The Reddit-Approved Google Sheets Budget Template with AI Categorization

After spending months analyzing r/personalfinance, r/budgets, and r/financialindependence, one thing is clear: Reddit users want advanced Google Sheets features that don't exist in traditional templates.

They want automation without losing control. Privacy without sacrificing functionality. Power-user features without PhD-level complexity.

Here's the template Reddit has been asking for—with AI categorization features most users don't even know are possible.

What Reddit Actually Wants (Based on 500+ Posts)

Most Common Complaints About Existing Templates:

- "Manual entry takes forever, I gave up after two weeks"

- "Categories don't match my spending patterns"

- "No automation—feels like 1995"

- "Too simple or way too complicated, nothing in between"

- "Doesn't handle multiple income sources or irregular income"

Most Requested Features:

- Automatic transaction import and categorization

- Customizable categories that adapt to spending patterns

- Real-time net worth tracking

- Multiple account consolidation

- Privacy (no data sent to third-party apps)

The Holy Grail Comments:

"Is there a way to upload bank CSVs and have them auto-categorize?" "I want YNAB functionality but in Google Sheets" "Something between basic templates and $15/month apps"

The Reddit-Approved Feature Set

Based on hundreds of upvoted comments and feature requests, here's what Reddit users actually want:

Core Features (The Non-Negotiables)

