The Smart Couple's Google Sheets Budget: Track Individual Expenses, Calculate Shared Runway

Managing money as a couple is complicated. You want transparency without micromanagement, individual freedom within shared goals, and a clear path toward financial independence together.

Most couple budgeting tools force you into rigid categories or shared accounts that eliminate personal autonomy. Here's a better approach: a Google Sheets system that tracks everything while respecting individual preferences and calculating your combined runway toward financial freedom.

Why Most Couple Budgeting Methods Fail

All-Shared Accounts: Every latte becomes a negotiation. Personal autonomy disappears.

Completely Separate: No shared vision, conflicting goals, financial secrets creep in.

Generic Apps: Force you into their categories, don't handle complex couple scenarios, expensive monthly fees.

Traditional Spreadsheets: Manual entry nightmare, no automation, quickly abandoned.

The solution? A smart Google Sheets system that combines automation with flexibility, transparency with autonomy.

The Smart Couple's Framework

Core Principles:

- Shared transparency on all major financial decisions

- Individual autonomy for personal spending within agreed limits

- Combined goals with clear progress tracking

- Automated categorization to eliminate data entry drudgery

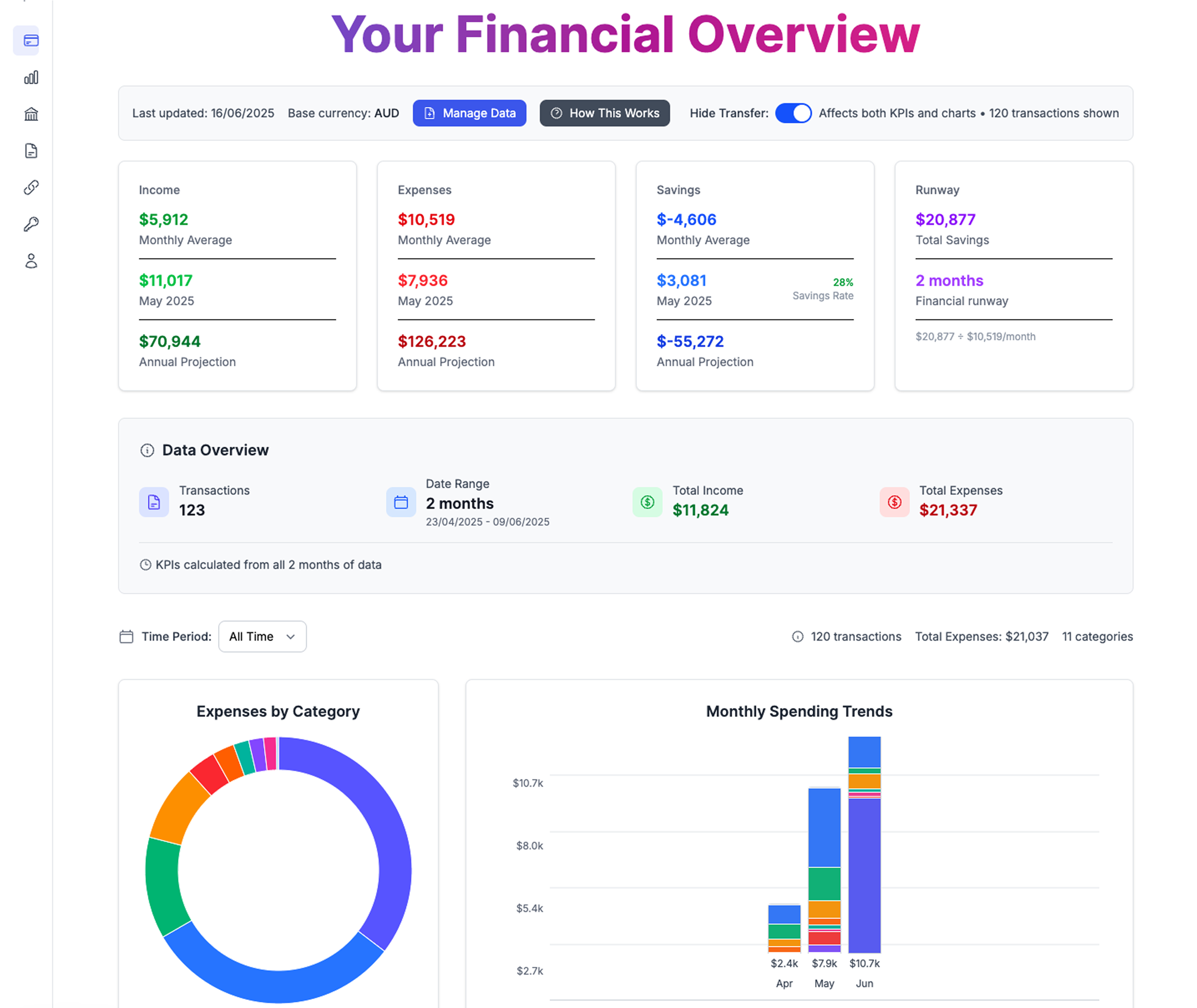

- Financial runway calculation showing months until complete freedom

How It Works:

- Each partner uploads their bank statements monthly

- AI categorization handles 90% of transactions automatically

- Shared dashboard shows combined financial picture

- Individual sheets track personal spending patterns

- Runway calculator shows progress toward work-optional life

Setting Up Your Couple's Financial Command Center

Sheet 1: Shared Dashboard

Combined Overview:

- Total household income (both partners)

- Essential shared expenses (rent, utilities, groceries)

- Individual spending allowances

- Combined savings rate

- Months of financial runway (total savings ÷ monthly expenses)

Monthly Targets:

- Essential expenses: 50% of combined income

- Individual allowances: 20% of combined income

- Savings/investments: 30% of combined income

Sheet 2: Partner A Transactions

Automated Categories:

- Housing (if paid by Partner A)

- Transportation

- Personal discretionary

- Health/fitness

- Professional development

Sheet 3: Partner B Transactions

Same category structure for easy comparison and combined reporting

