Are you still spending hours each month manually sorting through bank transactions? Those little squares on your calendar represent time you'll never get back.

Time Is Your Most Valuable Currency

Let's be real: your time is worth far more than the money you're tracking. When I first started my business, I spent nearly 5 hours each month categorizing transactions. That's 60 hours a year—1.5 full work weeks—just labeling spending that already happened.

What could you do with an extra 60 hours each year?

The Hidden Cost of Manual Transaction Categorization

Most people calculate the cost of financial management in dollars. But the true cost? It's measured in time:

| Activity | Monthly Time | Yearly Time | Value at $100/hr |

|---|---|---|---|

| Manual categorization | 5 hours | 60 hours | $6,000 |

| Error correction | 1.5 hours | 18 hours | $1,800 |

| Recategorizing | 2 hours | 24 hours | $2,400 |

| TOTAL | 8.5 hours | 102 hours | $10,200 |

Is maintaining your transaction categories really worth $10,200 of your time each year?

How AI Bank Transaction Categorization Works (In Plain English)

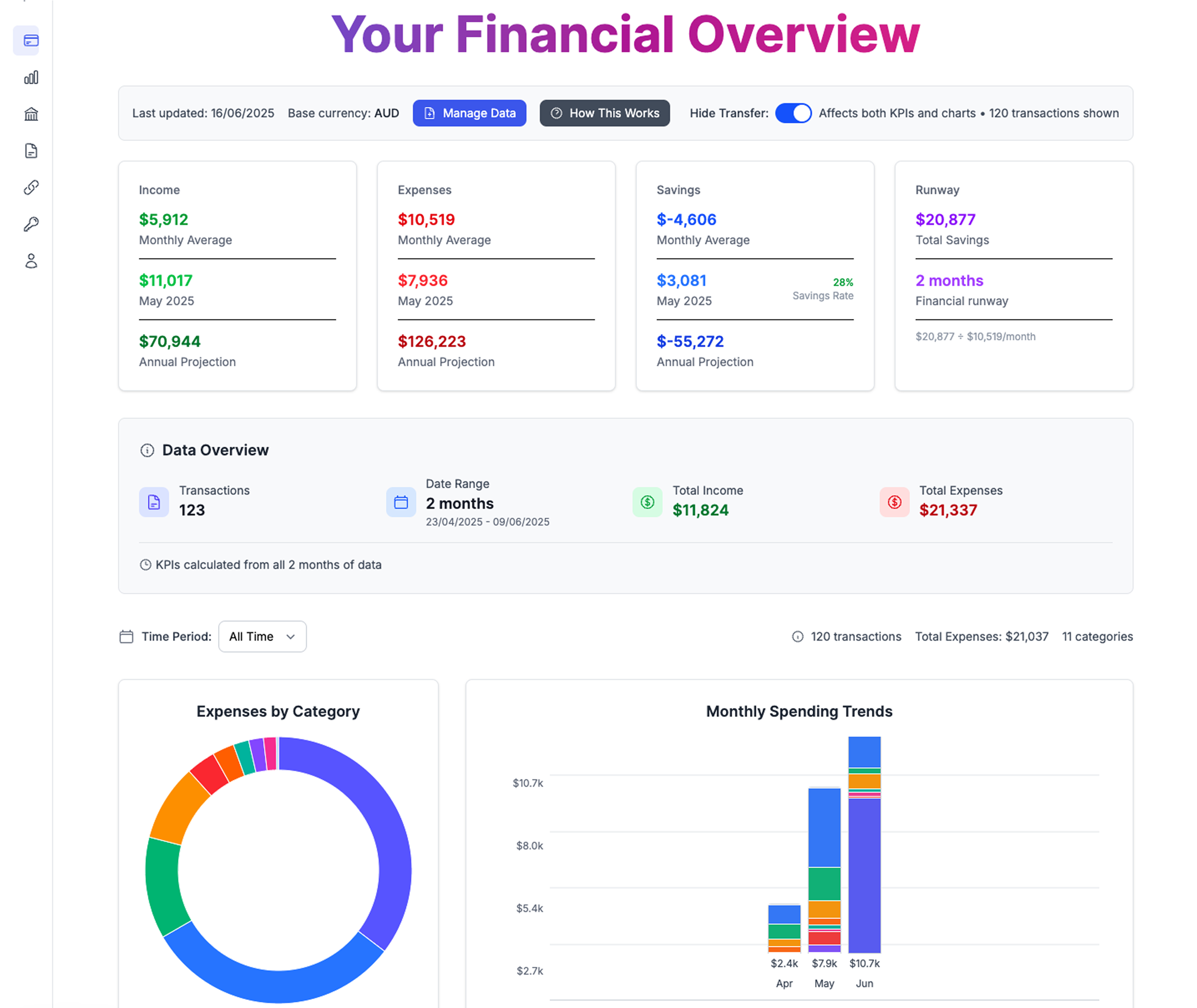

Complete financial overview with AI-powered categorization - see your money insights in minutes, not hours

Complete financial overview with AI-powered categorization - see your money insights in minutes, not hours

AI transaction categorization isn't futuristic science fiction—it's practical technology that works by:

- Learning from patterns: The system recognizes that "SBUX" is always coffee

- Understanding context: It knows the difference between Amazon for office supplies versus personal shopping based on amounts and timing

- Improving over time: Your corrections train the system to get smarter with every transaction

Unlike generic rules, AI adapts to YOUR specific spending patterns. "Target" might mean groceries for you but office supplies for someone else—and the AI learns the difference.

The Freedom Framework: From Manual to Automated

I've developed a simple framework to help you reclaim your time:

Time Reclaimed = (Current Hours Spent - Implementation Time) × (Accuracy Rate)

For most businesses:

- Current Hours Spent: 8.5 hours/month

- Implementation Time: 1 hour/month

- Accuracy Rate: 95%

That's 7.1 hours of pure time freedom each month. What would you do with an extra day of time? This reclaimed time allows you to focus on the bigger picture, like tracking your overall financial runway using our Google Sheet template.