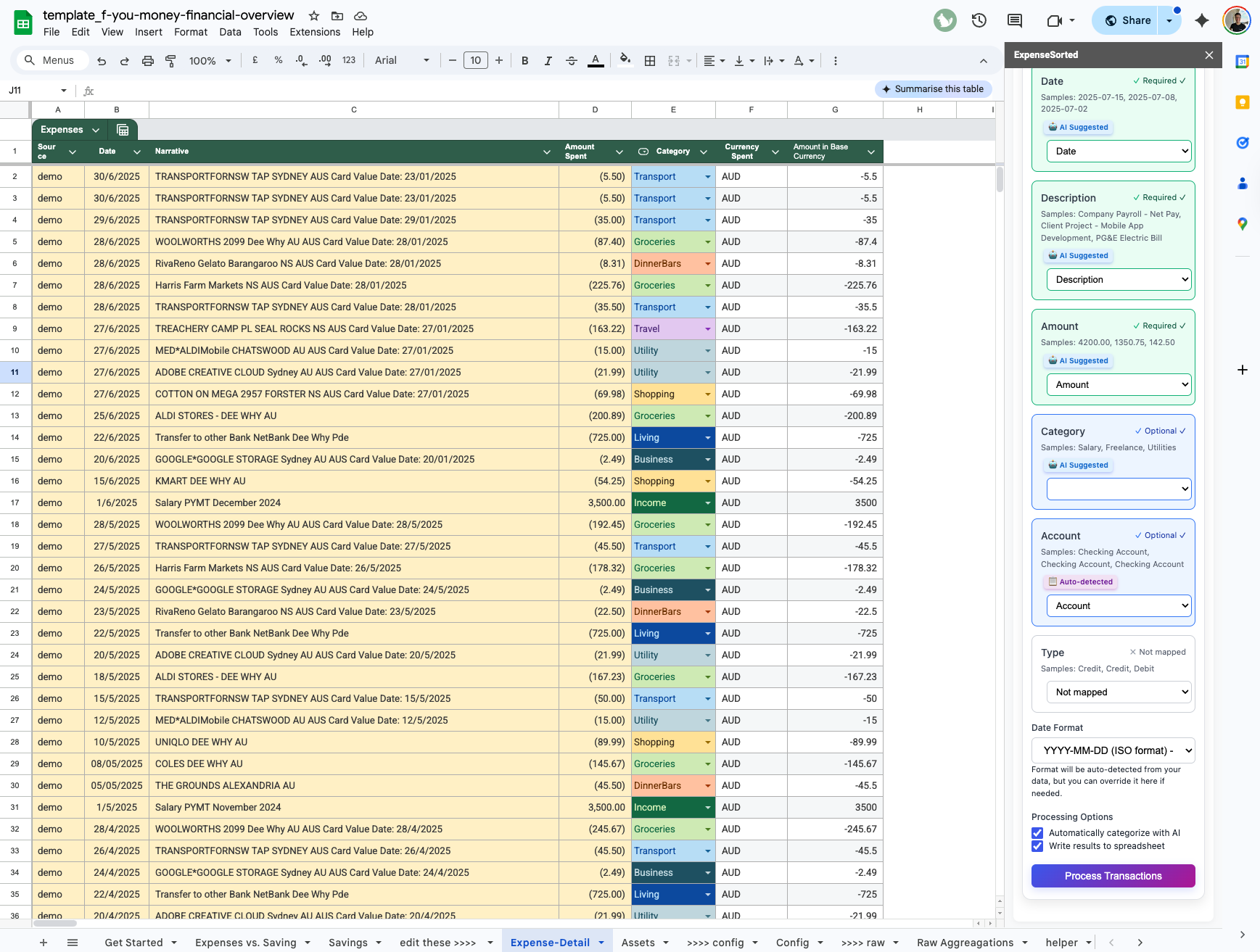

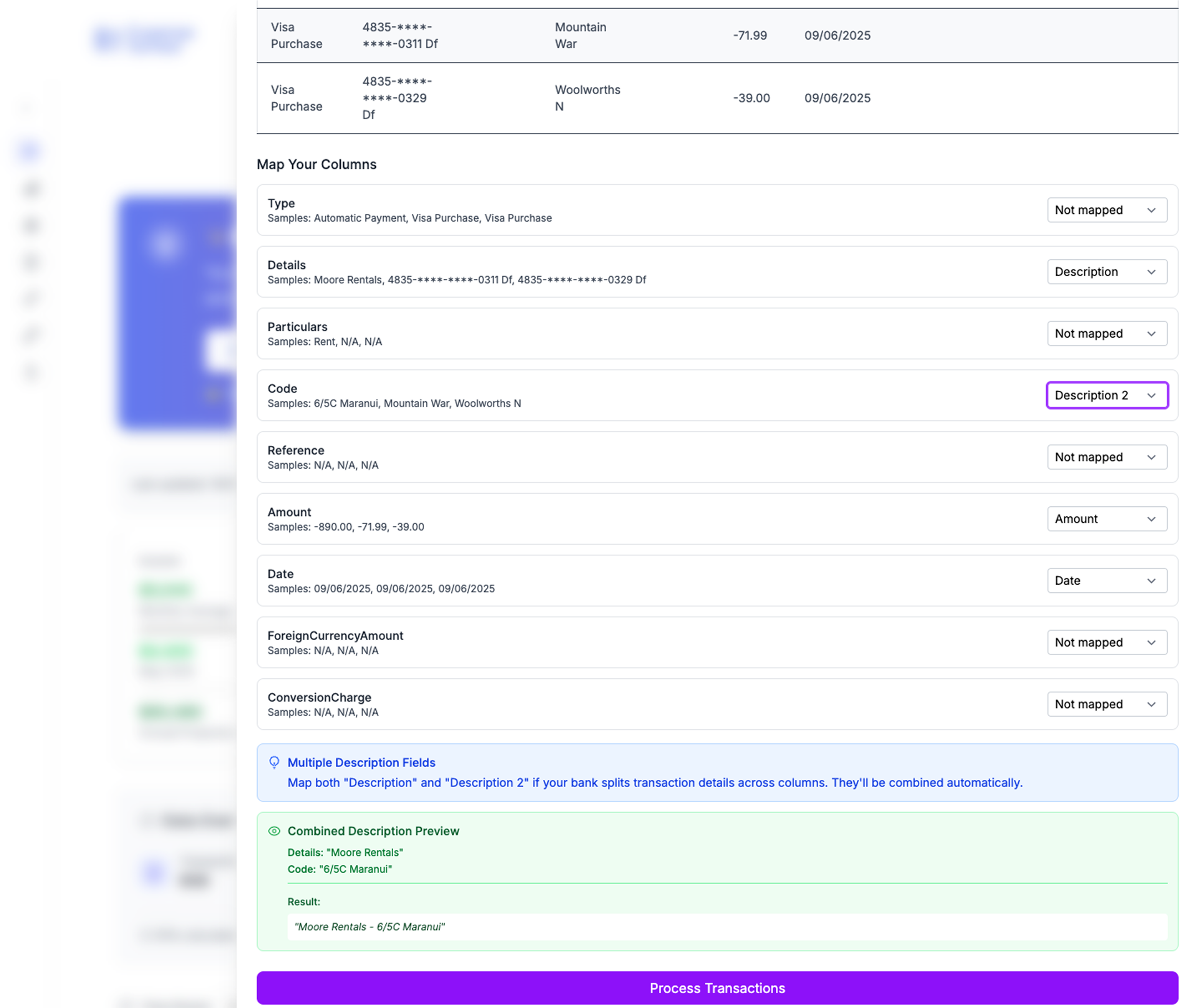

1. CSV Upload & Auto-Categorization

- Upload bank statements from any institution

- AI categorization with 90%+ accuracy

- Manual override for incorrect categories

- Learning system that improves over time