Sheet 4: Shared Expenses Tracker

Joint Categories:

- Rent/mortgage

- Utilities

- Groceries

- Date nights

- Vacations

- Home improvements

Sheet 5: Financial Runway Calculator

Combined Freedom Metrics:

- Current total savings (both partners)

- Monthly essential expenses

- Months until financial independence

- Timeline to various freedom milestones

Download our spreadsheet to calculate your freedom number now

Smart Categorization for Couples

Individual Categories:

Personal Discretionary: Coffee, personal shopping, hobbies, individual entertainment Professional: Career development, networking, work-related expenses Health: Personal healthcare, fitness, wellness not covered by insurance Transportation: Personal vehicle costs, rideshares, public transit

Shared Categories:

Home: Rent/mortgage, utilities, maintenance, improvements Food: Groceries, shared meals, household supplies Joint Entertainment: Date nights, couple activities, shared subscriptions Travel: Vacations, visiting family, shared adventures

Example Transaction Handling:

- "STARBUCKS" → Partner A Personal Discretionary

- "WHOLE FOODS $127" → Shared Food (if shopping together)

- "NETFLIX" → Shared Entertainment

- "SHELL GAS" → Partner B Transportation

- "COUPLES MASSAGE" → Shared Entertainment

The Weekly Money Meeting (15 Minutes Max)

Week 1: Quick Check-in

- Review last week's spending vs. budget

- Confirm any unusual transactions

- Check progress toward monthly savings goals

Week 2: Category Deep-dive

- Analyze spending patterns in one category

- Discuss any concerns or observations

- Adjust upcoming week if needed

Week 3: Individual Review

- Each partner reviews their personal spending

- Discuss any desired changes to allowances

- Plan for upcoming expenses

Week 4: Runway Review

- Calculate current months of financial runway

- Celebrate progress or problem-solve challenges

- Plan any optimization for next month

Financial Freedom Milestones for Couples

Months of Runway Targets:

3 Months: Basic emergency coverage 6 Months: Traditional "secure" level 12 Months: Career change flexibility 24 Months: True financial independence 36+ Months: Work entirely optional

Sample Couple Calculation:

Combined Monthly Expenses: $6,500

- Housing: $2,200

- Food: $800

- Transportation: $600

- Utilities: $300

- Insurance: $400

- Personal allowances: $1,200

Combined Savings: $78,000 Current Runway: 12 months

Goal: Reach 24-month runway (requires $156,000 total savings)

