Supercharge Your Google Sheets Expense Tracking with AI Categorization

Are you tired of spending hours maintaining your expense tracking spreadsheet in Google Sheets? Do you dread the tedious task of manually categorizing each transaction? If you're like most people who use Google Sheets for tracking expenses, you've probably experienced the frustration of copy-pasting bank transactions and then laboriously assigning categories one by one.

In this guide, I'll show you how to transform your basic expense tracking spreadsheet into an intelligent system that automatically categorizes your transactions, saving you hours of manual work while providing more accurate financial insights.

As a first step, you can grab our powerful Google Sheets expense tracker template which provides a great foundation.

Why Google Sheets Is Popular for Expense Tracking

Before diving into the AI-powered upgrade, let's understand why Google Sheets remains a favorite tool for expense tracking:

- Accessibility: Available anywhere with internet access

- Flexibility: Fully customizable to your specific needs

- Collaboration: Easy to share with family members or business partners

- Integration: Works with other Google services and third-party tools

Despite these advantages, traditional Google Sheets expense tracking has one major drawback: manual categorization. Every transaction must be assigned to a category by hand, which is time-consuming and error-prone.

The Problem with Traditional Expense Tracking Spreadsheets

A typical expense tracking workflow in Google Sheets looks something like this:

- Download transactions from your bank

- Copy-paste them into your spreadsheet

- Create rules or manually categorize each transaction

- Update formulas and visualizations

- Repeat this process weekly or monthly

The most painful part? Step 3. Even with complex formulas and conditional formatting, you'll still need to:

- Create and maintain rules for each merchant

- Manually categorize new merchants you haven't seen before

- Fix miscategorizations when transaction descriptions change slightly

- Deal with generic descriptions that provide little context

For most people, this means spending 1-2 hours every month just on transaction categorization — time that could be better spent analyzing your spending habits or, better yet, enjoying life!

Introducing AI-Powered Categorization for Google Sheets

What if your Google Sheets expense tracker could intelligently categorize transactions based on their meaning rather than rigid rules? This is now possible thanks to advances in AI, specifically sentence transformer models.