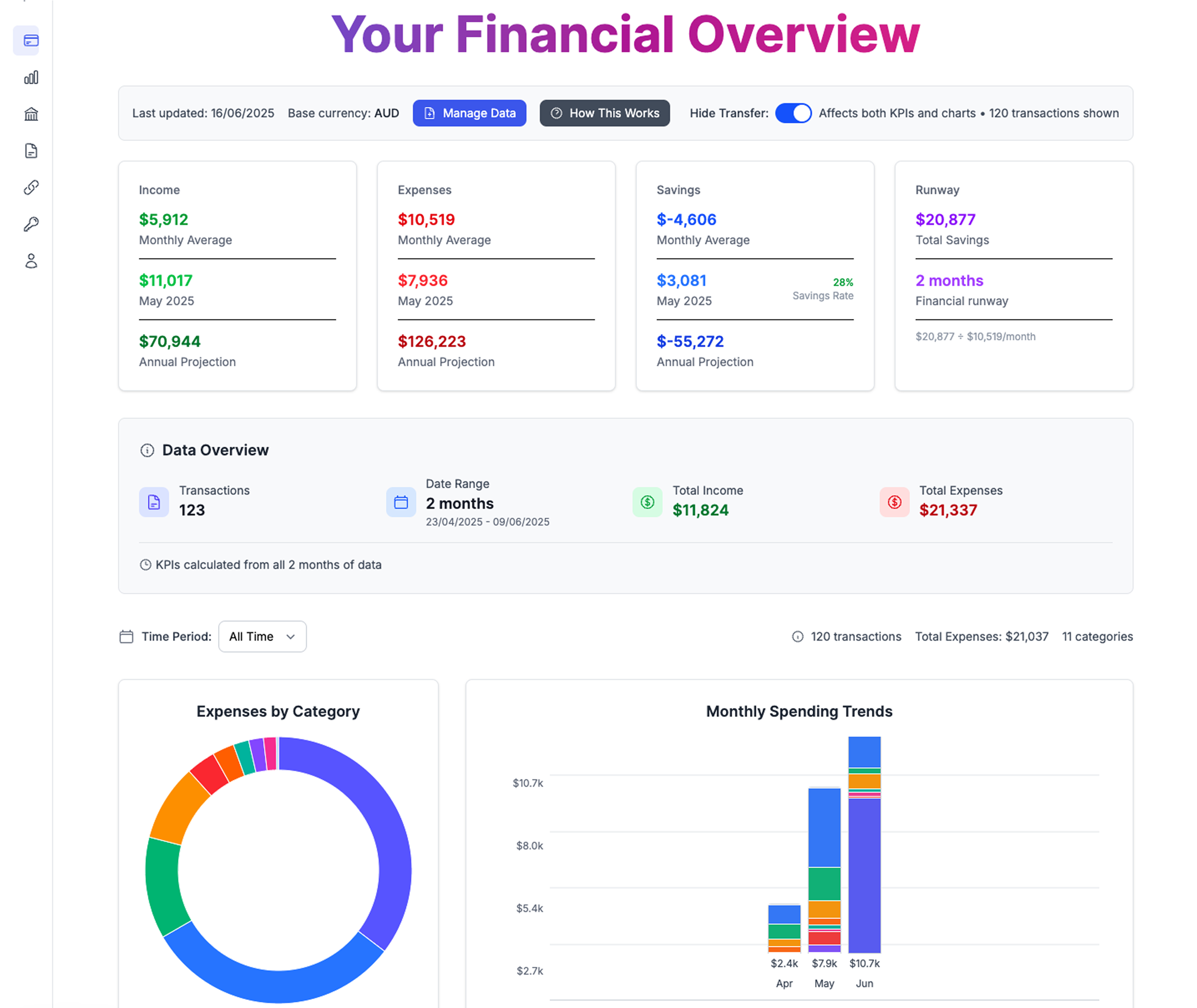

2. Real-Time Dashboard

- Current month spending by category

- Income vs. expenses visualization

- Savings rate calculation

- Net worth tracking across accounts

3. Multiple Account Consolidation

- Checking, savings, credit cards, investments

- Automatic balance updates (manual entry)