Handling Common Couple Money Scenarios

Scenario 1: Income Imbalance

Partner A: $75,000/year Partner B: $45,000/year

Solution: Percentage-based contributions

- Partner A pays 62.5% of shared expenses

- Partner B pays 37.5% of shared expenses

- Personal allowances remain equal amounts

Scenario 2: Different Spending Styles

Partner A: Saver, tracks everything Partner B: Spender, hates budgeting

Solution: Automated guardrails

- Auto-save 30% before anyone can spend it

- Partner B gets weekly discretionary "allowance" auto-transferred

- Monthly review focuses on goals, not daily purchases

Scenario 3: Debt Differences

Partner A: $50,000 student loans Partner B: Debt-free

Solution: Shared debt elimination plan

- Individual debt payments count toward household savings rate

- Celebrate debt payoff as shared victory

- Redirect payments to shared investments once clear

Advanced Features for Power Couples

Investment Tracking Integration

- Link investment accounts for complete net worth picture

- Track progress toward FIRE number (25x annual expenses)

- Asset allocation across both partners' accounts

Tax Optimization

- Track deductible expenses by partner

- Plan tax-advantaged contributions

- Optimize filing status annually

Estate Planning Integration

- Beneficiary tracking

- Insurance coverage analysis

- Will/trust coordination notes

Security and Privacy Best Practices

Google Sheets Security:

- Use two-factor authentication on both Google accounts

- Share sheets with view/edit permissions clearly defined

- Regular backup downloads for security

Financial Data Protection:

- Never store full account numbers in sheets

- Use bank transaction descriptions only (no account details)

- Regular password updates on all financial accounts

Relationship Boundaries:

- Agree on personal spending limits that don't require discussion

- Define "major purchase" threshold requiring joint approval

- Respect individual financial privacy within agreed framework

Common Implementation Mistakes (And How to Avoid Them)

Mistake 1: Over-categorizing

Problem: 47 different spending categories Solution: Start with 10-12 categories max, refine over time

Mistake 2: Perfectionist tracking

Problem: Arguing over $3.47 coffee purchases Solution: Focus on patterns and progress, not perfection

Mistake 3: One partner does everything

Problem: Financial knowledge imbalance creates dependency Solution: Rotate monthly responsibilities, both partners learn system

Mistake 4: No regular reviews

Problem: System works for two months, then abandoned Solution: Calendar recurring 15-minute money meetings