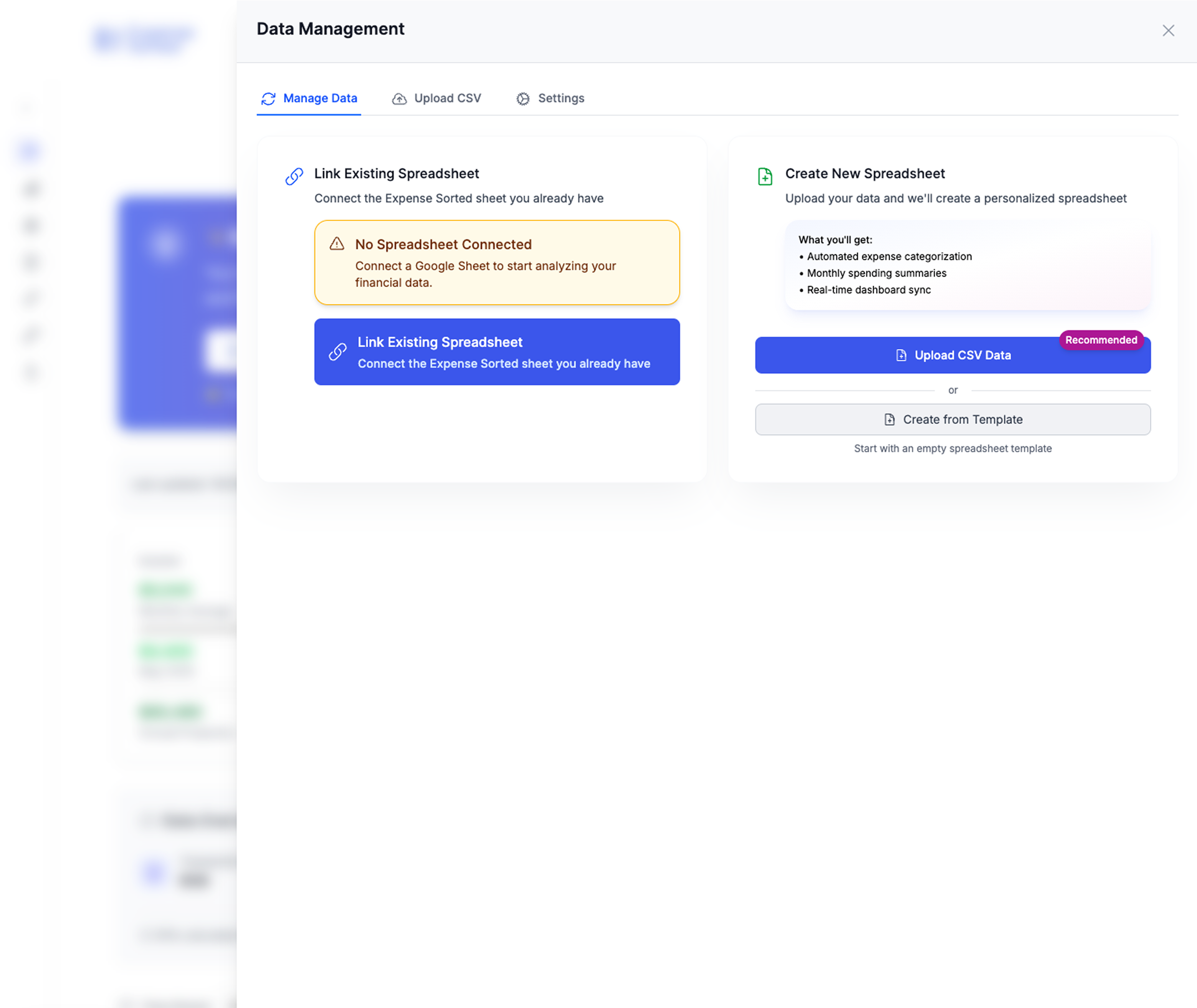

Comprehensive data management with multiple import sources and intelligent categorization

Comprehensive data management with multiple import sources and intelligent categorization

Here's how an AI-powered approach transforms the expense tracking process:

- Download transactions from your bank (same as before)

- Copy-paste them into your spreadsheet (same as before)

- Let the AI automatically categorize 85-95% of transactions correctly

- Review and correct any miscategorizations (typically only 5-15% of transactions)

- The AI learns from your corrections, getting smarter over time

The result? A process that previously took hours now takes minutes, with better accuracy and zero rule maintenance.

How It Works: Sentence Transformers vs. Rules-Based Categorization

Traditional rule-based categorization in spreadsheets works by matching exact patterns in transaction descriptions. For example:

IF transaction contains "STARBUCKS" → Category = "Coffee"

IF transaction contains "AMZN" → Category = "Shopping"

This approach breaks down when you encounter:

- New merchants

- Slightly different descriptions for the same merchant

- Generic descriptions

By contrast, sentence transformer models understand the meaning behind the text. They convert transaction descriptions into numerical representations (embeddings) that capture semantic meaning. Similar transactions will have similar embeddings, allowing the system to categorize new transactions based on similarity to ones it's seen before.

For example, if you've previously categorized "STARBUCKS DOWNTOWN" as "Coffee", the AI would likely also categorize "COFFEE BROS CAFE" as "Coffee" without any explicit rule, simply because it understands these are semantically similar.