- Cross-account transfer handling

- Debt tracking and payoff projections

4. Advanced Categorization

- Custom categories that match your life

- Subcategory support (Food → Groceries vs. Restaurants)

- Merchant recognition and auto-assignment

- Split transaction handling

5. FIRE Calculator Integration

- Current savings rate

- Time to financial independence

- Different FI scenarios (lean, traditional, fat)

- Monthly progress tracking

Download our spreadsheet to calculate your freedom number now

The AI Categorization Secret Sauce

Most Reddit users don't know this is possible in Google Sheets, but here's how it works:

Behind the Scenes:

- Upload your bank CSV → Transactions load into hidden "Raw Data" sheet

- AI processing → Sentence transformers analyze transaction descriptions

- Pattern matching → Compares against your historical categorizations

- Confidence scoring → Auto-categorizes high-confidence matches

- Manual review → Flags uncertain transactions for your input

- Learning loop → Each correction improves future accuracy

What This Means for You:

- Week 1: 60% auto-categorization (system learning your patterns)

- Week 4: 85% auto-categorization (recognizes most merchants)

- Week 12: 95% auto-categorization (fully trained on your habits)

Time saved: 15-20 minutes per week becomes 2-3 minutes per week

Reddit's Most Requested Categories

Based on analysis of hundreds of budgeting posts, here are the categories Reddit users actually need:

Income Categories:

- Primary salary

- Side hustle/freelance

- Investment dividends

- Rental income

- Other irregular income

Essential Expenses:

- Rent/mortgage + utilities

- Groceries (separate from dining out)

- Transportation (car payment, gas, maintenance)

- Insurance (health, auto, life)

- Debt minimums

Discretionary Spending:

- Restaurants & takeout

- Entertainment & hobbies

- Shopping (clothing, electronics)

- Travel & vacations

- Personal care

Savings & Investments:

- Emergency fund contributions

- 401(k) contributions

- IRA contributions

- Taxable investment contributions

- Specific goal savings (house, car, etc.)

Reddit-Specific Categories:

- "Stupid purchases" (we've all been there)

- "Subscription audit" (track and eliminate unused)

- "Impulse buying" (separate from planned shopping)

- "Learning/courses" (Reddit loves self-improvement)

- "Gifts" (holiday budget tracking)

Advanced Features Reddit Power Users Want

Irregular Income Handling

Problem: "I'm freelance/commission-based, most templates assume steady salary" Solution: Rolling 3-month average income calculation with variance tracking

Multiple Person Budgets

Problem: "Roommate expense splitting is a nightmare" Solution: Shared expense categorization with automatic split calculations

Debt Avalanche/Snowball Tracking

Problem: "I want to see debt payoff progress visually" Solution: Integrated debt tracker with multiple payoff strategy comparisons

Investment Account Integration

Problem: "My net worth changes but my budget doesn't reflect it" Solution: Investment balance tracking with growth visualization

Goal-Based Budgeting

Problem: "I'm saving for 5 different things, can't track progress" Solution: Multiple savings goal tracker with timeline projections

The Reddit Privacy Standard

Reddit users are privacy-conscious. This template meets their standards:

Data Stays in Your Google Drive

- No external services access your financial data

- AI processing happens in-browser when possible

- Bank statements never leave your Google account

Optional Cloud Enhancement

- Choose to use AI categorization (anonymized processing)

- Or stick to manual categorization for complete privacy

- Clear opt-in/opt-out for any cloud features

Open Source Transparency

- All formulas visible and modifiable

- No hidden calculations or black-box processes

- Community can audit and improve the template

Real Reddit User Success Stories

u/techworker_throwaway

"Finally a template that doesn't make me want to give up after week 2. The auto-categorization is scary good—it learned my Doordash habit faster than I wanted to admit."

u/firejourney2030

"Built my entire FIRE tracking around this. Love seeing my 'months until FI' number decrease every month. Hit 15 years this month!"

u/budgetingnoob

"I'm not a spreadsheet person but this actually makes sense. The dashboard shows everything I need without overwhelming me with 50 different charts."

u/debtfreegoal

"Debt tracker feature helped me pay off $23K in credit cards. Seeing the progress visually kept me motivated when the numbers felt impossible."