Real Results: My Transaction Categorization Journey

When I implemented AI categorization for my own finances:

- Week 1: 45 minutes to set up

- Month 1: Accuracy hit 87%, spent 30 minutes reviewing

- Month 3: Accuracy reached 96%, spent 15 minutes reviewing

- Today: 98% accuracy, I spend 10 minutes glancing at the results

The runway this has created in my life is immeasurable. That's 7+ hours monthly I've redirected to activities that actually move my business forward—or better yet, to enjoying life outside of work.

Your Path to Financial Data Freedom

Ready to step off the transaction categorization hamster wheel? Here's how to get started:

- Measure your current time cost: Track exactly how long you spend on transaction management

- Choose the right AI approach: Self-trained models or ready-to-use API solutions

- Implement and train: The first month requires some input to teach the system

- Enjoy the time dividend: Reinvest your newfound time into what actually matters

Remember: Your financial data stays in your control—this isn't about surrendering your information, but about using smart tools to free up your most precious resource: time.

The Time-Money Calculation That Changes Everything

Most people calculate ROI in dollars saved. Let's flip the script and calculate the Time ROI:

Time ROI = (Hours Saved Per Year × Your Hourly Value) ÷ Solution Cost

Example:

- Hours Saved: 100 hours/year

- Your Value: $150/hour

- Solution Cost: $500/year

Time ROI = (100 × $150) ÷ $500 = 30x return

Is there any other investment that delivers a 30x return on your most precious asset?

Take Back Your Calendar

Stop treating your financial data as a burden that consumes your hours. Bank transaction categorization through AI doesn't just organize your spending—it gives you back your life.

The question isn't whether you can afford AI transaction categorization. It's whether you can afford to keep spending irreplaceable hours of your life on tasks a machine can do in seconds.

Your time is running out—literally. How many more calendar squares are you willing to color in with "categorizing transactions"?

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation.

Calculate Your Financial Freedom Number

Find out exactly how much money you need to achieve financial independence.

Calculate Now