The Ultimate Google Sheets Expense Tracker Template (2025)

Most expense tracker templates are frustratingly basic. They track your spending but don't help you understand it. After analyzing dozens of existing templates and building expense tracking tools for thousands of users, I've created what I believe is the most comprehensive Google Sheets expense tracker available—and it's completely free.

What makes this different? This isn't just a glorified list. It's a complete financial analysis system that automatically categorizes expenses, shows spending trends, calculates your savings rate, and even estimates your "financial runway"—how long your money would last if income stopped.

Why Google Sheets for Expense Tracking?

Before diving into the template, let's address the obvious question: why use Google Sheets when there are dozens of expense tracking apps?

Privacy and Control: Your financial data stays in your Google account. No third-party company can access, analyze, or sell your spending patterns.

Customization: Unlike rigid apps, you can modify every aspect of this tracker to match your specific needs and spending categories.

No Subscription Fees: Many expense tracking apps charge monthly fees. This solution costs nothing beyond your existing Google account. For a powerful option, you can download our Ultimate Google Sheets Expense Tracker.

Universal Access: Works on any device with internet access. No app downloads or updates required.

Data Ownership: You own your data completely. Export it, analyze it, or use it however you want.

Template Features Overview

This expense tracker goes far beyond basic input-output tracking:

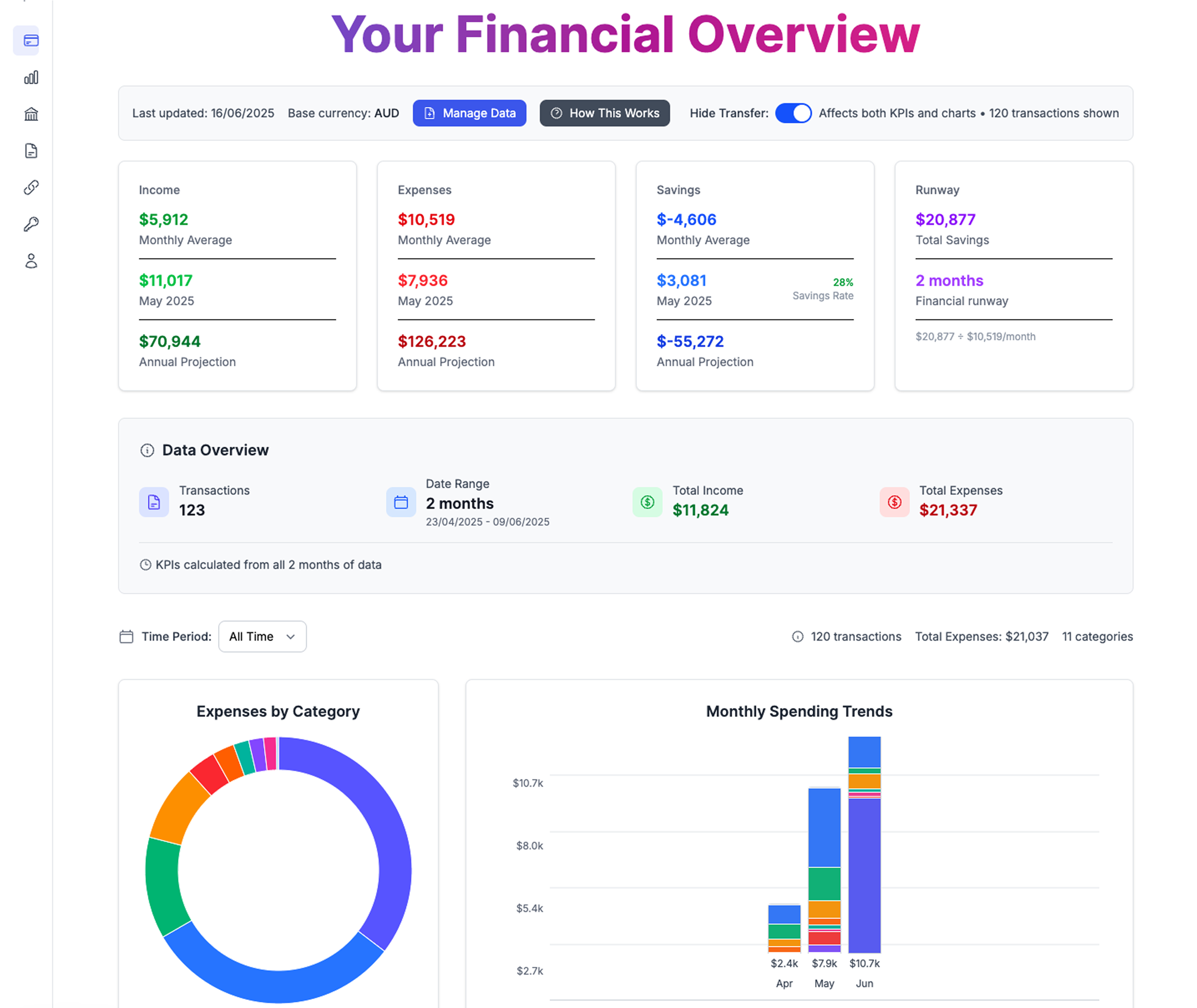

Complete financial overview with automated categorization and spending insights

Complete financial overview with automated categorization and spending insights

Automatic Categorization

Smart formulas automatically categorize common expenses based on merchant names and descriptions. No more manually sorting every coffee purchase or grocery bill.

Visual Dashboard

See your spending patterns at a glance with automatically generated charts showing:

- Monthly spending trends

- Category breakdowns

- Income vs. expenses

- Savings rate over time

Financial Runway Calculator

Understand how long your current savings would last at your current spending rate—a crucial metric for financial security that most trackers ignore.

Want a more advanced, ready-to-use solution? Check out our Financial Freedom Spreadsheet to track your runway, savings rate, and more automatically.

Savings Rate Tracking

Automatically calculates your monthly and yearly savings rate, the single most important metric for building wealth. Ready to get started? Download our spreadsheet to start tracking this crucial metric.

How to Use the Template

Step 1: Make Your Copy

Click here to get your copy of the Ultimate Expense Tracker Template

- Click the link above

- Go to File → Make a Copy

- Save it to your Google Drive

- Rename it to something like "My Expense Tracker 2025"

Step 2: Set Up Your Categories

The template comes with common expense categories, but you should customize them for your lifestyle:

Essential Categories:

- Housing (rent/mortgage, utilities, insurance)

- Transportation (car payment, gas, public transit)

- Food (groceries, dining out)

- Healthcare (insurance, medical expenses)

Lifestyle Categories:

- Entertainment (streaming, hobbies, social activities)

- Shopping (clothing, electronics, miscellaneous)

- Travel (flights, hotels, vacation expenses)

- Personal Care (gym, beauty, health)

Pro tip: Keep categories broad initially. You can always add subcategories later as you understand your spending patterns.

Step 3: Connect Your Bank Data

You have three options for getting transaction data into the tracker:

Option 1: Manual Entry (Most Secure) Enter transactions manually. Yes, it takes more time, but you'll become intimately familiar with your spending patterns.