Setting Up Your AI-Powered Expense Tracking Spreadsheet

There are two approaches to implementing this AI-powered upgrade:

Option 1: Use the Expense Sorted Extension (Recommended)

The easiest way to add AI categorization to your Google Sheets expense tracking is with the Expense Sorted extension:

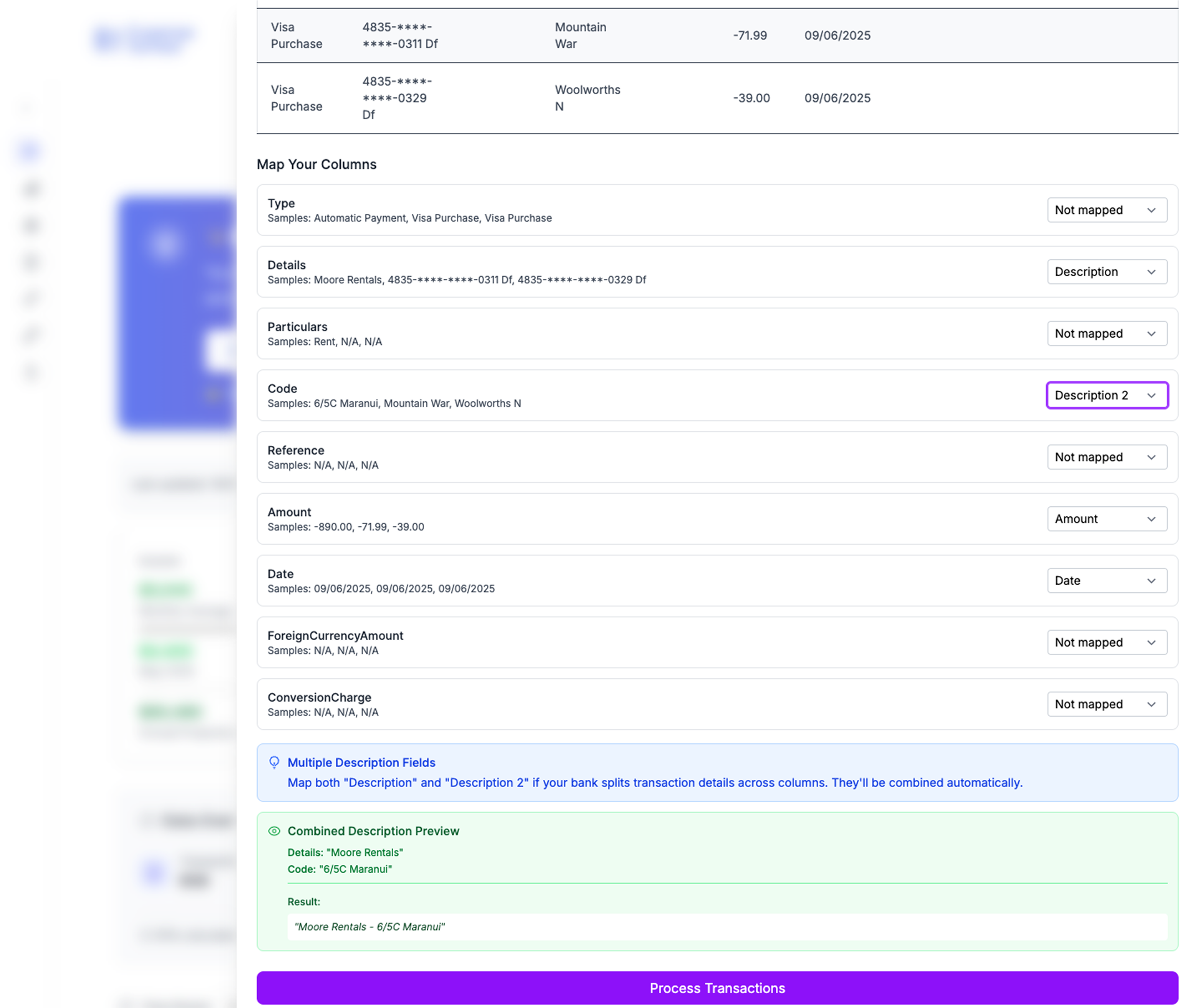

Intelligent bank statement import with automatic column mapping and format detection

Intelligent bank statement import with automatic column mapping and format detection

- Install the Expense Sorted extension from the Google Workspace Marketplace

- Connect it to your existing expense tracking spreadsheet

- Train it with your previously categorized transactions

- Start enjoying automatic categorization

The extension uses a sentence transformer model that runs directly in your browser, keeping your financial data private and secure. No transaction data is sent to external servers.

