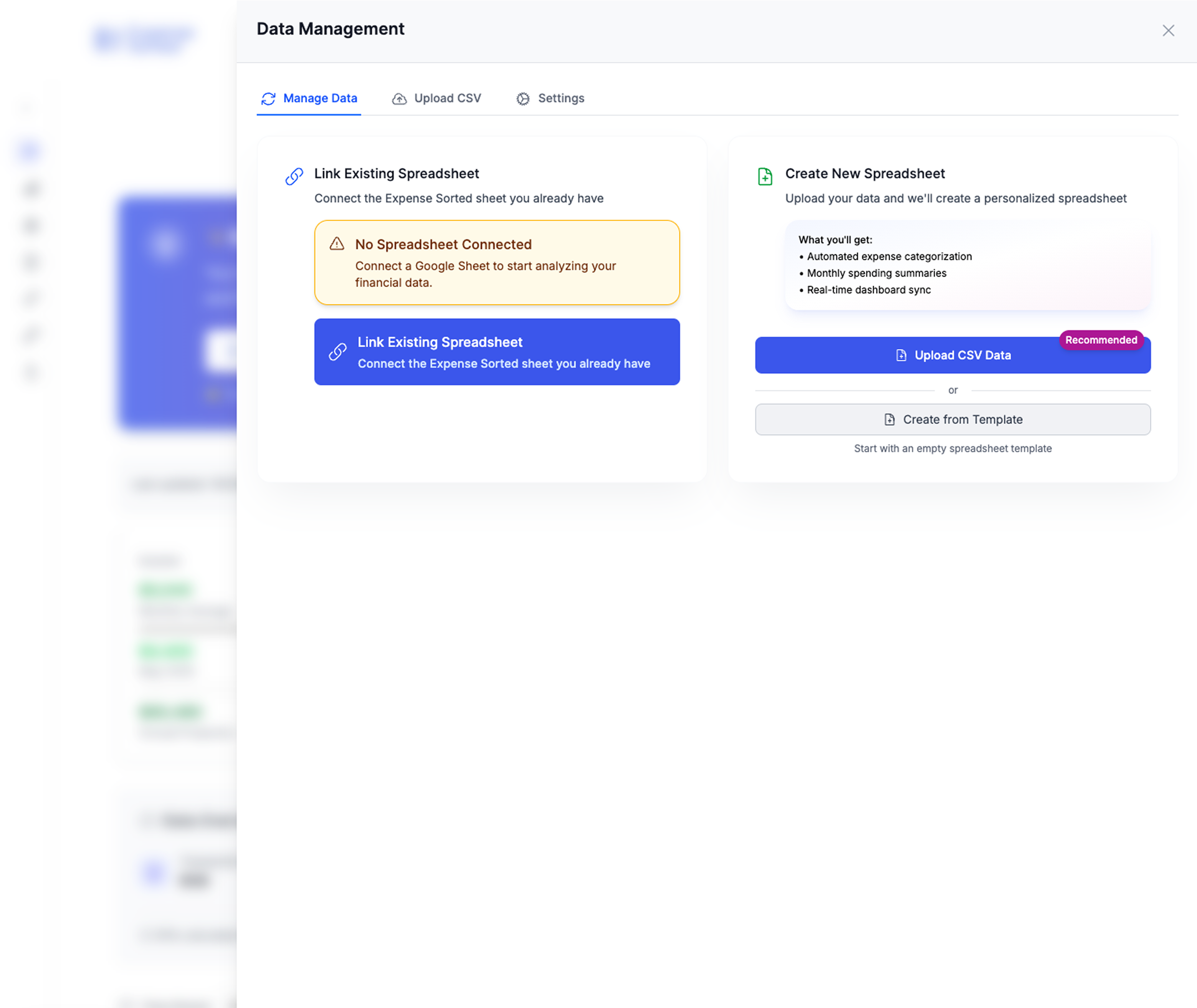

Streamlined data management that saves hours while maintaining complete privacy and control

Streamlined data management that saves hours while maintaining complete privacy and control

If you want to implement this approach, here's your action plan:

Phase 1: The 30-Second Assessment (This Week)

- Calculate your monthly after-tax income

- Add up your true essentials (if everything else stopped, what would you still have to pay?)

- Check your current liquid savings balance

- Note where that money is (and what interest you're earning)

Time investment: 30 seconds, once per month Time savings: Hours of transaction categorization

Phase 2: The Behavioral Audit (Next Month)

Instead of tracking every expense, track every time decision:

- What did you buy to save time? (Uber instead of bus, takeaways instead of cooking)

- What did you buy that cost you time? (Things that require maintenance, subscription services you forget about)

- Where did you spend money to buy back your weekend?

Smart categorization that focuses on time-value decisions rather than endless micro-categories

Smart categorization that focuses on time-value decisions rather than endless micro-categories

This shifts your focus from guilt about spending to strategic thinking about time.

Phase 3: The Automation Setup (Month 3)

- Set up automatic transfers to savings the day after payday

- Automate all possible bills (but review annually)

- Create spending alerts for unusual amounts (not categories)

- Build a simple spreadsheet that shows your runway and survival timeline

The Tools That Actually Deserve Your Time

If you must use apps, here are the only ones worth considering in New Zealand:

For Simple Tracking: Your bank's own app. ANZ, ASB, and Westpac all have decent spending categorization now. No extra logins, no data sharing.

For Couples: Splitwise for shared expenses, but use it like a short-term ledger, not a permanent tracking system.

For Goal Setting: A simple spreadsheet with your four key numbers and target dates. More motivating than any app dashboard.

For Privacy: A notebook and calculator. Seriously. Sometimes the old ways are the best ways.

The Real Cost of "Free" Budgeting Apps

Here's something no one talks about: Free budgeting apps aren't free.

You're paying with:

- Your transaction data (which banks and advertisers value highly)

- Your time (setup, maintenance, troubleshooting)

- Your mental energy (decision fatigue from constant notifications)

- Your privacy (your spending patterns reveal more about you than your social media)

Before you hand over your bank login to any app, ask yourself: What could I achieve with a simple system that I own completely?

Your Next Steps

If you're ready to move beyond traditional budgeting apps, here's what to do this week:

- Calculate your current financial runway using the four-input system

- Set up one automatic transfer that increases your savings rate by just 2%

- Cancel one subscription you forgot you had (check your bank statements from the last 3 months)

- Have one conversation with your partner about what financial freedom would actually look like for your family

Each of these takes less than 15 minutes but moves you closer to the real goal: more time to live the life you want.

The Bottom Line

Budgeting apps aren't evil. But they're solving yesterday's problem.

The question isn't "How do I track every dollar?"

The question is "How do I build a financial system that gives me more time and less stress?"

Your time is finite. Your money is infinite (with the right system).

Choose tools and strategies that honor this truth.

Related Articles

NZ-Specific:

- The 2025 Guide to Budgeting Apps in NZ: Why Privacy Matters

- NZ Expense Tracker for Google Sheets (2025 Edition)

Budget Alternatives:

- YNAB Alternative: Why Google Sheets Gives You More Control (And Costs Less)

- Best Free YNAB Alternative: Why Google Sheets Wins for Privacy & Control

- Budget Control Without Subscription Fees: The Case Against YNAB, Mint & Apps

Build Your System:

- Build an Automated Budget Tracker in Google Sheets (No Bank Upload Required)

- Expense Tracker Google Sheets Template: Complete Setup Guide (2025)

Financial Freedom:

- Financial Runway Calculator: How Long Can You Last Without Income?

- 6 Month Emergency Fund Calculator: How Much Do You Actually Need?

Privacy:

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money