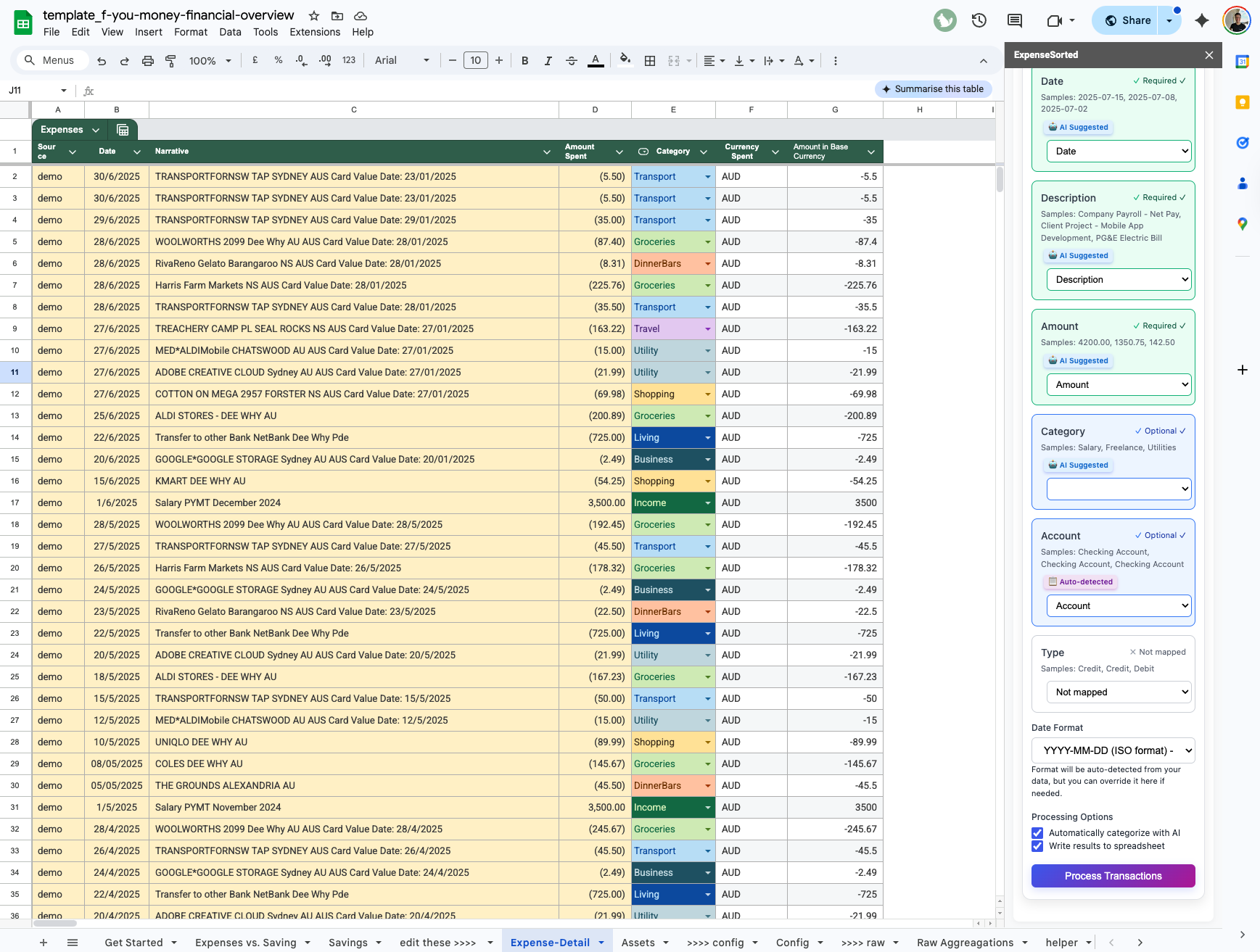

Option 2: CSV Import Most banks allow you to export transaction data as CSV files. Import these monthly for bulk updates.

Streamlined CSV import with automatic column mapping for all major banks

Streamlined CSV import with automatic column mapping for all major banks

Option 3: Google Sheets Banking Add-ons Several add-ons can connect directly to your bank accounts. Research security carefully before using these options.

Step 4: Customize the Formulas

The template includes smart categorization by using our comprehensive system. Keep using the sheet, but use our import to take care of data mapping and automatic categorisation.

Advanced Features Explained

The Financial Runway Calculator

This feature calculates how long your current savings would last at your current spending rate—a concept borrowed from startup terminology that's incredibly relevant for personal finance.