Getting Started: Your First 30 Days

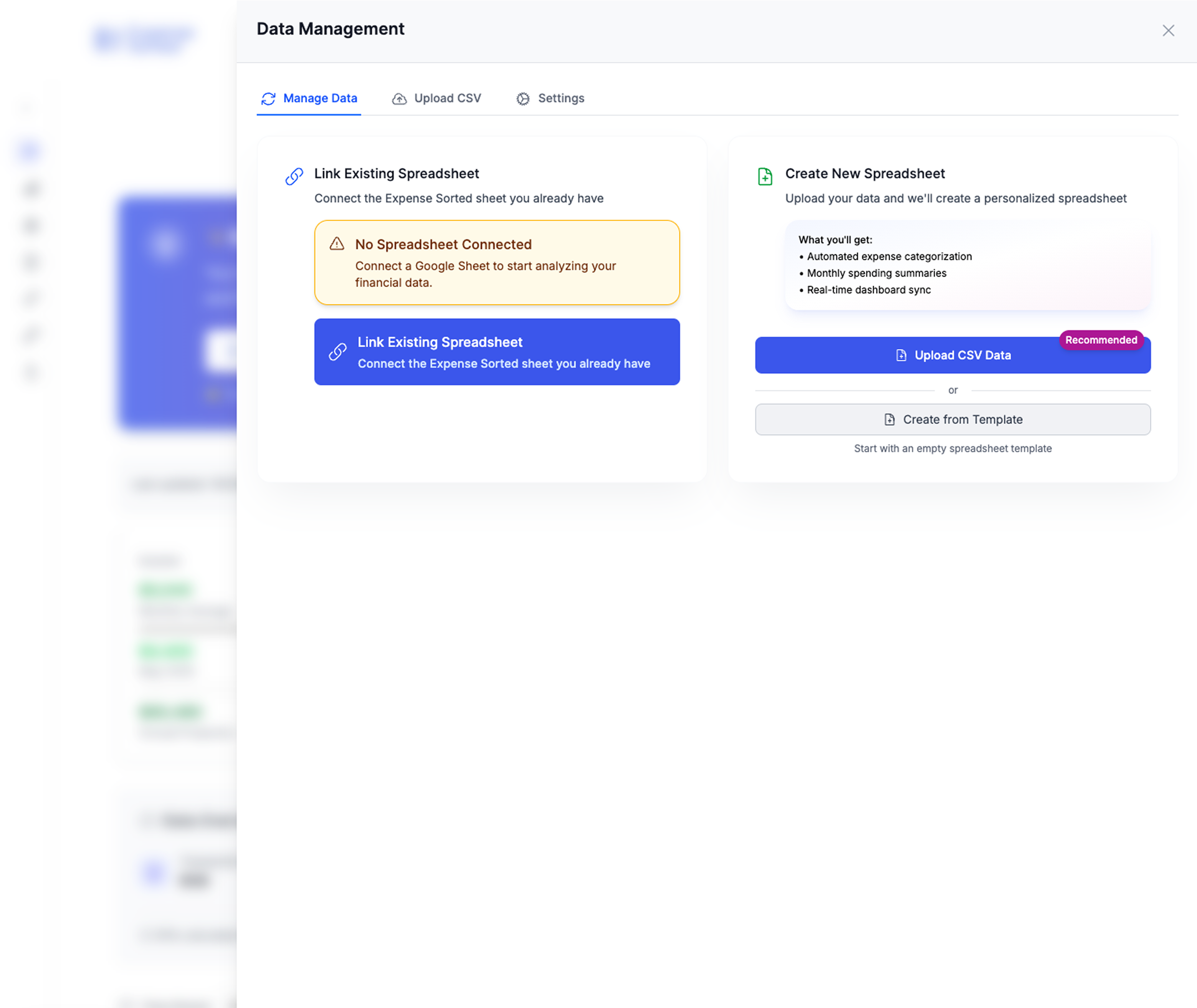

Week 1: Setup

- Download the Smart Couple's Google Sheets template

- Each partner uploads last month's bank statements

- Review AI categorization, correct any errors

- Calculate current financial runway

Week 2: Calibration

- Adjust categories based on your spending patterns

- Set realistic monthly targets for each category

- Agree on personal spending allowances

- Schedule weekly 15-minute money meetings

Week 3: Automation

- Set up automatic savings transfers

- Enable bank statement download automation if available

- Create shared calendar reminders for monthly uploads

Week 4: Optimization

- Review first month's data for patterns

- Adjust budget categories if needed

- Set 3-month and 12-month financial runway goals

- Plan celebration for reaching first milestone

Beyond Budgeting: Building Wealth Together

Your Google Sheets budget is the foundation, not the destination. Once you've mastered tracking and built initial runway:

Investment Strategy

- Coordinate 401(k) and IRA contributions

- Build shared taxable investment account

- Consider real estate investment strategy

Business Building

- Track side hustle income and expenses

- Plan business investment using shared savings

- Calculate breakeven for career transitions

Lifestyle Optimization

- Identify highest-impact expense reductions

- Plan "lifestyle inflation" strategically

- Balance current enjoyment with future freedom

The Relationship ROI

Financial transparency isn't just about money—it's about trust, shared vision, and eliminating the #1 source of relationship conflict.

Couples using systematic financial planning report:

- 67% reduction in money-related arguments

- Faster progress toward shared goals

- Increased confidence about future security

- Better communication about life priorities

Your Google Sheets budget becomes a weekly touchpoint for discussing dreams, concerns, and progress toward the life you're building together.

Ready to Build Your Financial Future Together?

Download the Smart Couple's Google Sheets Budget Template and start tracking your combined journey toward financial freedom. With AI-powered categorization and automated runway calculation, you'll spend 15 minutes weekly instead of hours monthly managing your money.

Template includes:

- 5-sheet system for complete financial transparency

- AI categorization for automatic transaction sorting

- Financial runway calculator showing months until freedom

- Weekly meeting templates and milestone trackers

Stop arguing about money. Start building wealth together.

Calculate Your Financial Freedom

How much money do you need to never worry about work again?

Calculate My F*** You Money