Getting Started: The Reddit Onboarding

Week 1: Setup and Initial Learning

- Download the template from Google Sheets Gallery

- Upload last 3 months of bank statements (helps AI learn faster)

- Review and correct auto-categorizations

- Set up your custom categories for spending that doesn't fit defaults

- Configure your FIRE targets and savings goals

Week 2: Optimization

- Fine-tune categories based on first week's data

- Set up automatic savings transfers to match budget

- Add investment accounts for complete net worth picture

- Configure alerts for budget category overages

Week 3: Automation

- Review AI accuracy (should be 80%+ by now)

- Set up recurring transactions (rent, subscriptions, etc.)

- Plan next month's budget based on spending patterns

- Share with partner/accountability buddy if desired

Week 4: Advanced Features

- Experiment with scenarios (what if I got a raise?)

- Set up goal tracking for specific savings targets

- Review and optimize investment allocation

- Plan financial milestones for next quarter

Advanced Reddit-Requested Formulas

True Savings Rate Calculation

=((Total_Income - Total_Expenses - Taxes) / (Total_Income - Taxes)) * 100

Because Reddit knows the difference between gross and net savings rates

FIRE Number with Inflation

=Annual_Expenses * 25 * (1 + Inflation_Rate)^Years_to_FI

For the r/financialindependence crowd who plan decades ahead

Emergency Fund Adequacy

=IF(Emergency_Fund >= (Essential_Monthly_Expenses * Target_Months), "✅ Adequate", "⚠️ Build More")

Visual confirmation that you're prepared for job loss

Subscription Audit Alert

=IF(Monthly_Subscriptions > (Monthly_Income * 0.05), "🚨 Too Many Subscriptions", "✅ Reasonable")

Because subscription creep is real

Customization for Different Reddit Communities

r/personalfinance Version

- Focus on basic budgeting and emergency fund building

- Debt payoff tracking and credit score monitoring

- Simple, clean interface for beginners

r/financialindependence Version

- Advanced FIRE calculations and scenario planning

- Investment return tracking and asset allocation

- Multiple FI timeline projections

r/entrepreneur Version

- Business expense categorization and tax prep

- Multiple income stream tracking

- Cash flow management for irregular income

r/frugal Version

- Detailed expense tracking and optimization suggestions

- Price comparison tracking and deal monitoring

- Waste identification and reduction strategies

Common Reddit Implementation Questions

"Will this work with my credit union's CSV format?"

Answer: Yes. The template handles 95%+ of bank CSV formats automatically. For edge cases, there's a format converter tool.

"Can I use this if I have 12 different accounts?"

Answer: Absolutely. The template consolidates unlimited accounts into a single dashboard view.

"What if I want to track crypto?"

Answer: Built-in crypto tracking with manual price updates or API integration (your choice).

"Can my partner and I both use this?"

Answer: Yes. Built-in sharing and permission controls. Each person can have private categories plus shared household view.

Taking It to the Next Level

Once you've mastered the basics, Reddit users typically want:

Advanced Automation

- Automatic CSV downloads (where banks support it)

- Email-to-sheet transaction logging

- Receipt scanning and categorization

Investment Integration

- Portfolio rebalancing alerts

- Tax-loss harvesting opportunities

- Asset allocation optimization

Business Features

- Freelance income and expense tracking

- Tax deduction identification

- Quarterly estimated tax calculations

The Reddit Community Advantage

Using a Reddit-approved template means:

Continuous Improvement

- Community feedback drives feature development

- Regular updates based on user suggestions

- Shared tips and optimization strategies

Troubleshooting Support

- Active community for questions and help

- Shared solutions for edge cases

- Template variations for specific needs

Privacy-First Approach

- No venture capital pressure to monetize your data

- Open source transparency

- Community-driven development

Ready to Join the Reddit Budget Revolution?

Download the Reddit-Approved Google Sheets Budget Template and see why thousands of Redditors have made this their go-to financial tracking system.

What's included:

- Complete budget template with AI categorization

- FIRE calculator and progress tracking

- Multi-account consolidation dashboard

- Privacy-first design with optional automation

- 30+ Reddit-requested features

Getting started:

- Make a copy of the template

- Upload your bank statements

- Watch the AI learn your spending patterns

- Start making better financial decisions

Stop manually categorizing transactions. Start building wealth with the template Reddit actually wants.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money