Option 2: Build Your Own Solution (Advanced)

If you're technically inclined and want to build your own solution:

- Use Google Apps Script to integrate with a sentence transformer model API

- Create functions to process transaction descriptions and compare embeddings

- Implement a learning mechanism to improve categorization over time

This approach requires programming knowledge and will involve setting up API connections, but gives you complete control over the implementation.

Get Started with a Powerful Template

To help you get started, I've created a template that's already set up for AI-powered expense tracking and provides a comprehensive financial dashboard out of the box.

Access our Financial Freedom Spreadsheet here.

This template includes:

- A transaction import sheet

- Category management

- Monthly spending analysis

- Visualization dashboards

- Integration with Expense Sorted (optional)

Beyond Basic Categorization: Advanced Features

Once you have automatic categorization working, you can take your expense tracking to the next level with these advanced features:

1. Multi-Account Consolidation

Track expenses across multiple accounts and credit cards in a single spreadsheet, with consistent categorization across all sources.

2. Personalized Categories

Create custom categories that match your specific financial goals and lifestyle. The AI will learn your personal categorization preferences.

3. Spending Forecasts

Use historical spending patterns to forecast future expenses by category, helping you plan and budget more effectively.

4. Merchant Intelligence

Get insights into your spending patterns with specific merchants, including frequency and average transaction amount.

5. Tax Preparation

Automatically tag tax-deductible expenses throughout the year, making tax time much less stressful.

Real User Stories: Time Savings and Better Insights

Here's how real users have benefited from upgrading their Google Sheets expense tracking with AI categorization:

"I used to spend about 2 hours every month categorizing transactions. Now it takes me less than 10 minutes to review what the AI has done. It's literally given me hours of my life back." - Sarah K.

"The best part isn't just the time savings, but the consistency. The AI categorizes things more consistently than I did manually, which makes my spending reports much more accurate." - Mike T.

"I've tried Mint, YNAB, and other apps, but I always come back to my Google Sheet because of the flexibility. Adding AI categorization gave me the best of both worlds - the automation of an app with the customization of a spreadsheet." - Jamie L.

A Complete Financial Picture

While AI categorization saves you time on data entry, the ultimate goal is financial clarity. Our Financial Freedom Spreadsheet goes beyond just tracking expenses. It automatically calculates your savings rate, net worth, and most importantly, your financial runway—how long you could live without income. This high-level view is what truly empowers you to make life-changing decisions.

Common Questions

Is my financial data secure?

Yes! When using the Expense Sorted extension, all processing happens in your browser. Your transaction data never leaves your Google Sheet or your device.

How accurate is the AI categorization?

Most users report 85-95% accuracy after training on just 50-100 transactions. The system continues to improve as it learns from your corrections.

Will this work with my bank?

The system works with transaction data from any bank, credit card, or financial institution that allows you to export transactions.

Do I need to rebuild my existing spreadsheet?

No. The AI categorization can be added to your existing expense tracking spreadsheet without requiring a complete redesign.

How much technical knowledge do I need?

Using the Expense Sorted extension requires no technical knowledge beyond basic Google Sheets skills. Building your own solution would require programming experience.

Conclusion: Reclaim Your Time While Maintaining Financial Control

The beauty of upgrading your Google Sheets expense tracking with AI categorization is that you get the best of both worlds:

- The automation and intelligence typically found only in premium financial apps

- The flexibility and customization that makes Google Sheets so powerful

- Complete control over your financial data without sharing it with third-party services

By reducing the time spent on manual categorization from hours to minutes, you can focus on what really matters: understanding your financial patterns and making better decisions.

Ready to transform your expense tracking experience? Try Expense Sorted today and see how much time you can save.

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money