Formula: Current Savings ÷ Average Monthly Expenses = Months of Financial Runway

Why it matters: Knowing your runway helps you make better decisions about:

- When you can afford to take risks (job changes, starting a business)

- How much emergency fund you actually need

- Whether you're spending at a sustainable rate

Savings Rate Tracking

The template automatically calculates your personal savings rate using this formula:

Savings Rate = (Income - Expenses) ÷ Income × 100

This single metric is more important than your salary, net worth, or any other financial number. Here's why:

- 50%+ savings rate: You're on track for early retirement

- 20-30% savings rate: Solid foundation for traditional retirement

- 10-15% savings rate: Meeting basic recommendations

- Below 10%: Consider this a wake-up call

Spending Trend Analysis

The visual dashboard shows your spending trends over time, helping you identify:

- Seasonal spending patterns (higher expenses in December, summer vacation months)

- Gradual lifestyle inflation

- The impact of specific financial decisions

- Categories where spending is increasing without you noticing

Customization Ideas

For Couples

Create separate input sheets for each partner while maintaining a combined dashboard. This preserves individual spending privacy while tracking household totals.

For Irregular Income

Add columns for different income sources and use averaging formulas to smooth out month-to-month variations. This is especially useful for freelancers, commissioned sales professionals, or seasonal workers.

For Business Owners

Separate personal and business expenses clearly. The template can track both, but keep them in distinct categories for tax purposes.

For Renters vs. Homeowners

Homeowners should break housing costs into more detailed categories (maintenance, improvements, property taxes) while renters can keep housing simpler.

Common Mistakes to Avoid

Over-Categorization

Don't create 50 different categories. Start with 8-12 broad categories and add detail only where you need specific insights.

Perfectionism Paralysis

Don't spend hours categorizing every small expense perfectly. Focus on the big categories that represent 80% of your spending.

Ignoring Small Recurring Expenses

Those $10/month subscriptions add up. The template helps identify these "subscription creep" expenses that can total hundreds per year.

Not Reviewing Regularly

Set a monthly date to review your dashboard and trends. Without regular review, even the best tracking system provides no value.

Integration with Other Tools

Connecting to Investment Tracking

While this template focuses on expenses, you can link it to investment tracking sheets to get a complete financial picture.

Tax Preparation

Use the category totals to simplify tax preparation. Business owners can easily separate deductible expenses.

Goal Planning

The savings rate and runway calculations help with major goal planning—buying a house, taking a sabbatical, or changing careers.

Frequently Asked Questions

Q: How much time does this take to maintain? A: With proper setup, about 30 minutes per month. The automatic categorization handles most of the work.

Q: What if I prefer mobile entry? A: Google Sheets mobile apps work well for quick expense entry. You can also use Google Forms connected to the sheet for easier mobile input.

Q: Can I share this with my financial advisor? A: Absolutely. The standardized format makes it easy for professionals to review your finances.

Q: What about security? A: Your data stays in your Google account with the same security Google provides for Gmail and other services. Never share your Google account credentials.

Taking It Further

This expense tracker is designed to grow with your financial sophistication. As you become more comfortable with the basics, consider adding:

- Investment tracking sheets

- Net worth calculation

- Goal-based savings tracking

- Debt payoff calculators

- Tax optimization analysis

The beauty of owning your financial data is the ability to evolve your system without switching platforms or losing historical information.

Your Financial Data Belongs to You

In an era where companies monetize every piece of personal information, maintaining control over your financial data isn't just about privacy—it's about financial independence. When you understand your spending patterns deeply, you make better decisions. When you own your data completely, you're never locked into a platform that might change its terms or disappear.

This expense tracker embodies a simple philosophy: the best financial tools are the ones that give you more control, not less. Your money, your data, your decisions.

Ready to take control of your expenses? Download the template and start tracking. Your future self will thank you for the insights you're about to gain.

Looking for even more advanced financial tracking? Check out our automated expense categorization app that works alongside your Google Sheets for the best of both worlds—privacy and automation .

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money